|

Payment Orchestration

Payment orchestration is the process of managing and optimizing digital payments by integrating multiple payment service providers, gateways, and methods into a single platform. Overview Payment orchestration is an advanced framework that enables businesses to streamline and optimize their payment processing by integrating multiple payment methods and service providers into a single platform. Payment orchestration is distinct from a payment gateway or payment optimization. A gateway is narrower in scope, as it provides a means of access to payment processing, and is not a system to tailor and optimize payment flows for specific merchants or payment service providers. Payment optimization involves techniques to improve the outcome of an individual transaction. Orchestration is the entire "payments stack". Components of payment orchestration include the use of a platform for processing; integration with payment service providers; built-in fraud prevention and security; and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-payments

Electronic funds transfer (EFT) is the transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems. The funds transfer process generally consists of a series of electronic messages sent between financial institutions directing each to make the debit and credit accounting entries necessary to complete the transaction. An electronic funds transfer starts when the sending customer send an electronic instruction with the purpose of making payment to the beneficiary or the receiving customer. Process According to the United States Electronic Fund Transfer Act of 1978 it is "a funds transfer initiated through an electronic terminal, telephone, computer (including on-line banking) or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit a consumer's account". EFT transactions are known by a number of names across countries ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Service Provider

A payment service provider (PSP) is a third-party company that allows businesses to accept electronic payments, such as credit card and debit card payments. PSPs act as intermediaries between those who make payments, i.e. consumers, and those who accept them, i.e. retailers. They will often provide merchant services and act as a payment gateway or payment processor for e-commerce and brick and mortar businesses. They may also offer risk management services for card and bank based payments, transaction payment matching, digital wallets, reporting, fund remittance, currency exchange and fraud protection. The PSP will typically provide software to integrate with e-commerce websites or point of sale systems. Operation PSPs establish technical connections with acquiring banks and card networks, enabling merchants to accept different payment methods without the need to partner with a particular bank. They fully manage payment processing and external network relationships, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CiteseerX

CiteSeerX (formerly called CiteSeer) is a public search engine and digital library for scientific and academic papers, primarily in the fields of computer and information science. CiteSeer's goal is to improve the dissemination and access of academic and scientific literature. As a non-profit service that can be freely used by anyone, it has been considered part of the open access movement that is attempting to change academic and scientific publishing to allow greater access to scientific literature. CiteSeer freely provided Open Archives Initiative metadata of all indexed documents and links indexed documents when possible to other sources of metadata such as DBLP and the ACM Portal. To promote open data, CiteSeerX shares its data for non-commercial purposes under a Creative Commons license. CiteSeer is considered a predecessor of academic search tools such as Google Scholar and Microsoft Academic Search. CiteSeer-like engines and archives usually only harvest documents f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customer Relationship Management

Customer relationship management (CRM) is a strategic process that organizations use to manage, analyze, and improve their interactions with customers. By leveraging data-driven insights, CRM helps businesses optimize communication, enhance customer satisfaction, and drive sustainable growth. CRM systems compile data from a range of different communication channels, including a company's website, telephone (which many services come with a softphone), email, live chat, marketing materials and more recently, social media. They allow businesses to learn more about their target audiences and how to better cater to their needs, thus retaining customers and driving sales growth. CRM may be used with past, present or potential customers. The concepts, procedures, and rules that a corporation follows when communicating with its consumers are referred to as CRM. This complete connection covers direct contact with customers, such as sales and service-related operations, forecasting, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CORE (research Service)

CORE (Connecting Repositories) is a service provided by the based at The Open University, United Kingdom. The goal of the project is to aggregate all open access content distributed across different systems, such as repositories and open access journals, enrich this content using text mining and data mining, and provide free access to it through a set of services. The CORE project also aims to promote open access to scholarly outputs. CORE works closely with digital libraries and institutional repositories. Service description There are existing commercial academic search systems, such as Google Scholar, which provide search and access level services, but do not support programmable machine access to the content. This is seen with the use of an API or data dumps, and limits the further reuse of the open access content (e.g., text and data mining). There are three access levels to content: * access at the granularity of papers * analytical access and granularity of colle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Application Programming Interfaces

An application programming interface (API) is a connection between computers or between computer programs. It is a type of software interface, offering a service to other pieces of software. A document or standard that describes how to build such a connection or interface is called an ''API specification''. A computer system that meets this standard is said to ''implement'' or ''expose'' an API. The term API may refer either to the specification or to the implementation. In contrast to a user interface, which connects a computer to a person, an application programming interface connects computers or pieces of software to each other. It is not intended to be used directly by a person (the end user) other than a computer programmer who is incorporating it into software. An API is often made up of different parts which act as tools or services that are available to the programmer. A program or a programmer that uses one of these parts is said to ''call'' that portion of the API. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Encryption

In Cryptography law, cryptography, encryption (more specifically, Code, encoding) is the process of transforming information in a way that, ideally, only authorized parties can decode. This process converts the original representation of the information, known as plaintext, into an alternative form known as ciphertext. Despite its goal, encryption does not itself prevent interference but denies the intelligible content to a would-be interceptor. For technical reasons, an encryption scheme usually uses a pseudo-random encryption Key (cryptography), key generated by an algorithm. It is possible to decrypt the message without possessing the key but, for a well-designed encryption scheme, considerable computational resources and skills are required. An authorized recipient can easily decrypt the message with the key provided by the originator to recipients but not to unauthorized users. Historically, various forms of encryption have been used to aid in cryptography. Early encryption ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

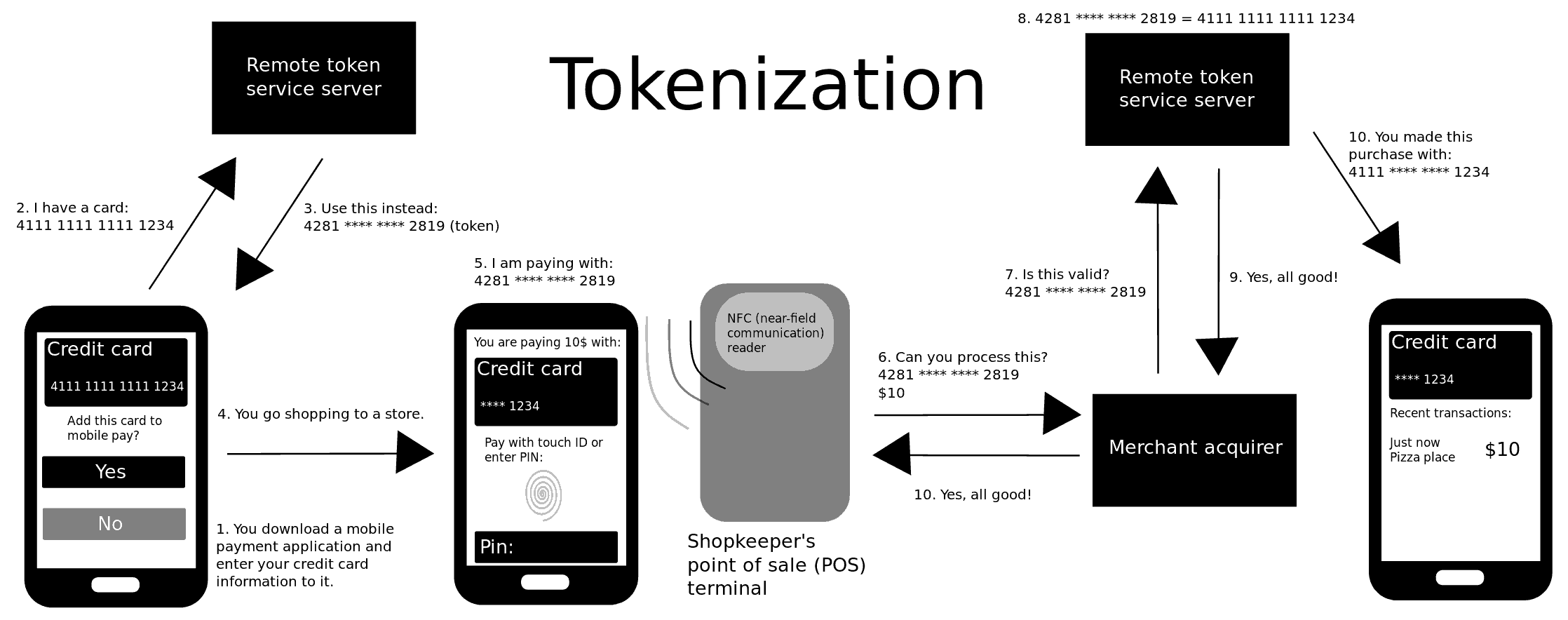

Tokenization (data Security)

Tokenization, when applied to data security, is the process of substituting a sensitive data element with a non-sensitive equivalent, referred to as a Security token, token, that has no intrinsic or exploitable meaning or value. The token is a reference (i.e. identifier) that maps back to the sensitive data through a tokenization system. The mapping from original data to a token uses methods that render tokens infeasible to reverse in the absence of the tokenization system, for example using tokens created from Random number generation, random numbers. A one-way cryptographic function is used to convert the original data into tokens, making it difficult to recreate the original data without obtaining entry to the tokenization system's resources. To deliver such services, the system maintains a vault database of tokens that are connected to the corresponding sensitive data. Protecting the system vault is vital to the system, and improved processes must be put in place to offer dat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment Systems

A payment system is any system used to settle financial transactions through the transfer of monetary value. This includes the institutions, payment instruments such as payment cards, people, rules, procedures, standards, and technologies that make its exchange possible.Biago Bossone and Massimo Cirasino, "The Oversight of the Payment Systems: A Framework for the Development and Governance of Payment Systems in Emerging Economies"The World Bank, July 2001, p.7 A payment system is an operational network which links bank accounts and provides for monetary exchange using bank deposits. Some payment systems also include credit mechanisms, which are essentially a different aspect of payment. Payment systems are used in lieu of tendering cash in domestic and international transactions. This consists of a major service provided by banks and other financial institutions. Traditional payment systems include negotiable instruments such as drafts (e.g., cheques) and documentary credits such ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |