|

Perpetual Futures

In finance, a perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future. Perpetual futures are cash-settled, and they differ from regular futures in that they lack a pre-specified delivery date and can thus be held indefinitely without the need to roll over contracts as they approach expiration. Payments are periodically exchanged between holders of the two sides of the contracts, long and short, with the direction and magnitude of the settlement based on the difference between the contract price and that of the underlying asset, as well as, if applicable, the difference in leverage between the two sides. Perpetual futures were first proposed by economist Robert Shiller in 1992, to enable derivatives markets for illiquid assets. Shiller, Robert J, 1993.Measuring Asset Values for Cash Settlement in Derivative Markets: Hedonic Repeated Measures Indices and Perpetual Futures" Journal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract For Difference

In finance, a contract for difference (CFD) is a financial agreement between two parties, commonly referred to as the "buyer" and the "seller." The contract stipulates that the buyer will pay the seller the difference between the current value of an asset and its value at the time the contract was initiated. If the asset's price increases from the opening to the closing of the contract, the seller compensates the buyer for the increase, which constitutes the buyer's profit. Conversely, if the asset's price decreases, the buyer compensates the seller, resulting in a profit for the seller. History Invention Developed in Britain in 1974 as a way to leverage gold, modern CFDs have been trading widely since the early 1990s. CFDs were originally developed as a type of equity swap that was traded on margin. The invention of the CFD is widely credited to Brian Keelan and Jon Wood, both of UBS Warburg, during their Trafalgar House deal in the early 1990s. Asset management and syntheti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivatives (finance)

The derivative of a function is the rate of change of the function's output relative to its input value. Derivative may also refer to: In mathematics and economics * Brzozowski derivative in the theory of formal languages *Covariant derivative, a way of specifying a derivative along tangent vectors of a manifold with a connection. * Exterior derivative, an extension of the concept of the differential of a function to differential forms of higher degree. *Formal derivative, an operation on elements of a polynomial ring which mimics the form of the derivative from calculus * Fréchet derivative, a derivative defined on normed spaces. * Gateaux derivative, a generalization of the concept of directional derivative in differential calculus. * Lie derivative, the change of a tensor field (including scalar functions, vector fields and one-forms), along the flow defined by another vector field. * Radon–Nikodym derivative in measure theory * Derivative (set theory), a concept app ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backwardation

Normal backwardation, also sometimes called backwardation, is the market condition where the price of a commodity's forward contract, forward or futures contract is trading below the ''expected'' spot price at contract maturity. The resulting futures or forward curve would ''typically'' be downward sloping (i.e. "inverted"), since contracts for further dates would typically trade at even lower prices. In practice, the expected future spot price is unknown, and the term "backwardation" may refer to "positive basis", which occurs when the current spot price exceeds the price of the future. The opposite market condition to normal backwardation is known as contango. Contango refers to "negative basis" where the future price is trading above the expected spot price. Note: In industry parlance backwardation may refer to the situation that futures prices are below the ''current'' spot price. Backwardation occurs when the difference between the forward price and the spot price is less ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contango

Contango is a situation in which the futures contract, futures price (or forward contract, forward price) of a commodity is higher than the spot price. In a contango situation, arbitrageurs or speculators are "willing to pay more for a commodity [to be received] at some point in the future than to purchase the commodity immediately. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, Hedge (finance), hedgers (commodity producers and commodity holders) are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a ''normal market'' or ''carrying cost, carrying-cost market''. The opposite market condition to contango is known as backwardation. "A market is 'in backwardation' when the futures price is below the spot price for a particular commodity. This is favorable for inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Price Index

A consumer price index (CPI) is a statistical estimate of the level of prices of goods and services bought for consumption purposes by households. It is calculated as the weighted average price of a market basket of Goods, consumer goods and Service (economics), services. Changes in CPI track changes in prices over time. The items in the basket are updated periodically to reflect changes in consumer spending habits. The prices of the goods and services in the basket are collected (often monthly) from a sample of retail and service establishments. The prices are then adjusted for changes in quality or features. Changes in the CPI can be used to track inflation over time and to compare inflation rates between different countries. While the CPI is not a perfect measure of inflation or the cost of living, it is a useful tool for tracking these economic indicators. It is one of several Price index, price indices calculated by many national statistical agencies. Overview A CPI is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repeated Measures Design

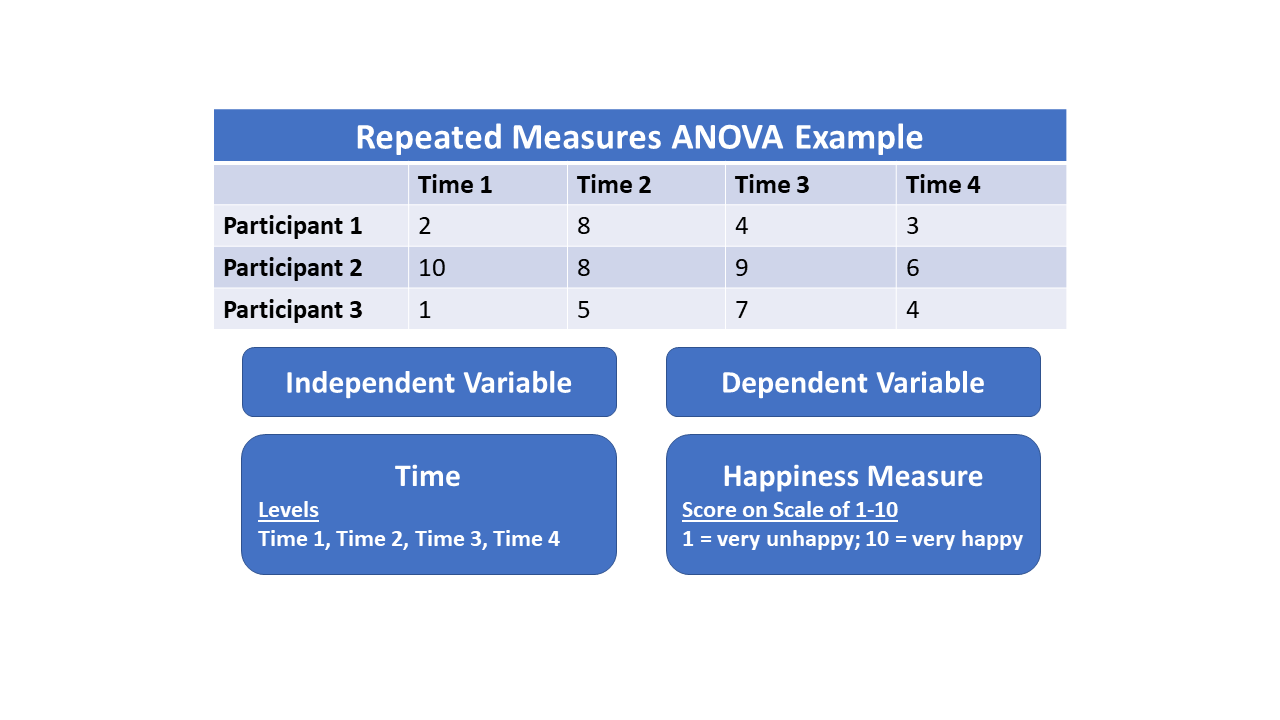

Repeated measures design is a research design that involves multiple measures of the same variable taken on the same or matched subjects either under different conditions or over two or more time periods. For instance, repeated measurements are collected in a longitudinal study in which change over time is assessed. Crossover studies A popular repeated-measures design is the crossover study. A crossover study is a longitudinal study in which subjects receive a sequence of different treatments (or exposures). While crossover studies can be observational studies, many important crossover studies are controlled experiments. Crossover designs are common for experiments in many scientific disciplines, for example psychology, education, pharmaceutical science, and health care, especially medicine. Randomized, controlled, crossover experiments are especially important in health care. In a randomized clinical trial, the subjects are randomly assigned treatments. When such a trial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedonic Regression

In economics, hedonic regression, also sometimes called hedonic demand theory, is a revealed preference method for estimating demand or value of a characteristic of a differentiated good. It decomposes the item being researched into its constituent characteristics and obtains estimates of the contributory value for each. This requires that the composite good (the item being researched and valued) ''can'' be reduced to its constituent parts and that those resulting parts are in some way valued by the market. Hedonic models are most commonly estimated using regression analysis, although some more generalized models such as sales adjustment grids are special cases which do not. Hedonic models are commonly used in real estate appraisal, real estate economics, environmental economics, and Consumer Price Index (CPI) calculations. For example, in real estate economics, a hedonic model might be used to estimate demand or willingness to pay for a housing characteristic such as the siz ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Counterparty

A counterparty (sometimes contraparty) is a Juristic person, legal entity, unincorporated entity, or collection of entities to which an exposure of financial risk may exist. The word became widely used in the 1980s, particularly at the time of the Basel I deliberations in 1988. Well-drafted contracts usually attempt to spell out in explicit detail what each counterparty's rights and obligations are in every conceivable circumstance, though there are limits. There are general provisions for how counterparties are treated under the law, and (at least in common law legal systems) there are many legal precedents that shape the common law. Financial services sector Within the financial services sector, the term market counterparty is used to refer to governments, public banks, national monetary authorities and international monetary organisations such as the World Bank Group that act as the ultimate guarantor for loans and indemnities. The term may also be applied, in a more general se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hong Kong

Hong Kong)., Legally Hong Kong, China in international treaties and organizations. is a special administrative region of China. With 7.5 million residents in a territory, Hong Kong is the fourth most densely populated region in the world. Hong Kong was established as a colony of the British Empire after the Qing dynasty ceded Hong Kong Island in 1841–1842 as a consequence of losing the First Opium War. The colony expanded to the Kowloon Peninsula in 1860 and was further extended when the United Kingdom obtained a 99-year lease of the New Territories in 1898. Hong Kong was occupied by Japan from 1941 to 1945 during World War II. The territory was handed over from the United Kingdom to China in 1997. Hong Kong maintains separate governing and economic systems from that of mainland China under the principle of one country, two systems. Originally a sparsely populated area of farming and fishing villages,. the territory is now one of the world's most signific ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chinese Gold And Silver Exchange Society

The Chinese Gold and Silver Exchange Society (CGSE; ) is an organisation of gold trading firms in Hong Kong who are participants of the Chinese Gold and Silver Exchange, the first exchange in Hong Kong. The Chinese Gold and Silver Exchange was established in 1910 and has a history of more than 110 years. CGSE is amongst the few Exchange in the world that has both an open outcry and an electronic precious metals trading platform. It is Hong Kong's only physical Gold and Silver Exchange approved by the government under the Laws of Hong Kong in Article 3(d) of Chapter 82. The CGSE has 171 corporate members from the precious metals industry representing key stakeholders, which include banks, large jeweler groups, bullion merchants, gold refineries, and financial institutions. The role of CGSE is to provide its members with a venue to facilitate precious metal trading activities and member advisory. History The CGSES was formally established as an organisation in 1910. Its fou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basis Risk

Basis risk in finance is the risk associated with imperfect hedging due to the variables or characteristics that affect the difference between the futures contract and the underlying "cash" position. It arises because of the difference between the price of the asset to be hedged and the price of the asset serving as the hedge before expiration, namely b = S - F. Barring idiosyncratic influence by the other aspects to be enumerated just below, by the time of expiration this simple difference will be eliminated by arbitrage. The other aspects that give rise to basis risk include: # Quality (grade) arising when the hedge in place has a different grade which is not perfectly correlated with the basis; # Timing arising due to mismatch between the expiration date of the hedge asset and the actual selling date of the underlying asset; # Location (leading to Transportation Costs) arising due to the difference in the location of the asset being hedged and the asset serving as the hedge, and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |