|

Neiman Marcus

Neiman Marcus Group, Inc. is an American integrated luxury retailer headquartered in Dallas, Texas, which owns Neiman Marcus, Bergdorf Goodman, Horchow, and Last Call. Since September 2021, NMG has been owned by a group of investment companies led by Davidson Kempner Capital Management, Sixth Street Partners and Pacific Investment Management. History 1907–1949 Herbert Marcus Sr., a former buyer with Dallas' Sanger Brothers department store, had left his previous job to found a new business with his sister Carrie Marcus Neiman and her husband, Abraham Lincoln Neiman, then employees of Sanger Brothers competitor A. Harris and Co. In 1907, the trio had $25,000 from the successful sales-promotion firm they had built in Atlanta, Georgia, and two potential investments of funds. Rather than take a chance on an unknown "sugary soda pop business," the three entrepreneurs rejected the fledgling Coca-Cola company and chose instead to return to Dallas to establish a retail busin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Norman Marcus

Norman Marcus (August 31, 1932 – June 30, 2008) was an American lawyer and zoning expert. He served as general counsel of the New York City Planning Commission for over twenty years and played a key role in designing zoning laws to preserve the historic integrity of New York City's old neighborhoods while allowing for new development. Biography Marcus was born on August 31, 1932 in The Bronx. He graduated from Columbia College in 1953 and Yale Law School in 1957. At Yale, he met his wife, Maria Eleanor Lenhoff, who became Joseph M. McLaughlin professor of law at Fordham University, and the two married in 1956. Marcus joined the New York City Planning Commission in 1963 and for 20 years was its general counsel. In that capacity, Marcus devised legal codes that helped transfer air rights above historic Broadway theaters in Theater District, Manhattan and above Grand Central Terminal, preserving their historic architecture while allowing construction of new skyscrapers. He als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Davidson Kempner Capital Management

Davidson Kempner Capital Management LP (“Davidson Kempner”) is a global institutional alternative investment management firm with over $38 billion in assets under management. Davidson Kempner is headquartered in New York City, with additional offices in London, Dublin, Hong Kong and Philadelphia. The firm is led by Anthony A. Yoseloff who serves as Executive Managing Member and Chief Investment Officer. As of September 20, 2021, Davidson Kempner was ranked as the 10th largest hedge fund in the world. Davidson Kempner has approximately 430 employees in the firm’s six offices. The firm is headquartered at 520 Madison Avenue in New York, New York. History Davidson Kempner was founded in May 1983 by Marvin H. Davidson and was initially named M.H. Davidson & Co. Thomas L. Kempner, Jr. joined the firm in December 1984 and was promoted to partner in 1986 and appointed to executive managing member in January 2004. The firm opened to outside capital in 1987 and was registered as an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panic Of 1907

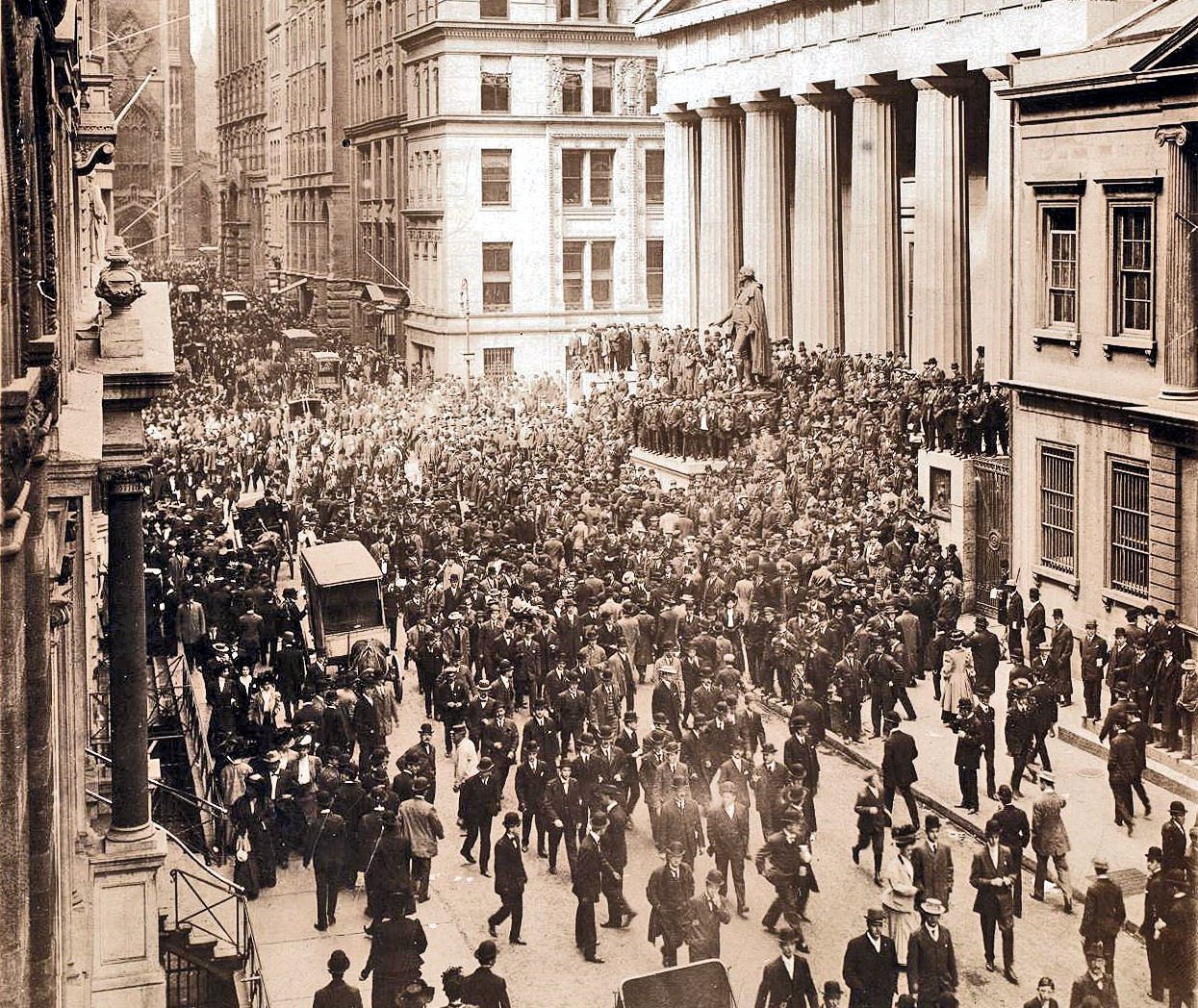

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs on banks and on trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops. The panic was triggered by the failed attempt in October 1907 to corner the market on stock of the United Copper Company. When that bid failed, banks that had lent money to the cornering scheme suffered runs that later spread to affiliated banks and trusts, leading a week ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |