|

Moneyness

In finance, moneyness is the relative position of the current price (or future price) of an underlying asset (e.g., a stock) with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly a three-fold classification: * If the derivative would have positive intrinsic value if it were to expire today, it is said to be in the money; * If the derivative would be worthless if expiring with the underlying at its current price, it is said to be out of the money; * And if the current underlying price and strike price are equal, the derivative is said to be at the money. There are two slightly different definitions, according to whether one uses the current price (spot) or future price (forward), specified as "at the money spot" or "at the money forward", etc. This rough classification can be quantified by various definitions to express the moneyness as a number, measuring how far the asset is in the money or out of the money with re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility Surface

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expiration, options whose strike price differs substantially from the underlying asset's price command higher prices (and thus implied volatilities) than what is suggested by standard option pricing models. These options are said to be either deep in-the-money or out-of-the-money. Graphing implied volatilities against strike prices for a given expiry produces a skewed "smile" instead of the expected flat surface. The pattern differs across various markets. Equity options traded in American markets did not show a volatility smile before the Crash of 1987 but began showing one afterwards. It is believed that investor reassessments of the probabilities of fat-tail have led to higher prices for out-of-the-money options. This anomaly implies def ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black–Scholes Model

The Black–Scholes or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a ''unique'' price given the risk of the security and its expected return (instead replacing the security's expected return with the risk-neutral rate). The equation and model are named after economists Fischer Black and Myron Scholes; Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited. The main principle behind the model is to hedge the option by buying and selling the underlying asset in a specific way to eliminate risk. This type of hedging is called "continuously revised delta hedging" and is the basis of more complicated he ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Delta (finance)

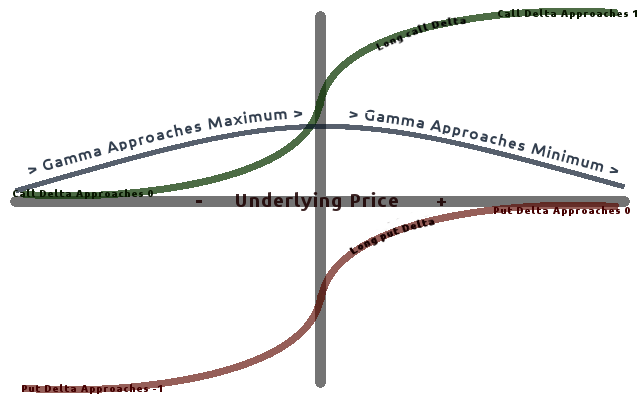

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, espe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strike Price

In finance, the strike price (or exercise price) of an option is a fixed price at which the owner of the option can buy (in the case of a call), or sell (in the case of a put), the underlying security or commodity. The strike price may be set by reference to the spot price, which is the market price of the underlying security or commodity on the day an option is taken out. Alternatively, the strike price may be fixed at a discount or premium. The strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the market price of the underlying instrument at that time. Moneyness Moneyness is the value of a financial contract if the contract settlement is financial. More specifically, it is the difference between the strike price of the option and the current trading price of its underlying security. In options trading, terms such as ''in-the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in ''over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strike Price

In finance, the strike price (or exercise price) of an option is a fixed price at which the owner of the option can buy (in the case of a call), or sell (in the case of a put), the underlying security or commodity. The strike price may be set by reference to the spot price, which is the market price of the underlying security or commodity on the day an option is taken out. Alternatively, the strike price may be fixed at a discount or premium. The strike price is a key variable in a derivatives contract between two parties. Where the contract requires delivery of the underlying instrument, the trade will be at the strike price, regardless of the market price of the underlying instrument at that time. Moneyness Moneyness is the value of a financial contract if the contract settlement is financial. More specifically, it is the difference between the strike price of the option and the current trading price of its underlying security. In options trading, terms such as ''in-the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-free Rate

The risk-free rate of return, usually shortened to the risk-free rate, is the rate of return of a hypothetical investment with scheduled payments over a fixed period of time that is assumed to meet all payment obligations. Since the risk-free rate can be obtained with no risk, any other investment having some risk will have to have a higher rate of return in order to induce any investors to hold it. In practice, to infer the risk-free interest rate in a particular currency, market participants often choose the yield to maturity on a risk-free bond issued by a government of the same currency whose risks of default are so low as to be negligible. For example, the rate of return on T-bills is sometimes seen as the risk-free rate of return in US dollars. Theoretical measurement As stated by Malcolm Kemp in chapter five of his book ''Market Consistency: Model Calibration in Imperfect Markets'', the risk-free rate means different things to different people and there is no consensus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Implied Volatility

In financial mathematics, the implied volatility (IV) of an option contract is that value of the volatility of the underlying instrument which, when input in an option pricing model (such as Black–Scholes), will return a theoretical value equal to the current market price of said option. A non-option financial instrument that has embedded optionality, such as an interest rate cap, can also have an implied volatility. Implied volatility, a forward-looking and subjective measure, differs from historical volatility because the latter is calculated from known past returns of a security. To understand where implied volatility stands in terms of the underlying, implied volatility rank is used to understand its implied volatility from a one-year high and low IV. Motivation An option pricing model, such as Black–Scholes, uses a variety of inputs to derive a theoretical value for an option. Inputs to pricing models vary depending on the type of option being priced and the pricing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Change Of Variables

Change or Changing may refer to: Alteration * Impermanence, a difference in a state of affairs at different points in time * Menopause, also referred to as "the change", the permanent cessation of the menstrual period * Metamorphosis, or change, a biological process by which an animal physically develops after birth or hatching * Personal development, or personal change, activities that improve awareness and identity * Social change, an alteration in the social order of a society * Technological change, invention, innovation, and diffusion of technology Organizations and politics * Change 2011, a Finnish political party * Change We Need, a slogan for Barack Obama's 2008 presidential campaign * Change.gov, the transition website for the incoming Obama administration in 2008–2009 * Change.org, a petition website operated by Change.org, Inc. * Communities Helping All Neighbors Gain Empowerment (CHANGE), a civic organization based in Winston-Salem, North Carolina * Movement for C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coordinate System

In geometry, a coordinate system is a system that uses one or more numbers, or coordinates, to uniquely determine the position of the points or other geometric elements on a manifold such as Euclidean space. The order of the coordinates is significant, and they are sometimes identified by their position in an ordered tuple and sometimes by a letter, as in "the ''x''-coordinate". The coordinates are taken to be real numbers in elementary mathematics, but may be complex numbers or elements of a more abstract system such as a commutative ring. The use of a coordinate system allows problems in geometry to be translated into problems about numbers and ''vice versa''; this is the basis of analytic geometry. Common coordinate systems Number line The simplest example of a coordinate system is the identification of points on a line with real numbers using the '' number line''. In this system, an arbitrary point ''O'' (the ''origin'') is chosen on a given line. The coordinate of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Boundary Condition

In mathematics, in the field of differential equations, a boundary value problem is a differential equation together with a set of additional constraints, called the boundary conditions. A solution to a boundary value problem is a solution to the differential equation which also satisfies the boundary conditions. Boundary value problems arise in several branches of physics as any physical differential equation will have them. Problems involving the wave equation, such as the determination of normal modes, are often stated as boundary value problems. A large class of important boundary value problems are the Sturm–Liouville problems. The analysis of these problems involves the eigenfunctions of a differential operator. To be useful in applications, a boundary value problem should be well posed. This means that given the input to the problem there exists a unique solution, which depends continuously on the input. Much theoretical work in the field of partial differential equ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |