|

Monopoly Price

A monopoly price is set by a monopoly.Roger LeRoy Miller, ''Intermediate Microeconomics Theory Issues Applications, Third Edition'', New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988. A monopoly occurs when a firm lacks any viable competition and is the sole producer of the industry's product. Because a monopoly faces no competition, it has absolute market power and can set a price above the firm's marginal cost. Since marginal cost is the increment in total cost required to produce an additional unit of the product, the firm can make a positive economic profit if it produces a greater quantity of the product and sells it at a lower price. The monopoly ensures a monopoly price exists when it establishes the quantity of the product. As the sole supplier of the product within the market, its sales establish the entire industry's supply within the market, and the monopoly's production and sales decision ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

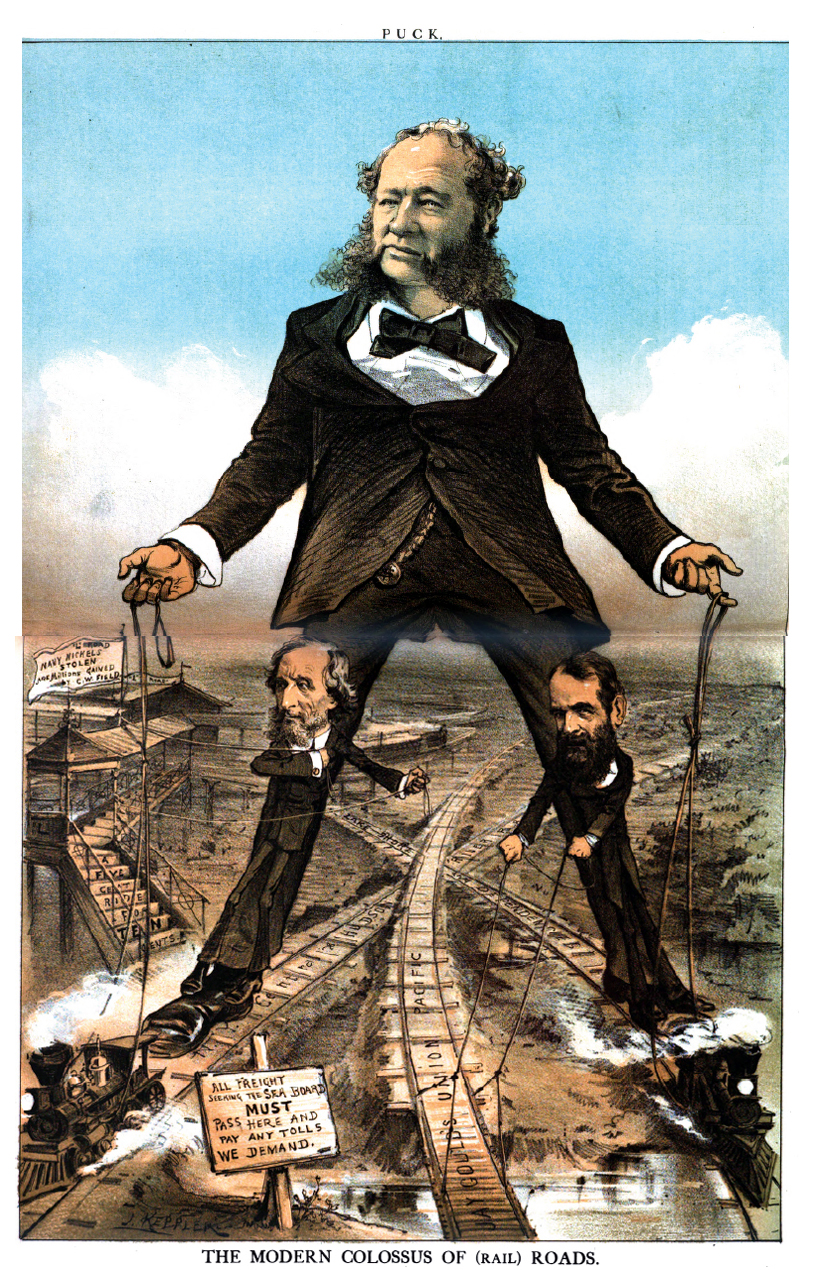

Monopoly

A monopoly (from Greek language, Greek el, μόνος, mónos, single, alone, label=none and el, πωλεῖν, pōleîn, to sell, label=none), as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or company, enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a Market (economics), market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic Competition (economics), competition to produce the good (economics), good or Service (economics), service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb ''monopolise'' or ''monopolize'' refers to the ''process'' by which a company gains the ability to raise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Per Unit Economic Costs For A Firm - Short Run With A Fixed Cost

Per is a Latin preposition which means "through" or "for each", as in per capita. Per or PER may also refer to: Places * IOC country code for Peru * Pér, a village in Hungary * Chapman code for Perthshire, historic county in Scotland Math and statistics * Rate (mathematics), ratio between quantities in different units, described with the word "per" * Price–earnings ratio, in finance, a measure of growth in earnings * Player efficiency rating, a measure of basketball player performance * Partial equivalence relation, class of relations that are symmetric and transitive * Physics education research Science * Perseus (constellation), standard astronomical abbreviation * Period (gene) or ''per'' that regulates the biological clock and its corresponding protein PER * Protein efficiency ratio, of food * PER or peregrinibacteria, a candidate bacterial phylum Media and entertainment * PeR (band), a Latvian pop band * ''Per'' (film), a 1975 Danish film Transport * IATA cod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Menu Cost

In economics, the menu cost is a cost that a firm incurs due to changing its prices. It is one microeconomic explanation of the price-stickiness of the macroeconomy put by New Keynesian economists. The term originated from the cost when restaurants print new menus to change the prices of items. However economists have extended its meaning to include the costs of changing prices more generally. Menu costs can be broadly classed into costs associated with informing the consumer, planning for and deciding on a price change and the impact of consumers potential reluctance to buy at the new price. Examples of menu costs include updating computer systems, re-tagging items, changing signage, printing new menus, mistake costs and hiring consultants to develop new pricing strategies. At the same time, companies can reduce menu costs by developing intelligent pricing strategies, thereby reducing the need for changes. Menu costs and nominal rigidity Menu costs are the costs incurred by the b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopoly Rent

In economics, economic rent is any payment (in the context of a market transaction) to the owner of a factor of production in excess of the cost needed to bring that factor into production. In classical economics, economic rent is any payment made (including imputed value) or benefit received for non-produced inputs such as location (land) and for assets formed by creating official privilege over natural opportunities (e.g., patents). In the moral economy of neoclassical economics, economic rent includes income gained by labor or state beneficiaries of other "contrived" (assuming the market is natural, and does not come about by state and social contrivance) exclusivity, such as labor guilds and unofficial corruption. Overview In the moral economy of the economics tradition broadly, economic rent is opposed to producer surplus, or normal profit, both of which are theorized to involve productive human action. Economic rent is also independent of opportunity cost, unlike econo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partial Derivative

In mathematics, a partial derivative of a function of several variables is its derivative with respect to one of those variables, with the others held constant (as opposed to the total derivative, in which all variables are allowed to vary). Partial derivatives are used in vector calculus and differential geometry. The partial derivative of a function f(x, y, \dots) with respect to the variable x is variously denoted by It can be thought of as the rate of change of the function in the x-direction. Sometimes, for z=f(x, y, \ldots), the partial derivative of z with respect to x is denoted as \tfrac. Since a partial derivative generally has the same arguments as the original function, its functional dependence is sometimes explicitly signified by the notation, such as in: :f'_x(x, y, \ldots), \frac (x, y, \ldots). The symbol used to denote partial derivatives is ∂. One of the first known uses of this symbol in mathematics is by Marquis de Condorcet from 1770, who used it for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inverse Demand Function

In economics, an inverse demand function is the inverse function of a demand function. The inverse demand function views price as a function of quantity. Quantity demanded, ''Q'', is a function f (the demand function) of price; the inverse demand function treats price as a function of quantity demanded, and is also called the price function: :P = f^(Q). The inverse demand function is the form of the demand function that appears in the famous Marshallian Scissors diagram. The function appears in this form because economists place the independent variable on the y-axis and the dependent variable on the x-axis. Definition In mathematical terms, if the demand function is Q = f(P), then the inverse demand function is P = f−1(Q). The value P in the inverse demand function is the highest price that could be charged and still generate the quantity demanded Q. This is useful because economists typically place price (P) on the vertical axis and quantity (Q) on the horizontal axis i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Present Value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has interest-earning potential, a characteristic referred to as the time value of money, except during times of zero- or negative interest rates, when the present value will be equal or more than the future value. Time value can be described with the simplified phrase, "A dollar today is worth more than a dollar tomorrow". Here, 'worth more' means that its value is greater than tomorrow. A dollar today is worth more than a dollar tomorrow because the dollar can be invested and earn a day's worth of interest, making the total accumulate to a value more than a dollar by tomorrow. Interest can be compared to rent. Just as rent is paid to a landlord by a tenant without the ownership of the asset being transferred, interest is paid to a lender by a borr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Opportunity Cost

In microeconomic theory, the opportunity cost of a particular activity is the value or benefit given up by engaging in that activity, relative to engaging in an alternative activity. More effective it means if you chose one activity (for example, an investment) you are giving up the opportunity to do a different option. The optimal activity is the one that, net of its opportunity cost, provides the greater return compared to any other activities, net of their opportunity costs. For example, if you buy a car and use it exclusively to transport yourself, you cannot rent it out, whereas if you rent it out you cannot use it to transport yourself. If your cost of transporting yourself without the car is more than what you get for renting out the car, the optimal choice is to use the car yourself. In basic equation form, opportunity cost can be defined as: "Opportunity Cost = (returns on best Forgone Option) - (returns on Chosen Option)." The opportunity cost of mowing one’s own la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition (economics)

In economics, competition is a scenario where different Economic agent, economic firmsThis article follows the general economic convention of referring to all actors as firms; examples in include individuals and brands or divisions within the same (legal) firm. are in contention to obtain goods that are limited by varying the elements of the Marketing mix for product software, marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products. The greater the selection of a good is in the market, prices are typically lower for the products, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly). The level of competition that exists within the market is dependent on a variety of factors both on the firm/ seller side; the number of firms, barriers to entry, infor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Markup Rule

A markup rule is the pricing practice of a producer with market power, where a firm charges a fixed mark-up over its marginal cost.Roger LeRoy Miller, ''Intermediate Microeconomics Theory Issues Applications, Third Edition'', New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988. Derivation of the markup rule Mathematically, the markup rule can be derived for a firm with price-setting power by maximizing the following expression for profit (economics), profit: : \pi = P(Q)\cdot Q - C(Q) :where :Q = quantity sold, :P(Q) = inverse demand function, and thereby the price at which Q can be sold given the existing demand :C(Q) = total cost of producing Q. : \pi = economic profit Profit maximization means that the derivative of \pi with respect to Q is set equal to 0: :P'(Q)\cdot Q+P-C'(Q)=0 : where :P'(Q) = the derivative of the inverse demand function. :C'(Q) = marginal cost–the derivative of total c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)