|

Minsky Moment

A Minsky moment is a sudden, major collapse of asset values which marks the end of the growth phase of a cycle in credit markets or business activity. Description According to the hypothesis, the rapid instability occurs because long periods of steady prosperity and investment gains encourage a diminished perception of overall market risk, which promotes the leveraged risk of investing borrowed money instead of cash. The debt-leveraged financing of speculative investments exposes investors to a potential cash flow crisis, which may begin with a short period of modestly declining asset prices. In the event of a decline, the cash generated by assets is no longer sufficient to pay off the debt used to acquire the assets. Losses on such speculative assets prompt lenders to call in their loans. This rapidly amplifies a small decline into a collapse of asset values, related to the degree of leverage in the market. Leveraged investors are also forced to sell less-speculative positio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stylized Minsky Cycle

In the visual arts, style is a "...distinctive manner which permits the grouping of works into related categories" or "...any distinctive, and therefore recognizable, way in which an act is performed or an artifact made or ought to be performed and made". It refers to the visual appearance of a work of art that relates it to other works by the same artist or one from the same period, training, location, "school", art movement or archaeological culture: "The notion of style has long been the art historian's principal mode of classifying works of art. By style he selects and shapes the history of art". Style is often divided into the general style of a period, country or cultural group, group of artists or art movement, and the individual style of the artist within that group style. Divisions within both types of styles are often made, such as between "early", "middle" or "late". In some artists, such as Picasso for example, these divisions may be marked and easy to see; in others ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt Deflation

Debt deflation is a theory that recessions and depressions are due to the overall level of debt rising in real value because of deflation, causing people to default on their consumer loans and mortgages. Bank assets fall because of the defaults and because the value of their collateral falls, leading to a surge in bank insolvencies, a reduction in lending and by extension, a reduction in spending. The theory was developed by Irving Fisher following the Wall Street Crash of 1929 and the ensuing Great Depression. The debt deflation theory was familiar to John Maynard Keynes prior to Fisher's discussion of it, but he found it lacking in comparison to what would become his theory of liquidity preference. The theory, however, has enjoyed a resurgence of interest since the 1980s, both in mainstream economics and in the heterodox school of post-Keynesian economics, and has subsequently been developed by such post-Keynesian economists as Hyman Minsky and by the neo-classical mainstream ec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

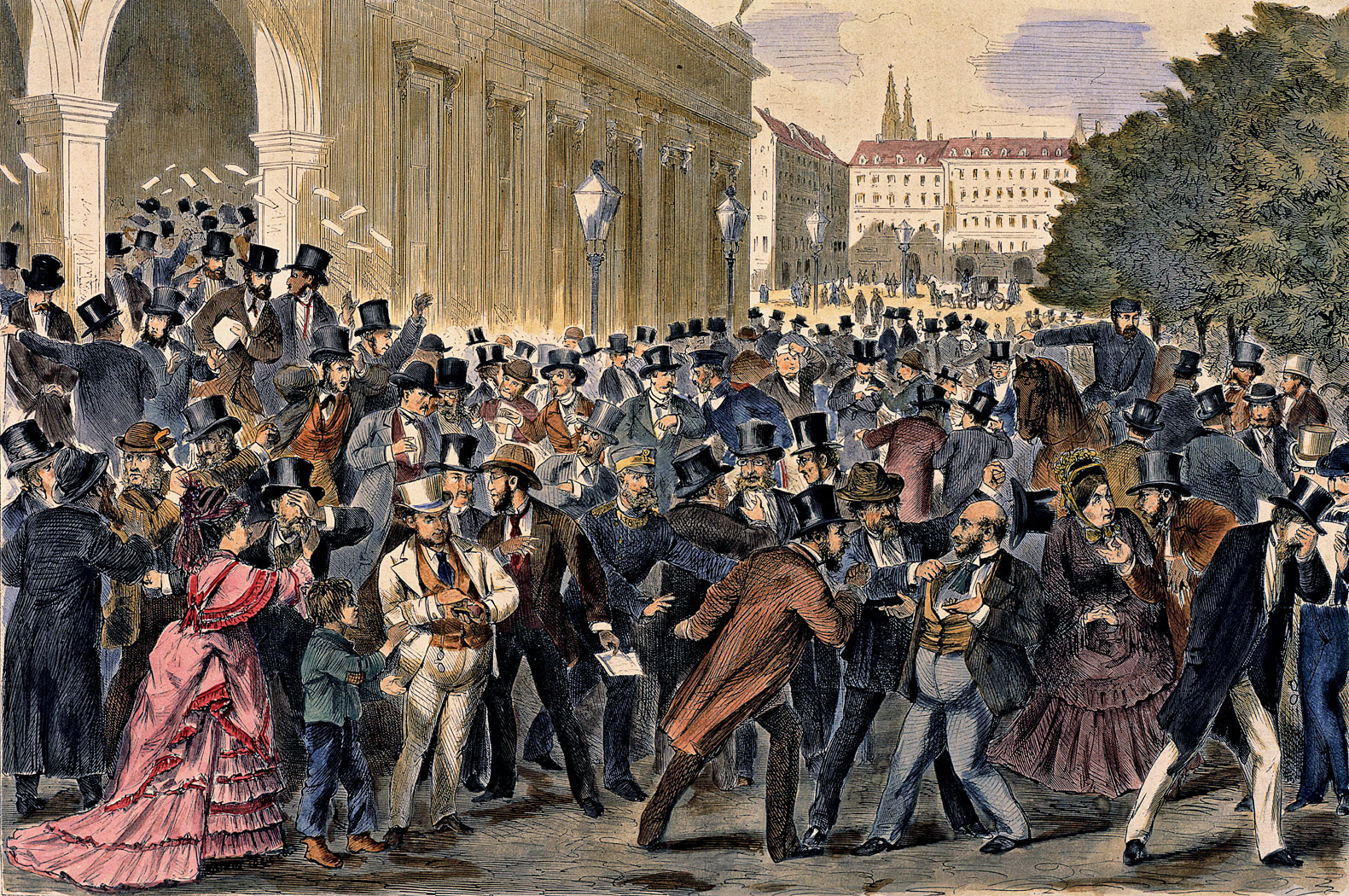

Financial Crises

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Sin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New Yorker

''The New Yorker'' is an American weekly magazine featuring journalism, commentary, criticism, essays, fiction, satire, cartoons, and poetry. Founded as a weekly in 1925, the magazine is published 47 times annually, with five of these issues covering two-week spans. Although its reviews and events listings often focus on the cultural life of New York City, ''The New Yorker'' has a wide audience outside New York and is read internationally. It is well known for its illustrated and often topical covers, its commentaries on popular culture and eccentric American culture, its attention to modern fiction by the inclusion of short stories and literary reviews, its rigorous fact checking and copy editing, its journalism on politics and social issues, and its single-panel cartoons sprinkled throughout each issue. Overview and history ''The New Yorker'' was founded by Harold Ross and his wife Jane Grant, a ''New York Times'' reporter, and debuted on February 21, 1925. Ross wanted t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Cassidy (journalist)

__NOTOC__ John Joseph Cassidy (born 1963) is an American journalist and British expatriate who is a staff writer at ''The New Yorker''. He is a contributor to ''The New York Review of Books'', and previously, an editor at ''The Sunday Times'' of London and a deputy editor at the ''New York Post''. He received his undergraduate degree from University College, Oxford, studied at Harvard University on a Harkness Fellowship, and received a master's degree in journalism from Columbia University and a master's in economics from New York University. He is the author of the well-received ''Dot.con: The Greatest Story Ever Sold'', which examines the dot-com bubble, and '' How Markets Fail: The Logic of Economic Calamities'', which combines a skeptical history of economics with an analysis of the housing bubble and credit bust. He is also well known for his biographical and economic writing on the famous Cambridge economist John Maynard Keynes, whom he interprets in a largely positive light ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sub-prime Mortgage Crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than government securities, along with attractive risk ratings from rating agencies. While elements of the crisis first became more visible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ponzi Scheme

A Ponzi scheme (, ) is a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors. Named after Italian businessman Charles Ponzi, the scheme leads victims to believe that profits are coming from legitimate business activity (e.g., product sales or successful investments), and they remain unaware that other investors are the source of funds. A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own. Some of the first recorded incidents to meet the modern definition of the Ponzi scheme were carried out from 1869 to 1872 by Adele Spitzeder in Germany and by Sarah Howe in the United States in the 1880s through the "Ladies' Deposit". Howe offered a solely female clientele an 8% monthly interest rate and then stole the money that the wome ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margin (finance)

In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty (most often their broker or an exchange) to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following: * Borrowed cash from the counterparty to buy financial instruments, * Borrowed financial instruments to sell them short, * Entered into a derivative contract. The collateral for a margin account can be the cash deposited in the account or securities provided, and represents the funds available to the account holder for further share trading. On United States futures exchanges, margins were formerly called performance bonds. Most of the exchanges today use SPAN ("Standard Portfolio Analysis of Risk") methodology, which was developed by the Chicago Mercantile Exchange in 1988, for calculating margins for options and futures. Margin account A margin account is a loan account with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment. The word hedge is from Old English ''hecg'', originally any fence, living or artificial. The first known use of the wor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade".William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama and Miller (1972), ''The Theory of Finance'', in Bibliograp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis Of 2007–2010

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability ass ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Bubble

An economic bubble (also called a speculative bubble or a financial bubble) is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth (e.g. dot-com bubble), and/or by the belief that intrinsic valuation is no longer relevant when making an investment (e.g. Tulip mania). They have appeared in most asset classes, including equities (e.g. Roaring Twenties), commodities (e.g. Uranium bubble), real estate (e.g. 2000s US housing bubble), and even esoteric assets (e.g. Cryptocurrency bubble). Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles (e.g. 1980s Japanese asset bubble and the 2020–21 Everything bubble), are attributed to central banking liquidity (e.g. overuse of the Fed put). In the early stages ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |