|

Option Time Value

In finance, the time value (TV) (''extrinsic'' or ''instrumental'' value) of an option is the premium a rational investor would pay over its ''current'' exercise value ( intrinsic value), based on the probability it will increase in value before expiry. For an American option this value is always greater than zero in a fair market, thus an option is ''always'' worth more than its current exercise value. As an option can be thought of as 'price insurance' (e.g., an airline insuring against unexpected soaring fuel costs caused by a hurricane), TV can be thought of as the ''risk premium'' the option seller charges the buyer—the higher the expected risk (volatility \cdot time), the higher the premium. Conversely, TV can be thought of as the price an investor is willing to pay for potential upside. Time value decays to zero at expiration, with a general rule that it will lose of its value during the first half of its life and in the second half. As an option moves closer to expiry, m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Formula

In science, a formula is a concise way of expressing information symbolically, as in a mathematical formula or a ''chemical formula''. The informal use of the term ''formula'' in science refers to the general construct of a relationship between given quantities. The plural of ''formula'' can be either ''formulas'' (from the most common English plural noun form) or, under the influence of scientific Latin, ''formulae'' (from the original Latin). In mathematics In mathematics, a formula generally refers to an identity which equates one mathematical expression to another, with the most important ones being mathematical theorems. Syntactically, a formula (often referred to as a ''well-formed formula'') is an entity which is constructed using the symbols and formation rules of a given logical language. For example, determining the volume of a sphere requires a significant amount of integral calculus or its geometrical analogue, the method of exhaustion. However, having do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Naked Call

A naked option or uncovered option is an options contract where the option writer (i.e., the seller) does not hold the underlying security position to cover the contract in case of assignment (like in a covered option). Nor does the seller hold any option of the same class on the same underlying security that could protect against potential losses (like in an options spread). A naked option involving a "call" is called a "naked call" or "uncovered call", while one involving a " put" is a "naked put" or "uncovered put". The naked option is one of riskiest options strategies, and therefore most brokers restrict them to only those traders that have the highest options level approval and have a margin account. Naked option are attractive because the seller receives the premium cost of the option without buying a corresponding position to hedge against potential losses. In the case of a naked put, the seller hopes that the underlying equity or stock price stays the same or rises. In t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intrinsic Value (finance)

In finance, the intrinsic value of an asset usually refers to a value calculated on simplified assumptions. For example, the intrinsic value of an option is based on the current market value of the underlying instrument, but ignores the possibility of future fluctuations and the time value of money. Options An option is said to have intrinsic value if the option is in-the-money. When out-of-the-money, its intrinsic value is ''zero''. For an option, the intrinsic value is the same as the "immediate value" or the "current value" of the contract, which is the profit that could be gained by exercising the option immediately. The intrinsic value for an in-the-money option is calculated as the absolute value of the difference between the current price (''S'') of the underlying and the strike price (''K'') of the option. :IV_= 0 :IV_=\left \vert S-K \right \vert = \left \vert K-S \right \vert For example, if the strike price for a call option is USD 1.00 and the price of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expiration (options)

In finance, the expiration date of an option contract (represented by Greek letter tau, τ) is the last date on which the holder of the option may exercise it according to its terms. In the case of options with "automatic exercise", the net value of the option is credited to the long and debited to the short position holders. Typically, exchange-traded option contracts expire according to a pre-determined calendar. For instance, for U.S. exchange-listed equity stock option contracts, the expiration date is always the Saturday that follows the third Friday of the month, unless that Friday is a market holiday, in which case the expiration is on Thursday right before that Friday. The clearing firm may automatically exercise by exception any option that is in the money at expiration to preserve its value for the holder of the option and at the same time, benefit from the commission fees collected from the account holder. However, the holder or the holder's broker may request ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

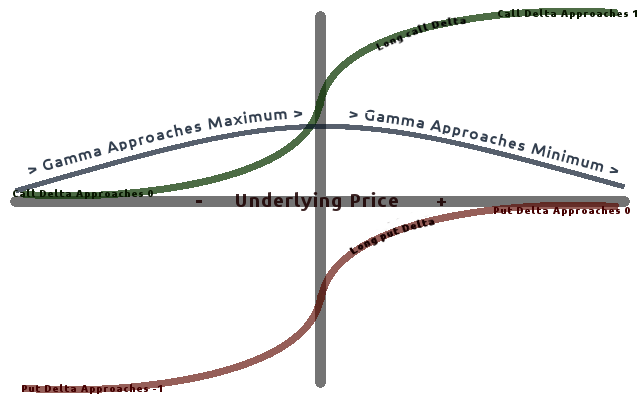

Greeks (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, espe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Binomial Options Model

In finance, the binomial options pricing model (BOPM) provides a generalizable Numerical analysis, numerical method for the valuation of Option (finance), options. Essentially, the model uses a "discrete-time" (Lattice model (finance), lattice based) model of the varying price over time of the underlying financial instrument, addressing cases where the Closed-form expression, closed-form Black–Scholes formula is wanting. The binomial model was first proposed by William F. Sharpe, William Sharpe in the 1978 edition of ''Investments'' (), and formalized by John Carrington Cox, Cox, Stephen Ross (economist), Ross and Mark Rubinstein, Rubinstein in 1979 and by Rendleman and Bartter in that same year. For binomial trees as applied to fixed income and interest rate derivatives see . Use of the model The Binomial options pricing model approach has been widely used since it is able to handle a variety of conditions for which other models cannot easily be applied. This is largely becau ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Numerical Method

In numerical analysis, a numerical method is a mathematical tool designed to solve numerical problems. The implementation of a numerical method with an appropriate convergence check in a programming language is called a numerical algorithm. Mathematical definition Let F(x,y)=0 be a well-posed problem, i.e. F:X \times Y \rightarrow \mathbb is a real or complex functional relationship, defined on the cross-product of an input data set X and an output data set Y, such that exists a locally lipschitz function g:X \rightarrow Y called resolvent, which has the property that for every root (x,y) of F, y=g(x). We define numerical method for the approximation of F(x,y)=0, the sequence In mathematics, a sequence is an enumerated collection of objects in which repetitions are allowed and order matters. Like a set, it contains members (also called ''elements'', or ''terms''). The number of elements (possibly infinite) is called ... of problems : \left \_ = \left \_, with F_n:X_n \ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option Value

Option or Options may refer to: Computing *Option key, a key on Apple computer keyboards *Option type, a polymorphic data type in programming languages * Command-line option, an optional parameter to a command *OPTIONS, an HTTP request method Literature * ''Options'' (novel), a novel by Robert Sheckley * ''Option'' (car magazine), a Japanese car magazine * ''Option'' (music magazine), a defunct American music magazine Legal rights *Option (aircraft purchasing) * South Tyrol Option Agreement, a forced resettling contract between fascist Italy and Nazi Germany regarding the German-speaking inhabitants of South Tyrol *Option (filmmaking), a contractual agreement between a film producer and a writer, in which the producer obtains the right to buy a screenplay from the writer before a certain date. *Option (finance), an instrument that conveys the right, but not the obligation, to engage in a future transaction (for example, on some underlying security or on a parcel of real pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |