|

Strangle (options)

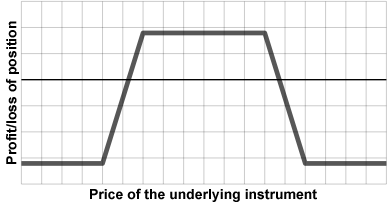

In finance, a strangle is an options strategy involving the purchase or sale of two options, allowing the holder to profit based on how much the price of the underlying security moves, with a neutral exposure to the ''direction'' of price movement. A strangle consists of one call and one put with the same expiry and underlying but different strike prices. Typically the call has a higher strike price than the put. If the put has a higher strike price instead, the position is sometimes called a guts. If the options are purchased, the position is known as a long strangle, while if the options are sold, it is known as a short strangle. A strangle is similar to a straddle position; the difference is that in a straddle, the two options have the same strike price. Given the same underlying security, strangle positions can be constructed with a lower cost but lower probability of profit than straddles. Characteristics A strangle, requires the investor to simultaneously buy or sell b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short Strangle Option

Short may refer to: Places * Short (crater), a lunar impact crater on the near side of the Moon * Short, Mississippi, an unincorporated community * Short, Oklahoma, a census-designated place People * Short (surname) * List of people known as the Short Companies * Short Brothers, a British aerospace company * Short Brothers of Sunderland, a former English shipbuilder Computing and technology * Short circuit, an accidental connection between two nodes of an electrical circuit * Short integer, a computer datatype Other uses * Short film, a cinema format, also called a short * Short (finance), stock-trading position * Short (cricket), fielding positions closer to the batsman * SHORT syndrome, a medical condition in which affected individuals have multiple birth defects * Short vowel, a vowel sound of short perceived duration * Holly Short, a fictional character in the ''Artemis Fowl'' series See also * Short time, a situation in which a civilian employee works reduced hours, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ladder (option Combination)

In finance, a ladder, also known as a Christmas tree, is a combination of three options of the same type (all calls or all puts) at three different strike prices. A long ladder is used by traders who expect low volatility, while a short ladder is used by traders who expect high volatility. Ladders are in some ways similar to strangles, vertical spreads, condors, or ratio spreads. A long call ladder consists of buying a call at one strike price and selling a call at each of two higher strike prices, while a long put ladder consists of buying a put at one strike price and selling a put at each of two lower strike prices. A short ladder is the opposite position, in which one option is sold and the other two are bought. Often, the strike prices are chosen to make the ladder delta neutral. All three options must have the same expiry date. The term ''ladder'' is also used for an unrelated type of exotic option, and the term ''Christmas tree'' is also used for an unrelated option ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Condor (options)

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike prices. The buyer of a condor earns a profit if the underlying is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range (low volatility), while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit. A long condor consists of four options of the same type (all calls or all puts). The options at the outer strikes are bought and the inner strikes are sold (and the reverse is done for a short condor). The difference between the two lowest strikes must be the same as the d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wiley Publishing

John Wiley & Sons, Inc., commonly known as Wiley (), is an American multinational publishing company that focuses on academic publishing and instructional materials. The company was founded in 1807 and produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students. History The company was established in 1807 when Charles Wiley opened a print shop in Manhattan. The company was the publisher of 19th century American literary figures like James Fenimore Cooper, Washington Irving, Herman Melville, and Edgar Allan Poe, as well as of legal, religious, and other non-fiction titles. The firm took its current name in 1865. Wiley later shifted its focus to scientific, technical, and engineering subject areas, abandoning its literary interests. Wiley's son John (born in Flatbush, New York, October 4, 1808; died in East O ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deviation

In statistics, the standard deviation is a measure of the amount of variation of the values of a variable about its Expected value, mean. A low standard Deviation (statistics), deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the values are spread out over a wider range. The standard deviation is commonly used in the determination of what constitutes an outlier and what does not. Standard deviation may be abbreviated SD or std dev, and is most commonly represented in mathematical texts and equations by the lowercase Greek alphabet, Greek letter Sigma, σ (sigma), for the population standard deviation, or the Latin script, Latin letter ''s'', for the sample standard deviation. The standard deviation of a random variable, Sample (statistics), sample, statistical population, data set, or probability distribution is the square root of its variance. (For a finite population, v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tail Risk

Tail risk, sometimes called "fat tail risk", is the financial risk of an asset or portfolio of assets moving more than three standard deviations from its current price, above the risk of a normal distribution. Tail risks include low-probability events arising at both ends of a normal distribution curve, also known as tail events. However, as investors are generally more concerned with unexpected losses rather than gains, a debate about tail risk is focused on the left tail. Prudent asset managers are typically cautious with the tail involving losses which could damage or ruin portfolios, and not the beneficial tail of outsized gains. The common technique of theorizing a normal distribution of price changes underestimates tail risk when market data exhibit fat tails, thus understating asset prices, stock returns and subsequent risk management strategies. Tail risk is sometimes defined less strictly: as merely the risk (or probability) of rare events. The arbitrary definition of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

McGraw-Hill

McGraw Hill is an American education science company that provides educational content, software, and services for students and educators across various levels—from K-12 to higher education and professional settings. They produce textbooks, digital learning tools, and adaptive technology to enhance learning experiences and outcomes. It is one of the "big three" educational publishers along with Houghton Mifflin Harcourt and Pearson Education. McGraw Hill also publishes reference and trade publications for the medical, business, and engineering professions. Formerly a division of The McGraw Hill Companies (later renamed McGraw Hill Financial, now S&P Global), McGraw Hill Education was divested and acquired by Apollo Global Management in March 2013 for $2.4 billion in cash. McGraw Hill was sold in 2021 to Platinum Equity for $4.5 billion. History McGraw Hill was founded in 1888, when James H. McGraw, co-founder of McGraw Hill, purchased the ''American Journal of Railway ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Institute Of Finance

The New York Institute of Finance (NYIF) is an American for-profit provider of continuing professional education that was founded by the New York Stock Exchange (NYSE) in 1922. The institute provides continuing education to professionals in the financial services industry and corporations worldwide. The institute owns the trademark "Where Wall Street Goes to School". History “In 1921 it became evident that, for the sake of the business itself and for the sake of the thousands of young men and women employed by the Exchange and by its member firms, some method should be devised whereby they might learn the fundamentals; the reasons why they did the things which occupied their working days…” “This was the inspiration behind the establishment of the Stock Exchange Institute. The growth of this Institute has demonstrated that it fills a real need. Through Institute classes and lectures in New York, and through Correspondence Courses available to those at a distance, instru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by "sigma, σ") is the Variability (statistics), degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Strangle Option

Long may refer to: Measurement * Long, characteristic of something of great duration * Long, characteristic of something of great length * Longitude (abbreviation: long.), a geographic coordinate * Longa (music), note value in early music mensural notation Places Asia * Long District, Laos * Long District, Phrae, Thailand * Longjiang (other) or River Long (lit. "dragon river"), one of several rivers in China * Yangtze River or Changjiang (lit. "Long River"), China Elsewhere * Long, Somme, France People * Long (Chinese surname) * Long (Western surname) Fictional characters * Long (''Bloody Roar''), in the video game series * Long, Aeon of Permanence in Honkai: Star Rail Sports * Long, a fielding term in cricket * Long, in tennis and similar games, beyond the service line during a serve and beyond the baseline during play Other uses * , a U.S. Navy ship name * Long (finance), a position in finance, especially stock markets * Lòng, name for a laneway in Sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Strategy

Option strategies are the simultaneous, and often mixed, buying or selling of one or more Option (finance), options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |