|

Postāearnings-announcement Drift

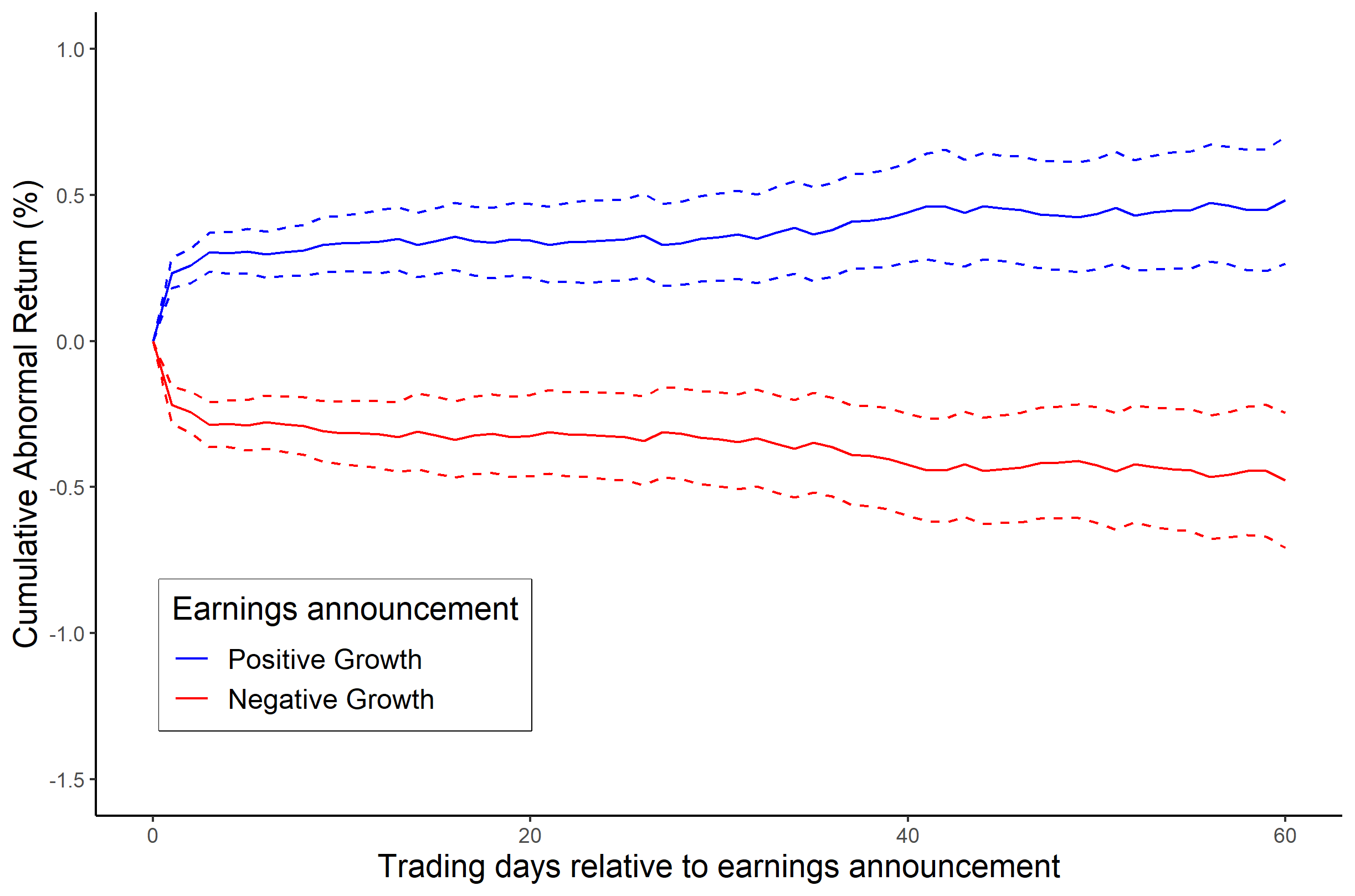

In financial economics and accounting research, postāearnings-announcement drift or PEAD (also named the SUE effect) is the tendency for a stockās cumulative abnormal returns to drift in the direction of an earnings surprise for several weeks (even several months) following an earnings announcement. Cause and effect Once a firm's current earnings become known, the information content should be quickly digested by investors and incorporated into the efficient market price. However, it has long been known that this is not exactly what happens. For firms that report good news in quarterly earnings, their abnormal security returns tend to drift upwards for at least 60 days following their earnings announcement. Similarly, firms that report bad news in earnings tend to have their abnormal security returns drift downwards for a similar period. This phenomenon is called post-announcement drift. This was initially proposed by the information content study of Ray J. Ball & P. Brown, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Research

Accounting research examines how accounting is used by individuals, organizations and government as well as the consequences that these practices have. Starting from the assumption that accounting both measures and makes visible certain economic events, accounting research has studied the roles of accounting in organizations and society and the consequences that these practices have for individuals, organizations, governments and capital markets. It encompasses a broad range of topics including financial accounting research, management accounting research, auditing research, capital market research, accountability research, social responsibility research and taxation research.Oler, Derek K., Mitchell J. Oler, and Christopher J. Skousen. 2010. "Characterizing Accounting Research." ''Accounting Horizons'' 24 (4): 635ā670. Academic accounting research "addresses all aspects of the accounting profession" using the scientific method, while research by practicing accountants focuses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abnormal Return

In finance, an abnormal return is the difference between the actual return of a security and the expected return. Abnormal returns are sometimes triggered by "events." Events can include mergers, dividend announcements, company earning announcements, interest rate increases, lawsuits, etc. all of which can contribute to an abnormal return. Events in finance can typically be classified as information or occurrences that have not already been priced by the market. Stock market In stock market trading, abnormal returns are the differences between a single stock or portfolio's performance and the expected return over a set period of time. Usually a broad index, such as the S&P 500 or a national index like the Nikkei 225, is used as a benchmark to determine the expected return. For example, if a stock increased by 5% because of some news that affected the stock price, but the average market only increased by 3% and the stock has a beta of 1, then the abnormal return was 2% (5% - 3% = 2%). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earnings Surprise

An earnings surprise, or unexpected earnings, in accounting, is the difference between the reported earnings and the expected earnings of an entity. Measures of a firm's expected earnings, in turn, include analysts' forecasts of the firm's profitDefond, Mark L., and Chul W. Park. 2001. āThe Reversal of Abnormal Accruals and the Market Valuation of Earnings Surprises.ā ''The Accounting Review'' 76 (3): 375ā404. and mathematical models of expected earnings based on the earnings of previous accounting periods. Effect of earnings surprises Stock markets tend to react in the same direction as earnings surprisesāpositively to positive earnings surprises and negatively to negative earnings surprisesāalthough a significant proportion of earnings surprises result in stock markets reacting in the opposite direction, which may be a reaction to other relevant information released with the earnings announcement or inaccurate measurement of the earnings surprise. The market, howeve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ray J

William Ray Norwood Jr. (born January 17, 1981), known professionally as Ray J, is an American singer, actor, and television personality. Born in McComb, Mississippi, and raised in Carson, California, he is the younger brother of recording artist and actress Brandy Norwood and the first cousin of rapper Snoop Dogg. In January 2017, he competed in the nineteenth season of the UK reality television programme '' Celebrity Big Brother''. Early life William Ray Norwood Jr. was born in McComb, Mississippi to Willie Norwood and Sonja Bates-Norwood. His older sister Brandy is a multi-platinum recording artist. Early in his life, he moved with his family from McComb, Mississippi to Los Angeles, California, and in 1989 started appearing in television commercials for different companies. In 1989, at the age of eight, Norwood began auditioning for and appearing in television commercials; he played the foster son in ''The Sinbad Show'', from 1993 to 1994. This period in Norwood's life ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficient-market Hypothesis

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Random Walk

In mathematics, a random walk is a random process that describes a path that consists of a succession of random steps on some mathematical space. An elementary example of a random walk is the random walk on the integer number line \mathbb Z which starts at 0, and at each step moves +1 or ā1 with equal probability. Other examples include the path traced by a molecule as it travels in a liquid or a gas (see Brownian motion), the search path of a foraging animal, or the price of a fluctuating stock and the financial status of a gambler. Random walks have applications to engineering and many scientific fields including ecology, psychology, computer science, physics, chemistry, biology, economics, and sociology. The term ''random walk'' was first introduced by Karl Pearson in 1905. Lattice random walk A popular random walk model is that of a random walk on a regular lattice, where at each step the location jumps to another site according to some probability distribution. In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earnings Response Coefficient

In financial economics, finance, and accounting, the earnings response coefficient, or ERC, is the estimated relationship between equity returns and the unexpected portion of (i.e., new information in) companies' earnings announcements. Development Arbitrage pricing theory describes the theoretical relationship between information that is known to market participants about a particular equity (e.g., a common stock share of a particular company) and the price of that equity. Under the strong form of the efficient market hypothesis, equity prices are expected in the aggregate to reflect all relevant information at a given time. Market participants with superior information are expected to exploit that information until share prices have effectively impounded the information. Therefore, in the aggregate, a portion of changes in a company's share price is expected to result from changes in the relevant information available to the market. The ERC is an estimate of the change in a c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Momentum Investing

Momentum investing is a system of buying stocks or other securities that have had high returns over the past three to twelve months, and selling those that have had poor returns over the same period. While momentum investing is well-established as a phenomenon no consensus exists about the explanation for this strategy, and economists have trouble reconciling momentum with the efficient market hypothesis and random walk hypothesis. Two main hypotheses have been submitted to explain the momentum effect in terms of an efficient market. In the first, it is assumed that momentum investors bear significant risk for assuming this strategy, and, therefore, the high returns are a compensation for the risk. Momentum strategies often involve disproportionately trading in stocks with high bid-ask spreads and so it is important to take transactions costs into account when evaluating momentum profitability. The second theory assumes that momentum investors are exploiting behavioral shortcomings i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accounting Research

Accounting research examines how accounting is used by individuals, organizations and government as well as the consequences that these practices have. Starting from the assumption that accounting both measures and makes visible certain economic events, accounting research has studied the roles of accounting in organizations and society and the consequences that these practices have for individuals, organizations, governments and capital markets. It encompasses a broad range of topics including financial accounting research, management accounting research, auditing research, capital market research, accountability research, social responsibility research and taxation research.Oler, Derek K., Mitchell J. Oler, and Christopher J. Skousen. 2010. "Characterizing Accounting Research." ''Accounting Horizons'' 24 (4): 635ā670. Academic accounting research "addresses all aspects of the accounting profession" using the scientific method, while research by practicing accountants focuses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind. Size of the market The total market capitalization of all publicly traded securities worldwide rose from US$2.5 trillion in 1980 to US$93.7 trillion at the end of 2020. , there are 60 stock exchanges in the world. Of these, there are 16 exchanges with a market capitalization of $1 trillion or more, and they account for 87% of global market capitalization. Apart from the Australian Securities Exchange, these 16 exchanges are all in North America, Europe, or Asia. By country, the largest stock markets as of January 202 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics, also known as finance, is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade". William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing, commonly known as "Investments", and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |