|

Organic Composition Of Capital

The organic composition of capital (OCC) is a concept created by Karl Marx in his theory of capitalism, which was simultaneously his critique of the political economy of his time. It is derived from his more basic concepts of 'value composition of capital' and 'technical composition of capital'. Marx defines the organic composition of capital as "the value-composition of capital, in so far as it is determined by its technical composition and mirrors the changes of the latter". The 'technical composition of capital' measures the relation between the elements of constant capital (plant, equipment and materials) and variable capital (wage workers). It is 'technical' because no valuation is here involved. In contrast, the 'value composition of capital' is the ratio between the value of the elements of constant capital involved in production and the value of the labor. Marx found that the special concept of 'organic composition of capital' was sometimes useful in analysis, since it assu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Karl Marx

Karl Heinrich Marx (; 5 May 1818 – 14 March 1883) was a German philosopher, economist, historian, sociologist, political theorist, journalist, critic of political economy, and socialist revolutionary. His best-known titles are the 1848 pamphlet ''The Communist Manifesto'' and the four-volume (1867–1883). Marx's political and philosophical thought had enormous influence on subsequent intellectual, economic, and political history. His name has been used as an adjective, a noun, and a school of social theory. Born in Trier, Germany, Marx studied law and philosophy at the universities of Bonn and Berlin. He married German theatre critic and political activist Jenny von Westphalen in 1843. Due to his political publications, Marx became stateless and lived in exile with his wife and children in London for decades, where he continued to develop his thought in collaboration with German philosopher Friedrich Engels and publish his writings, researching in the British Mus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Faux Frais Of Production

Faux frais of production is a concept used by classical political economists and by Karl Marx in his critique of political economy. It refers to "incidental operating expenses" incurred in the productive investment of capital, which do not themselves add new value to output. In Marx's social accounting, the faux frais are a component of constant capital, or alternately are funded by a fraction of the new surplus value. {{Marxism When owners of capital invest in production, they do not just invest in labor power, materials, buildings and equipment (or means of production). They must also meet a range of other operating expenses. These can include all kinds of things like bookkeeping, training, catering, cleaning & repairs, advertising, insurance, security services, bribes, taxes & levies etc. Marx has in mind mainly those circulation costs directly necessary and indispensable to keep production going, not "fringe benefits". In modern medium-sized to large-sized business, fixed cap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Capital

In accounting, fixed capital is any kind of real, physical asset that is used repeatedly in the production of a product. In economics, fixed capital is a type of capital good that as a real, physical asset is used as a means of production which is durable or isn't fully consumed in a single time period.Varri P. (1987) Fixed Capital. In: Durlauf S., Blume L. (eds) The New Palgrave Dictionary of Economics. Palgrave Macmillan, London. "fixed capital", '' The New Palgrave: A Dictionary of Economics'', 1st Editio/ref> It contrasts with circulating capital such as raw materials, operating expenses etc. The concept was first theoretically analyzed in some depth by the economist Adam Smith in The Wealth of Nations (1776) and by David Ricardo in On the Principles of Political Economy and Taxation (1821). Ricardo studied the use of machines in place of labor and concluded that workers' fear of technology replacing them might be justified. Thus fixed capital is that portion of the t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intermediate Consumption

Intermediate consumption (also called "intermediate expenditure") is an economic concept used in national accounts, such as the United Nations System of National Accounts (UNSNA), the US National Income and Product Accounts (NIPA) and the European System of Accounts (ESA). Conceptually, the aggregate "intermediate consumption" is equal to the amount of the difference between gross output (roughly, the total sales value) and net output (gross value added or GDP). In the US economy, total intermediate consumption represents about 45% of gross output. The services component in intermediate consumption has grown strongly in the US, from about 30% in the 1980s to more than 40% today. Thus, intermediate consumption is an accounting flow which consists of the total monetary value of goods and services ''consumed or used up as inputs in production'' by enterprises, including raw materials, services and various other operating expenses. Because this value must be subtracted from gross ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

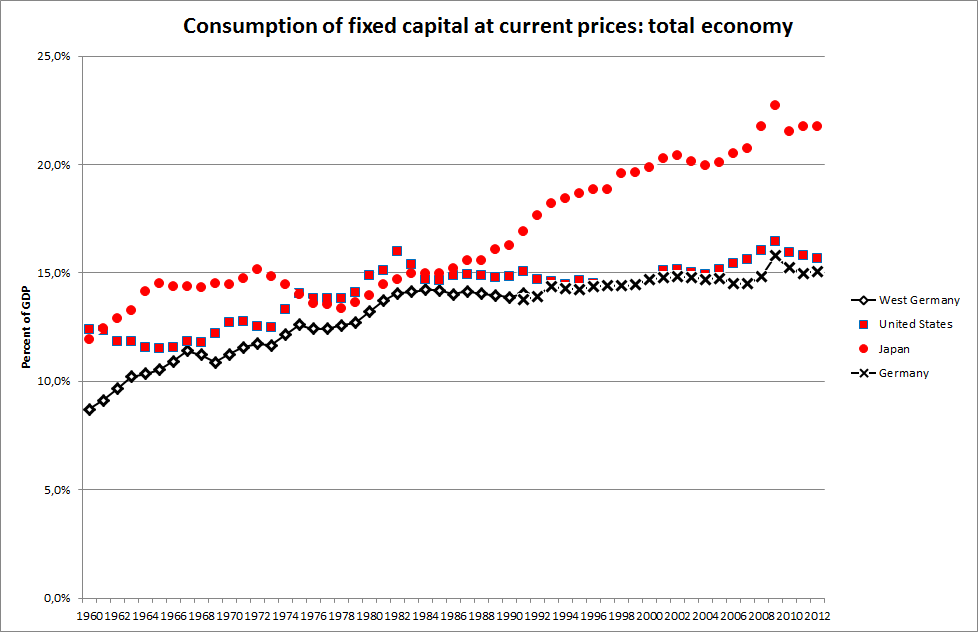

Consumption Of Fixed Capital

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value (so-called "economic depreciation"); CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to ''producing'' enterprises, but sometimes it applies also to real estate assets. CFC refers to a depreciation charge (or "write-off") against the gross income of a producing enterprise, which reflects the decline in value of fixed capital being operated with. Fixed assets will decline in value after they are purchased for use in production, due to wear and tear, changed market valuation and possibly market obsolescence. Thus, CFC represen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock And Flow

Economics, business, accounting, and related fields often distinguish between quantities that are stocks and those that are flows. These differ in their units of measurement. A ''stock'' is measured at one specific time, and represents a quantity existing at that point in time (say, December 31, 2004), which may have accumulated in the past. A ''flow'' variable is measured over an interval of time. Therefore, a flow would be measured ''per unit of time'' (say a year). Flow is roughly analogous to rate or speed in this sense. For example, U.S. nominal gross domestic product refers to a total number of dollars spent over a time period, such as a year. Therefore, it is a flow variable, and has units of dollars/year. In contrast, the U.S. nominal capital stock is the total value, in dollars, of equipment, buildings, and other real productive assets in the U.S. economy, and has units of dollars. The diagram provides an intuitive illustration of how the ''stock'' of capital currently ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Accounts

National accounts or national account systems (NAS) are the implementation of complete and consistent accounting techniques for measuring the economic activity of a nation. These include detailed underlying measures that rely on double-entry accounting. By design, such accounting makes the totals on both sides of an account equal even though they each measure different characteristics, for example production and the income from it. As a method, the subject is termed national accounting or, more generally, social accounting.Nancy D. Ruggles, 1987. "social accounting," '' The New Palgrave: A Dictionary of Economics'', v. 4, pp. 377–82. Stated otherwise, national accounts as ''systems'' may be distinguished from the economic data associated with those systems. While sharing many common principles with business accounting, national accounts are based on economic concepts. One conceptual construct for representing flows of all economic transactions that take place in an econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Surplus Value

In Marxian economics, surplus value is the difference between the amount raised through a sale of a product and the amount it cost to the owner of that product to manufacture it: i.e. the amount raised through sale of the product minus the cost of the materials, plant and labour power. The concept originated in Ricardian socialism, with the term "surplus value" itself being coined by William Thompson in 1824; however, it was not consistently distinguished from the related concepts of surplus labor and surplus product. The concept was subsequently developed and popularized by Karl Marx. Marx's formulation is the standard sense and the primary basis for further developments, though how much of Marx's concept is original and distinct from the Ricardian concept is disputed (see ). Marx's term is the German word "''Mehrwert''", which simply means value added (sales revenue minus the cost of materials used up), and is cognate to English "more worth". It is a major concept in Ka ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Compensation Of Employees

{{no footnotes, date=April 2010 Compensation of employees (CE) is a statistical term used in national accounts, balance of payments statistics and sometimes in corporate accounts as well. It refers basically to the total gross (pre-tax) wages paid by employers to employees for work done in an accounting period, such as a quarter or a year. However, in reality, the aggregate includes ''more'' than just gross wages, at least in national accounts and balance of payments statistics. The reason is that in these accounts, CE is defined as "the total remuneration, in cash or in kind, payable by an enterprise to an employee in return for work done by the latter during the accounting period". It represents effectively a total labour cost to an employer, paid from the gross revenues or the capital of an enterprise. Compensation of employees is accounted for on an accrual basis; i.e., it is measured by the value of the remuneration in cash or in kind which an employee ''becomes entitled to r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Circulating Capital

Circulating capital includes intermediate goods and operating expenses, i.e., short-lived items that are used in production and used up in the process of creating other goods or services.Mark Blaug, 2008. "circulating capital," ''The New Palgrave Dictionary of Economics'', 2nd Edition.Abstract This is roughly equal to intermediate consumption. Finer distinctions include raw materials, intermediate goods, inventories, ancillary operating expenses and (working capital). It is contrasted with fixed capital. The term was used in more specialized ways by classical economists such as Adam Smith, David Ricardo and Karl Marx. Where the distinction is used, circulating capital is a component of (total) capital, also including fixed capital used in a single cycle of production. In contrast to fixed capital, it is used up in every cycle (raw materials, basic and intermediate materials, combustible, energy…). In accounting, the circulating capital comes under the heading of current ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Intensity

Capital intensity is the amount of fixed or real capital present in relation to other factors of production, especially labor. At the level of either a production process or the aggregate economy, it may be estimated by the capital to labor ratio, such as from the points along a capital/labor isoquant. Growth The use of tools and machinery makes labor more effective, so rising capital intensity (or " capital deepening") pushes up the productivity of labor. Capital intensive societies tend to have a higher standard of living over the long run. Calculations made by Robert Solow claimed that economic growth was mainly driven by technological progress (productivity growth) rather than inputs of capital and labor. However recent economic research has invalidated that theory, since Solow did not properly consider changes in both investment and labor inputs. Dale Jorgenson, of Harvard University, President of the American Economic Association in 2000, concludes that: 'Griliches and I sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Sweezy

Paul Marlor Sweezy (April 10, 1910 – February 27, 2004) was a Marxist economist, political activist, publisher, and founding editor of the long-running magazine ''Monthly Review''. He is best remembered for his contributions to economic theory as one of the leading Marxian economists of the second half of the 20th century. Biography Early years and education Paul Sweezy was born on April 10, 1910 in New York City, the youngest of three sons of Everett B. Sweezy, a vice-president of First National Bank of New York.John Bellamy Foster"Memorial Service for Paul Marlor Sweezy (1910–2004),"''Monthly Review.'' His mother, Caroline Wilson Sweezy, was a graduate of Goucher College in Baltimore. Sweezy attended Phillips Exeter Academy and went on to Harvard and was editor of ''The Harvard Crimson'', graduating '' magna cum laude'' in 1932. Having completed his undergraduate coursework, his interests shifted from journalism to economics. Sweezy spent the 1931–32 academic ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |