|

National Pension (Japan)

The National Pension () is a pension system operated by the Japan Pension Service. All Japanese nationals and foreign residents are required to enroll in it. History In 1942 the Workers Pension Insurance Act was enacted, and in 1944 the name was changed to Employees' Pension Insurance Act. It was amended substantially in 1954, and in 1961 the National Pension Act created universal pension coverage for residents of Japan. Types of members (This is also described under Social welfare in Japan#Pension system, Social Welfare in Japan) *Category 1 – All registered residents of Japan who are aged between 20 and 60 years old, but do not fit into either category 2 or 3 (i.e. typically the unemployed, self-employed, or employees of very small companies). People in this category should go to the National Pension counter at their local municipal office. (People in this category are enrolled in the National Health Insurance (Japan), national health insurance scheme). *Category 2 – Workers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japanese Pension Handbook Front Cover

Japanese may refer to: * Something from or related to Japan, an island country in East Asia * Japanese language, spoken mainly in Japan * Japanese people, the ethnic group that identifies with Japan through ancestry or culture ** Japanese diaspora, Japanese emigrants and their descendants around the world * Japanese citizens, nationals of Japan under Japanese nationality law ** Foreign-born Japanese, naturalized citizens of Japan * Japanese writing system, consisting of kanji and kana * Japanese cuisine, the food and food culture of Japan See also * List of Japanese people * * Japonica (other) * Japanese studies {{disambiguation Language and nationality disambiguation pages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension

A pension (; ) is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be either a " defined benefit plan", where defined periodic payments are made in retirement and the sponsor of the scheme (e.g. the employer) must make further payments into the fund if necessary to support these defined retirement payments, or a " defined contribution plan", under which defined amounts are paid in during working life, and the retirement payments are whatever can be afforded from the fund. Pensions should not be confused with severance pay; the former is usually paid in regular amounts for life after retirement, while the latter is typically paid as a fixed amount after involuntary termination of employment before retirement. The terms " retirement plan" and " superannuation" tend to refer to a pension granted upon retirement of the individual; the terminolog ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japan Pension Service

The is a government organization administered by the Ministry of Health, Labour and Welfare. On January 1, 2010, it replaced the Social Insurance Agency.International Social Security Association websitEstablishment of the "Japan Pension Service" Retrieved on November 24th 2010 Organization It is a special public corporation with a non-governmental employees headquarters, nine regional headquarters, and 312 branch offices. It has 47 processing centers, which are planned to be integrated into the 9 regional headquarters. The President of the JPS is Toichiro Mizushima, and it has around 27,000 total staff, 15,000 full-time staff and 12,000 temporary workers.Japan Pension Service websitEnglish information Retrieved on November 24th 2010 Responsibilities The JPS is responsible for managing all tasks related to the public pension system: * Handling applications * Collecting contributions * Keeping records * Pension consultations * Paying benefits Pension records problem The Social ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Welfare In Japan

Social welfare, assistance for the ill or otherwise disabled and the old, has long been provided in Japan by both the government and private companies. Beginning in the 1920s, the Japanese government enacted a series of welfare programs, based mainly on European models, to provide medical care and financial support. During the post-war period, a comprehensive system of social security was gradually established. Universal health insurance and a pension system were established in 1960. The futures of health and welfare systems in Japan are being shaped by the rapid aging of the population. The mixture of public and private funding has created complex pension and insurance systems, meshing with Japanese traditional calls for support within the family and by the local community for welfare recipients. The Japanese welfare state Japan's welfare state has a non-typical conservative regime. Similar to other conservative countries, Japan has an occupational segmented social insurance sy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Health Insurance (Japan)

is one of the two major statutory types of insurance programs available in Japan. The other is . National Health insurance is designed for people who are not eligible to be members of any employment-based health insurance program. Although private insurance is also available, all Japanese citizens, permanent residents, and any non-Japanese residing in Japan with a visa lasting three months or longer are required to be enrolled in either National Health Insurance or Employees' Health Insurance. On July 9, 2012, the alien registration system was abolished and foreigners are now able to apply as part of the Basic Resident Registration System. Foreigners who reside in Japan for more than three months need to register for national health insurance. It is defined by the National Health Care Act of 1958. History Japan's first health insurance system was introduced in 1922. It took effect in 1927 to cover laborers, and in 1938 was extended to cover farmers also. The system originated f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

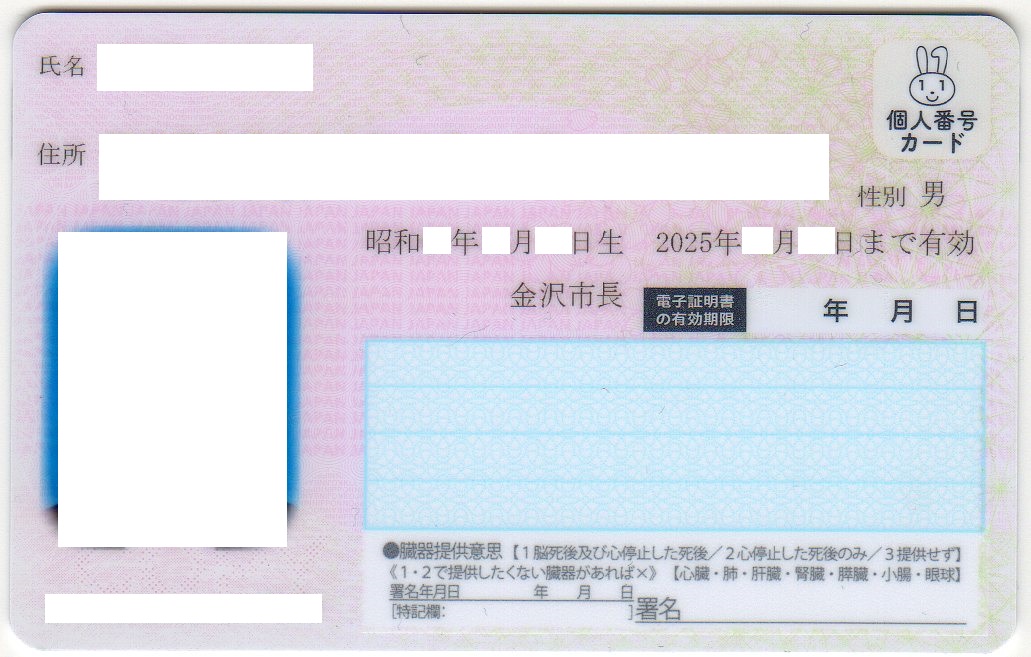

Individual Number (Japan)

An , also known as , is a twelve-digit ID number automatically issued to all citizens and foreign residents of Japan. It used for taxation, social security and disaster response purposes. The numbers were first issued in late 2015.Osaki, TomohirReady or not, government will soon have your My NumberSeptember 20, 2015 ''The Japan Times'' Retrieved October 6, 2015 The Individual Number is the de-facto Japanese equivalent to a U.S Social Security Number (SSN), and is required when applying for a Japanese bank account. Like the SSN, the number is sensitive and should be kept safe. Once issued the bearers Individual Number remains the same indefinitely, unless required to be changed by decree. Individuals may write this number down and keep it in a safe location, or apply for the free My Number Card, which contains the number. See also * My Number Card * Corporate Number (Japan) * Social Security number * National identification number A national identification number or nat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convenience Store

A convenience store, convenience shop, bakkal, bodega, corner store, corner shop, superette or mini-mart is a small retail store that stocks a range of everyday items such as convenience food, groceries, beverages, tobacco products, lottery tickets, over-the-counter drugs, toiletries, newspapers and magazines. In some jurisdictions, convenience stores (such as off-licences in the UK) are licensed to sell alcoholic drinks, although many other jurisdictions limit such beverages to those with relatively low alcohol content, like beer and wine. The stores may also offer money order and wire transfer services, along with the use of a fax machine or photocopier for a small per-copy cost. Some also sell tickets or recharge smart cards, e.g. Opus cards in Montreal, Canada, or include a small deli. They differ from general stores and village shops in that they are not in a rural location and are used as a convenient (hence their common name) supplement to larger stores. A con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wire Transfer

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office. Different wire transfer systems and operators provide a variety of options relative to the immediacy and finality of settlement and the cost, value, and volume of transactions. Central bank wire transfer systems, such as the Federal Reserves Fedwire system in the United States, are more likely to be real-time gross settlement (RTGS) systems, as they provide the quickest availability of funds. This is because RTGS systems, such as Fedwire, post each transaction individually and immediately to the electronic accounts of participating banks maintained by the central bank. Other systems, such as the Clearing House Interbank Payments System (CHIPS), provide net settlement on a periodic basis. More immediate settlement systems te ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demographics Of Japan

The demographics of Japan include birth and death rates, age distribution, population density, ethnicity, education level, healthcare system of the populace, economic status, religious affiliations, and other aspects regarding the Japanese population. According to the United Nations, the population of Japan was roughly 126.4 million people (as of January 2020), and peaked at 128.5 million people in 2010. It is the 6th-most populous country in Asia, and the 11th-most populous country in the world. In 2023, the median age of Japanese people was projected to be 49.5 years, the highest level since 1950, compared to 29.5 for India, 38.8 for the United States and 39.8 for China. Japan has the second highest median age in the world (behind only Monaco). An improved quality of life and regular health checks are just two reasons why Japan has one of the highest life expectancies in the world. The life expectancy from birth in Japan improved significantly after World War II, rising ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

JET Programme

The , shortly as , is a teaching program sponsored by the Japanese government that brings university graduates to Japan as Assistant Language Teachers (ALTs), Sports Education Advisors (SEAs) or as Coordinators for International Relations (CIRs) in local governments and boards of education. JET is one of the world's largest international exchange programmes. Since 1987, more than 77,000 people from 77 countries have participated in JET. As of July 1, 2024, 5,861 participants from 51 countries were employed on the programme. Holders of Japanese passports may participate in the programme, but must renounce their Japanese citizenship to do so. The focus of the programme as stated on the JET Programme website is "to promote internationalization in Japan's local communities by improving foreign language education and fostering international exchange at the community level." The JET Programme is not looking and/or hiring teachers but rather looking for cultural ambassadors to assis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pensions In Japan

Pensions in Japan comprise the National Pension system run by the government, and a series of voluntary private pension plans. National pension The National Pension system, which is administered by the Japan Pension Service, is the state pension program, and all registered residents aged 20 to 59, both Japanese citizens and legal foreign residents, are obliged to contribute to it. Contributions are deducted from employee paychecks, while the self-employed pay a set amount. The size of a pension is determined by the amount of contributions paid into the system. Non-Japanese who had short periods of National Pension coverage may withdraw a lump sum from the system. The Japanese government maintains the Government Pension Investment Fund, which makes investments designed to ensure the stability of the system at minimal risk. Private pensions Firms with 500 or more employees are covered by employee pension funds, and they may opt out of the National Pension system provided 50% hig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |