|

NASDAQ-100

The Nasdaq-100 (NDX) is a stock market index made up of equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index. The stocks' weights in the index are based on their market capitalizations, with certain rules capping the influence of the largest components. It is limited to companies from a single exchange, and it does not have any financial companies. The financial companies are in a separate index, the Nasdaq Financial-100. History The Nasdaq-100 was launched on January 31, 1985, by the Nasdaq. It created two indices: the Nasdaq-100, which consists of industrial, technology, retail, telecommunication, biotechnology, health care, transportation, media and service companies, and the Nasdaq Financial-100, which consists of banking companies, insurance firms, brokerage firms, and mortgage loan companies. The base price of the index was initially set at 250, but when it closed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. Many ETFs provide some level of diversification compared to owning an individual stock. An ETF divides ownership of itself into shares that are held by shareholders. Depending on the country, the legal structure of an ETF can be a corporation, trust, open-end management investment company, or unit investment trust. Shareholders indirectly own the assets of the fund and are entitled to a share of the profits, such as interest or dividends, and would be entitled to any residual value if the fund undergoes liquidation. They also receive annual reports. An ETF generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occur. The larges ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nasdaq

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalization-weighted Index

A capitalization-weighted (or cap-weighted) index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value (the share price multiplied by the number of outstanding shares), in a capitalization-weighted index. In other types of indices, different ratios are used. For example, the NYSE Amex Composite Index (XAX) is composed of all of the securities traded on the exchange including stocks and American depositary receipts (ADRs). The weighting of each component shifts with changes to each securities' price and the number of shares outstanding. The index moves in line with changes in price of the component. Stock market indices are a type of economic index. Free-float wei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Index

In finance, a stock index, or stock market index, is an Index (economics), index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors may be able to invest in a stock market index by buying an index fund, which is structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called ''tracking error''. Types of indices by coverage Stock market indices may be classified and segmented by the set of underlying stocks included in the index, sometimes referred to as the "coverage". The underlying stocks are typically grouped together based on their underlying economics or underlying investor demand that the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalization-weighted Index

A capitalization-weighted (or cap-weighted) index, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value (the share price multiplied by the number of outstanding shares), in a capitalization-weighted index. In other types of indices, different ratios are used. For example, the NYSE Amex Composite Index (XAX) is composed of all of the securities traded on the exchange including stocks and American depositary receipts (ADRs). The weighting of each component shifts with changes to each securities' price and the number of shares outstanding. The index moves in line with changes in price of the component. Stock market indices are a type of economic index. Free-float wei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Invesco QQQ

Invesco QQQ (best known by its ticker symbol, QQQ; full fund name Invesco QQQ Trust, Series 1), is an exchange-traded fund created by Invesco PowerShares. QQQ tracks the performance of the Nasdaq-100. __NOTOC__ History QQQ began trading in 1999. Price of shares declined more than 80% due to the collapse of the Dot-com bubble. The fund's ticker was changed to "QQQQ" in 2004, and was later changed back to "QQQ" in 2011. The fund reached a record high on 4 June 2020. Invesco offers several other ETFs related to Invesco QQQ. QQQM, for instance, offers a lower share price than QQQ and is marketed towards retail investors, as opposed to institutional investors. In July 2023, the fund had $5.3 billion in inflows. Scion Asset Management, the investment firm run by Michael Burry, established a bet against the performance of QQQ in August 2023. Assets and structure Assets As of August 2023, the fund had $200 billion in assets under management In finance, assets under management (AU ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Stock Exchange

NYSE American, formerly known as the American Stock Exchange (AMEX), and more recently as NYSE MKT, is an American stock exchange situated in New York City. AMEX was previously a mutual organization, owned by its members. Until 1953, it was known as the New York Curb Exchange. NYSE Euronext acquired AMEX on October 1, 2008, with AMEX integrated with the Alternext European small-cap exchange and renamed the NYSE Alternext U.S. In March 2009, NYSE Alternext U.S. was changed to NYSE Amex Equities. On May 10, 2012, NYSE Amex Equities changed its name to NYSE MKT LLC. Following the SEC approval of competing stock exchange IEX in 2016, NYSE MKT rebranded as NYSE American and introduced a 350-microsecond delay in trading, referred to as a "speed bump", which is also present on the IEX. History The Curb market The exchange grew out of the loosely organized curb market of curbstone brokers on Broad Street in Manhattan. Efforts to organize and standardize the market started early ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nasdaq Composite

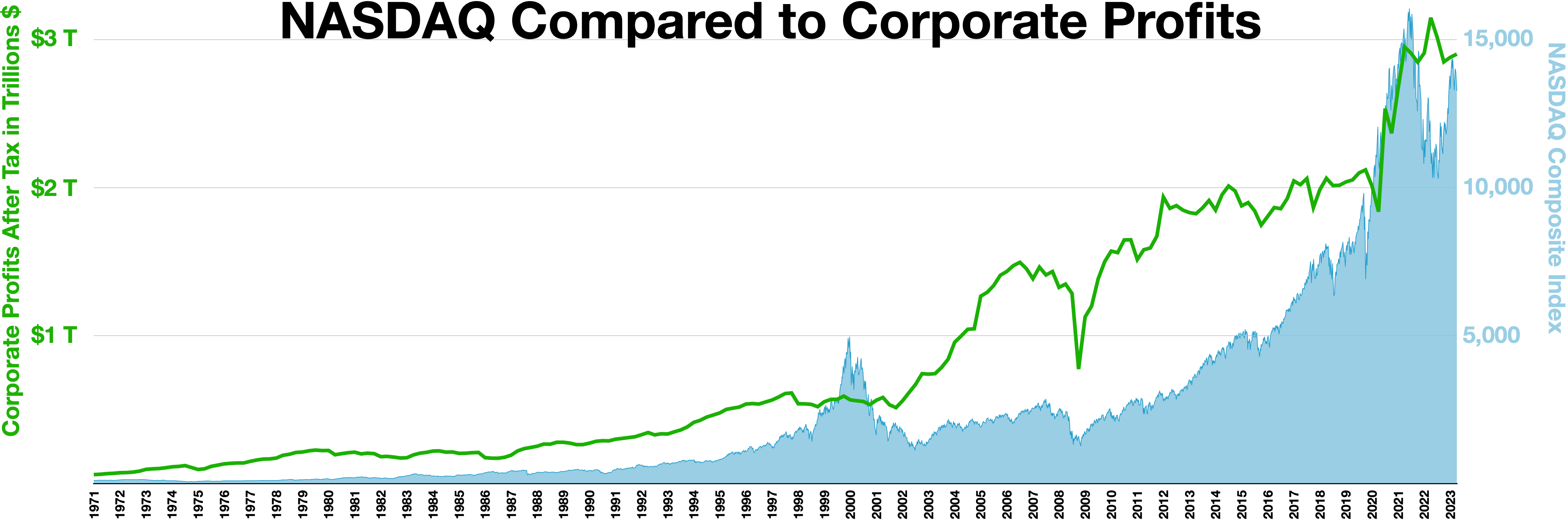

The Nasdaq Composite (ticker symbol ^IXIC) is a stock market index that includes almost all stocks listed on the Nasdaq stock exchange. Along with the Dow Jones Industrial Average and S&P 500, it is one of the three most-followed stock market indices in the United States. The composition of the NASDAQ Composite is heavily weighted towards companies in the information technology sector. The Nasdaq-100, which includes 100 of the largest non-financial companies in the Nasdaq Composite, accounts for about 80% of the index weighting of the Nasdaq Composite. The Nasdaq Composite is a capitalization-weighted index; its price is calculated by taking the sum of the products of closing price and index share of all of the securities in the index. The sum is then divided by a divisor which reduces the order of magnitude of the result. Investing in the Nasdaq Composite Index funds that attempt to track the Nasdaq Composite include Fidelity Investments' FNCMX mutual fund and ONEQ exchange-tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Board Options Exchange

Cboe Global Markets, Inc. is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets. History Founded by the Chicago Board of Trade in 1973 and member-owned for several decades, the Chicago Board Options Exchange was the first exchange to list standardized, exchange-traded stock options, and began its first day of trading on April 26, 1973, in celebration of the 125th birthday of the Chicago Board of Trade. In 1969, the vice chairman of the Chicago Board of Trade, Edmund “Eddie” O’Connor, developed the idea for an options exchange. At that time, options on stocks were traded in a New York-based, over-the-counter market which required a direct link between the buyer and seller and complex terms of sale. The options exchange that O'Connor imagined would use a central clearinghouse to facilitate trades and stand behind contracts. The Chicago Board of Trade established a committee to evaluate the concept. The optio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nasdaq, Inc

Nasdaq, Inc. is an American Multinational corporation, multinational financial services corporation that owns and operates three stock exchanges in the United States: the namesake Nasdaq stock exchange (on which it is also listed), the Philadelphia Stock Exchange, and the Boston Stock Exchange, and seven European stock exchanges: Nasdaq Copenhagen, Nasdaq Helsinki, Nasdaq Iceland, Nasdaq Riga, Nasdaq Stockholm, Nasdaq Tallinn, and Nasdaq Vilnius. It is Nasdaq MarketSite, headquartered in New York City, and its president and chief executive officer is Adena Friedman. Historically, the European operations have been known by the company name OMX AB (Aktiebolaget Optionsmäklarna/Helsinki Stock E''x''change), which was created in 2003 upon a merger between OM AB and HEX plc. The operations have been part of Nasdaq, Inc. (formerly known as Nasdaq OMX Group) since February 2008. They are now known as Nasdaq Nordic, which provides financial services and operates marketplaces for secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Invesco

Invesco Ltd. is an American independent investment management company headquartered in Atlanta, Georgia, with branch offices in 20 countries. Its common stock is a constituent of the S&P 500 and trades on the New York Stock Exchange. Invesco operates under the Invesco, Invesco Perpetual, and Powershares brand names. History Invesco (then officially spelled with all-capital letters: INVESCO) was founded in Atlanta in 1978 when Citizens & Southern National Bank divested its money management operations. In 1988, the company was purchased by the British firm Britannia Arrow, based in London, which later took the INVESCO name. In 1997 INVESCO public limited company, PLC merged with AIM Investments. Upon completion of the merger the company adopted the name Amvescap. In 2007 the company reverted to the Invesco name. Since 2000 Invesco has grown through acquisitions such as the Exchange-traded fund, ETF firm PowerShares Capital Management and the restructuring of WL Ross & Co. In 2004, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |