|

Pari Passu

''Pari passu'' is a Latin phrase that literally means "with an equal step" or "on equal footing". It is sometimes translated as "ranking equally", "hand-in-hand", "with equal force", or "moving together", and by extension, "fairly", "without partiality". Etymology :* '' pari'' is the ablative singular masculine (since it must grammatically agree with ''passu'') of the adjective ''par'', "equal". If it were nominative, "an equal step" it would be ''par passus''. :* '' passu'' is the ablative of the Latin noun ''passus'', "step". This term is commonly used in law. ''Black's Law Dictionary'' (8th ed., 2004) defines ''pari passu'' as "proportionally; at an equal pace; without preference". Usage In inheritance In inheritance, a ''pari passu'' (''per capita'') distribution can be distinguished from a '' per stirpes'' (by family branch) distribution. For example, suppose a testator had two children A and B. A has two children, and B has three. * If the testator leaves his or her ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latin

Latin (, or , ) is a classical language belonging to the Italic branch of the Indo-European languages. Latin was originally a dialect spoken in the lower Tiber area (then known as Latium) around present-day Rome, but through the power of the Roman Republic it became the dominant language in the Italian region and subsequently throughout the Roman Empire. Even after the fall of Western Rome, Latin remained the common language of international communication, science, scholarship and academia in Europe until well into the 18th century, when other regional vernaculars (including its own descendants, the Romance languages) supplanted it in common academic and political usage, and it eventually became a dead language in the modern linguistic definition. Latin is a highly inflected language, with three distinct genders (masculine, feminine, and neuter), six or seven noun cases (nominative, accusative, genitive, dative, ablative, and vocative), five declensions, four verb conjug ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vulture Fund

A vulture fund is a hedge fund, private-equity fund or distressed debt fund, that invests in debt considered to be very weak or in default, known as distressed securities. Investors in the fund profit by buying debt at a discounted price on a secondary market and then using numerous methods to subsequently sell the debt for a larger amount than the purchasing price. Debtors include companies, countries, and individuals. Vulture funds have had success in bringing attachment and recovery actions against sovereign debtor governments, usually settling with them before realizing the attachments in forced sales. Settlements typically are made at a discount in hard or local currency or in the form of new debt issuance. In one instance involving Peru, such a seizure threatened payments to other creditors of the sovereign obliger. History Sovereign debt collection was rare until the 1950s when sovereign immunity of government issuers started to become restricted by contract terms. Thi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, and the term ''bankruptcy'' is therefore not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian ''banca rotta'', literally meaning "broken bank". The term is often described as having originated in renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment so that the public could see that the banker, the owner of the bench, was no longer in a condition to continue his business, although some dismiss this as a false etymology. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Income

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing. For a company to grow its business, it often must raise money – for example, to finance an acquisition; buy equipment or land, or invest in new product development. The terms on which investors will finance the company will depend on the risk profile of the compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collective Action Clause

A collective action clause (CAC) allows a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders of the bond, including those who vote against the restructuring. Bondholders generally opposed such clauses in the 1980s and 1990s, fearing that it gave debtors too much power. However, following Argentina's December 2001 default on its debts in which its bonds lost 70% of their value, CACs have become much more common, as they are now seen as potentially warding off more drastic action, but enabling easier coordination of bondholders. During the financial crisis of 2011–12, the Greek government imposed, with the support of the IMF and ECB, a retroactive CAC with a threshold of 75%. That impacted 90% of the bonds, which issued under the jurisdiction of Greek courts. On 9 May 2012, the required supermajority was obtained, with 85.8% of domestic-law bonds tendered in favour. An investor named Bill Gross said, "The sanctity of their contra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Latin Phrases (P-R)

A ''list'' is any set of items in a row. List or lists may also refer to: People * List (surname) Organizations * List College, an undergraduate division of the Jewish Theological Seminary of America * SC Germania List, German rugby union club Other uses * Angle of list, the leaning to either port or starboard of a ship * List (information), an ordered collection of pieces of information ** List (abstract data type), a method to organize data in computer science * List on Sylt, previously called List, the northernmost village in Germany, on the island of Sylt * ''List'', an alternative term for ''roll'' in flight dynamics * To ''list'' a building, etc., in the UK it means to designate it a listed building that may not be altered without permission * Lists (jousting), the barriers used to designate the tournament area where medieval knights jousted * ''The Book of Lists'', an American series of books with unusual lists See also * The List (other) * Listing (di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Seniority (finance)

In finance, seniority refers to the order of repayment in the event of a sale or bankruptcy of the issuer. Seniority can refer to either debt or preferred stock. Senior debt must be repaid before subordinated (or junior) debt is repaid.The American Heritage Dictionary of Businessurt Publishing Company, 2010 Each security, either debt or equity, that a company issues has a specific seniority or ranking. Bonds that have the same seniority in a company's capital structure are described as being pari passu. Preferred stock is senior to common stock in a sale when preferred shareholders must receive back their preference, typically their original investment amount, before the common shareholders receive anything. FpML The seniority of bonds recognised in FpML (Financial products Markup Language) are as follows: See also * Security interest * Secured creditor * Senior debt * Unsecured creditor * Preferential creditor A preferential creditor (in some jurisdictions called a prefe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statute Of Bankrupts Act 1542

The Statute of Bankrupts or An Acte againste suche persones as doo make Bankrupte, 34 & 35 Henry VIII, c. 4, was an Act passed by the Parliament of England in 1542. It was the first statute under English law dealing with bankruptcy or insolvency. It was repealed by section 1 of the Act 6 Geo.4 c.16. The Act contained an extremely long preamble which denounced debtors acting in fraud of their creditors, directed that the bodies of the offenders and all of their assets be taken by the requisite authorities and the assets be sold to pay their creditors "a portion, rate and rate alike, according to the quantity of their debts". Thereby the first bankruptcy statute also imported into English law for the first time the ''pari passu'' principle of distribution on insolvency. These principles would later be heavily underscored by the House of Lords in the cases of ''National Westminster Bank Ltd v Halesowen Presswork & Assemblies Ltd ''National Westminster Bank Ltd v Halesowen Pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important central banks. The ECB Governing Council makes the projects for the monetary policy for the European Union with suggestions and recommendations and to the Eurozone with more direct applications of such policies, it also administers the foreign exchange reserves of EU member states in the Eurozone, engages in foreign exchange operations, and defines the intermediate monetary aims and objectives, and also the common interest rates for the EU. The ECB Executive Board makes policies and decisions of the Governing Council, and may give direction to the national central banks, especially when doing so for the Eurozone central banks. The ECB has the exclusive right to authorise the issuance of euro banknotes. EU member states can issue their langu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collective Action Clause

A collective action clause (CAC) allows a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders of the bond, including those who vote against the restructuring. Bondholders generally opposed such clauses in the 1980s and 1990s, fearing that it gave debtors too much power. However, following Argentina's December 2001 default on its debts in which its bonds lost 70% of their value, CACs have become much more common, as they are now seen as potentially warding off more drastic action, but enabling easier coordination of bondholders. During the financial crisis of 2011–12, the Greek government imposed, with the support of the IMF and ECB, a retroactive CAC with a threshold of 75%. That impacted 90% of the bonds, which issued under the jurisdiction of Greek courts. On 9 May 2012, the required supermajority was obtained, with 85.8% of domestic-law bonds tendered in favour. An investor named Bill Gross said, "The sanctity of their contra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Greek Government-debt Crisis

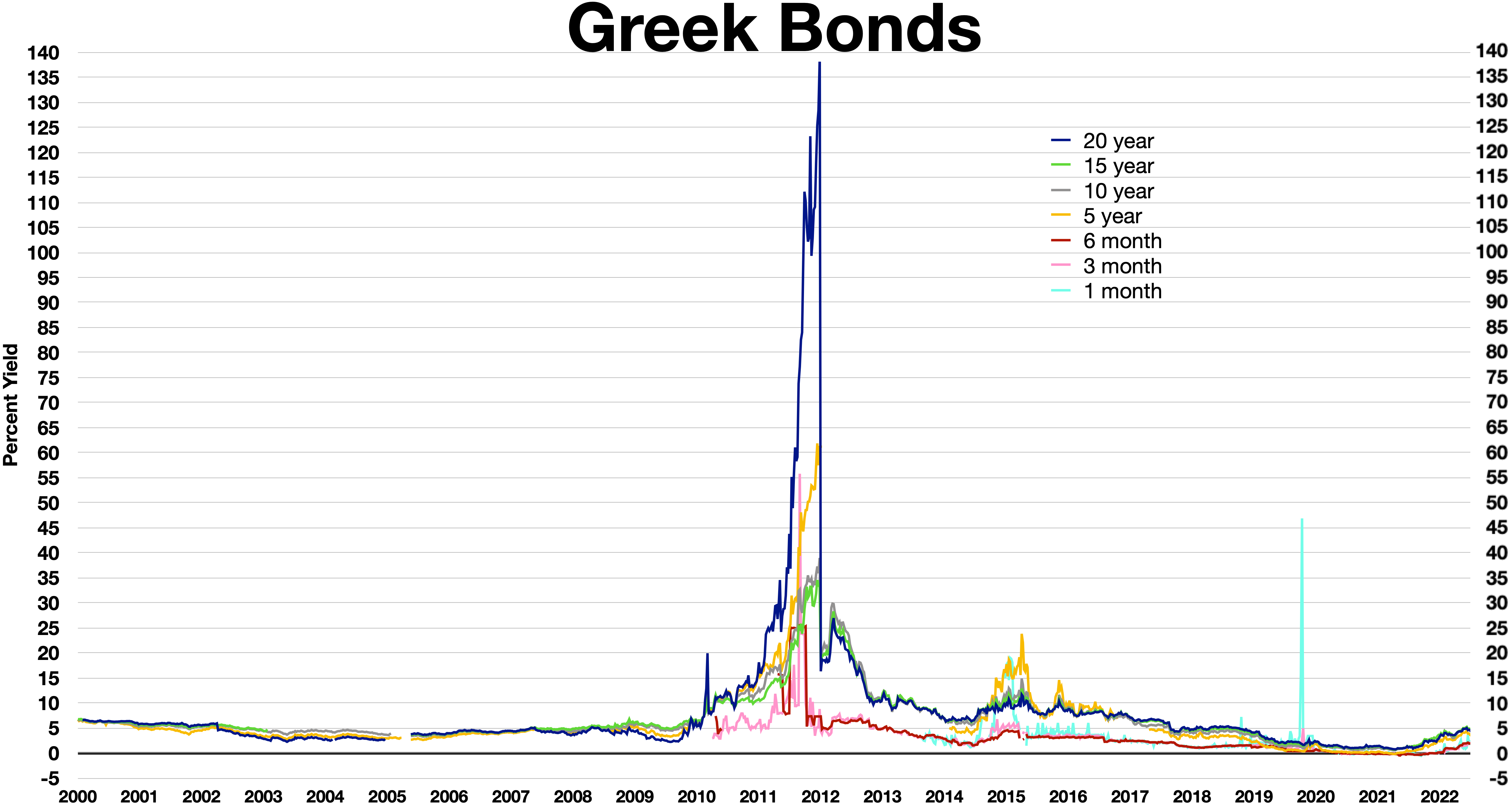

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis ( Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country. The Greek crisis started in late 2009, triggered by the turmoil of the world-wide Great Recession, structural weaknesses in the Greek economy, and lack of monetary policy flexibility as a member of the Eurozone. The crisis included revelations that previous data on government debt levels and deficits had been underreported by the Greek government: the official forecast for the 2009 budg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)