|

Real Estate Valuation

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property (usually market value). Real estate transactions often require appraisals because they occur infrequently and every property is unique (especially their condition, a key factor in valuation), unlike corporate stocks, which are traded daily and are identical (thus a centralized Walrasian auction like a stock exchange is unrealistic). The location also plays a key role in valuation. However, since property cannot change location, it is often the upgrades or improvements to the home that can change its value. Appraisal reports form the basis for mortgage loans, settling estates and divorces, taxation, and so on. Sometimes an appraisal report is used to establish a sale price for a property. Besides the mandatory educational grade, which can vary from Finance to Construction Technology, most, but not all, countries require appraisers to have the license for t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Property

In English common law, real property, real estate, immovable property or, solely in the US and Canada, realty, is land which is the property of some person and all structures (also called improvements or fixtures) integrated with or affixed to the land, including crops, buildings, machinery, wells, dams, ponds, mines, canals, and roads, among other things. The term is historic, arising from the now-discontinued form of action, which distinguished between real property disputes and personal property disputes. Personal property, or personalty, was, and continues to be, all property that is not real property. In countries with personal ownership of real property, civil law protects the status of real property in real-estate markets, where estate agents work in the market of buying and selling real estate. Scottish civil law calls real property "heritable property", and in French-based law, it is called ''immobilier'' ("immovable property"). Historical background The wor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

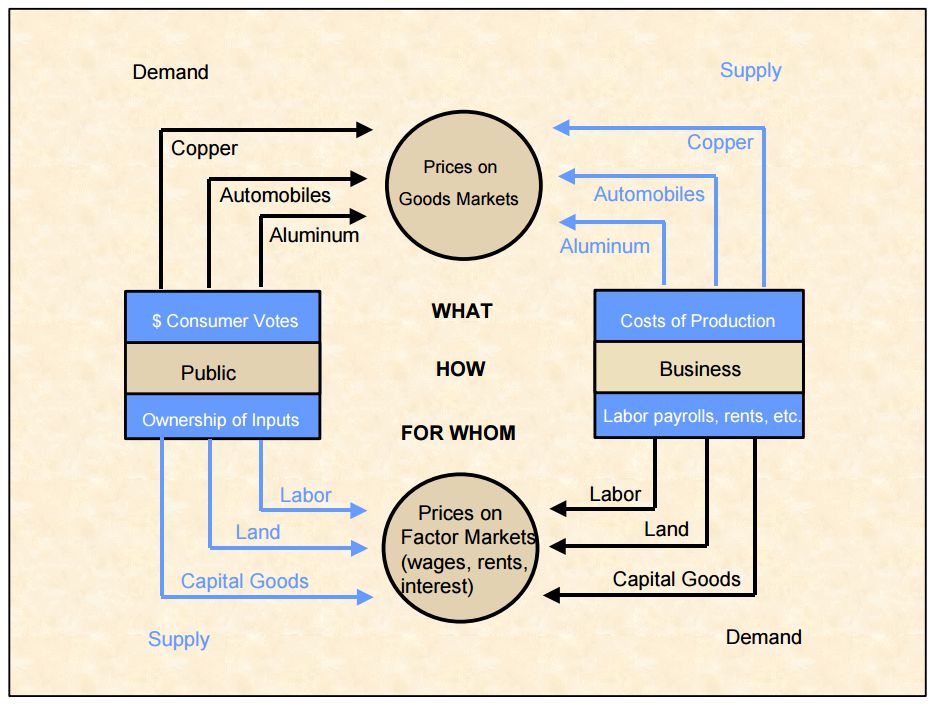

Price

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted to currency, quantities of goods or vouchers. * In modern economies, prices are generally expressed in units of some form of currency. (More specifically, for raw materials they are expressed as currency per unit weight, e.g. euros per kilogram or Rands per KG.) * Although ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depreciated

In accountancy, depreciation is a term that refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used (depreciation with the matching principle). Depreciation is thus the decrease in the value of assets and the method used to reallocate, or "write down" the cost of a tangible asset (such as equipment) over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes. The decrease in value of the asset affects the balance sheet of a business or entity, and the method of depreciating the asset, accounting-wise, affects the net income, and thus the income statement that they report. Generally, the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Measurement Standard

The American Measurement Standard is an authoritative measurement standard for use with single-family dwellings. The AMS 2020 edition is a voluntary guide developed for the measurement, calculation, and communication of square footage in residential dwellings. Description This standard defines eight specific categories for the reporting of all space associated with a residential dwelling. The AMS helps to establish common and logical definitions of "finished square footage" and "gross living area." The methodology of the American Measurement Standard was compiled and edited by a consensus of real estate professionals including real estate agents, appraisers, assessors, home builders and architects, and is based on the exterior dimensions of a dwelling. The AMS contains over three times more specific home measurement details than any other square footage guideline and includes numerous illustrations and examples. The standard provides acceptable square footage calculations for use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Skyscrapers

A skyscraper is a tall continuously habitable building having multiple floors. Modern sources currently define skyscrapers as being at least or in height, though there is no universally accepted definition. Skyscrapers are very tall high-rise buildings. Historically, the term first referred to buildings with between 10 and 20 stories when these types of buildings began to be constructed in the 1880s. Skyscrapers may host offices, hotels, residential spaces, and retail spaces. One common feature of skyscrapers is having a steel frame that supports curtain walls. These curtain walls either bear on the framework below or are suspended from the framework above, rather than resting on load-bearing walls of conventional construction. Some early skyscrapers have a steel frame that enables the construction of load-bearing walls taller than of those made of reinforced concrete. Modern skyscrapers' walls are not load-bearing, and most skyscrapers are characterised by large surface ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Approach

The income approach is one of three major groups of methodologies, called valuation ''approaches'', used by appraisers. It is particularly common in commercial real estate appraisal and in business appraisal. The fundamental math is similar to the methods used for financial valuation, securities analysis, or bond pricing. However, there are some significant and important modifications when used in real estate or business valuation. While there are quite a few acceptable methods under the rubric of the income approach, most of these methods fall into three categories: direct capitalization, discounted cash flow, and gross income multiplier. Direct Capitalization This is simply the quotient of dividing the annual net operating income (NOI) by the appropriate capitalization rate (CAP rate). For income-producing real estate, the NOI is the net income of the real estate (but not the business interest) plus any interest expense and non-cash items (e.g. -- depreciation) minus a reserve fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cost Approach

In real estate appraisal, the cost approach is one of three basic valuation methods.Uniform Standard of Professional Appraisal Practice, 2008, Appraisal Foundation, Standards Rule 1-4(b) p. U18 The others are market approach, or sales comparison approach, and income approach. The fundamental premise of the cost approach is that a potential user of real estate won't, or shouldn't, pay more for a property than it would cost to build an equivalent. The cost of construction minus depreciation, plus land, therefore is a limit, or at least a metric, of market value. There are some fairly large assumptions embedded here. One of the basics is that there is a sufficient supply of buildable land that construction is a viable alternative to purchase of an existing property. In some parts of the world today, including in the US, there are areas which are either so fully developed, or so restrictive in their planning approvals, that new construction is not an option because of the scarcity of l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Comparison Approach

The sales comparison approach (SCA) relies on the assumption that a matrix of attributes or significant features of a property drive its value. For examples, in the case of a single family residence, such attributes might be floor area, views, location, number of bathrooms, lot size, age of the property and condition of property. Economic Basis The sales comparison approach is based upon the principles of supply and demand, as well as upon the principle of substitution. Supply and demand indicates value through typical market behavior of both buyers and sellers. Substitution indicates that a purchaser would not purchase an improved property for any value higher than it could be replaced for on a site with equivalent utility, assuming no undue delays in construction. Examples of Methods In practice, the most common SCA method used by estate agents and real estate appraisers is the sales adjustment grid. It uses a small number of recently sold properties in the immediate vicinity of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Raleigh, North Carolina

Raleigh (; ) is the capital city of the state of North Carolina and the seat of Wake County in the United States. It is the second-most populous city in North Carolina, after Charlotte. Raleigh is the tenth-most populous city in the Southeast, the 41st-most populous city in the U.S., and the largest city of the Research Triangle metro area. Raleigh is known as the "City of Oaks" for its many oak trees, which line the streets in the heart of the city. The city covers a land area of . The U.S. Census Bureau counted the city's population as 474,069 in the 2020 census. It is one of the fastest-growing cities in the United States. The city of Raleigh is named after Sir Walter Raleigh, who established the lost Roanoke Colony in present-day Dare County. Raleigh is home to North Carolina State University (NC State) and is part of the Research Triangle together with Durham (home of Duke University and North Carolina Central University) and Chapel Hill (home of the Uni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tree Measurement

Trees have a wide variety of sizes and shapes and growth habits. Specimens may grow as individual trunks, multitrunk masses, coppices, clonal colonies, or even more exotic tree complexes. Most champion tree programs focus finding and measuring the largest single-trunk example of each species. There are three basic parameters commonly measured to characterize the size of a single trunk tree: height, girth, and crown spread. Additional details on the methodology of Tree height measurement, Tree girth measurement, Tree crown measurement, and Tree volume measurement are presented in the links herein. A detailed guideline to these basic measurements is provided in ''The Tree Measuring Guidelines of the Eastern Native Tree Society'' by Will Blozan.Blozan, Will. 2006. Tree Measuring Guidelines of the Eastern Native Tree Society. Bulletin of the Eastern Native Tree Society, Volume 1, Number 1, Summer 2006. pp. 3–10. These are summaries of how to measure trees are also presented by var ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uniform Standards Of Professional Appraisal Practice

Uniform Standards of Professional Appraisal Practice (USPAP) can be considered the quality control standards applicable for real property, personal property, intangible assets, and business valuation Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation techniques are used by financial market participants to determine the price they are willing t ... appraisal analysis and reports in the United States and its territories. USPAP, as it is commonly known, was first developed in the 1980s by a joint committee representing the major U.S. and Canadian appraisal organizations. As a result of the savings and loan crisis, the Appraisal Foundation (TAF) was formed by these same groups, along with support and input from major industry and educational groups, and TAF took over administration of USPAP. The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) authoriz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |