|

Low-volatility Anomaly

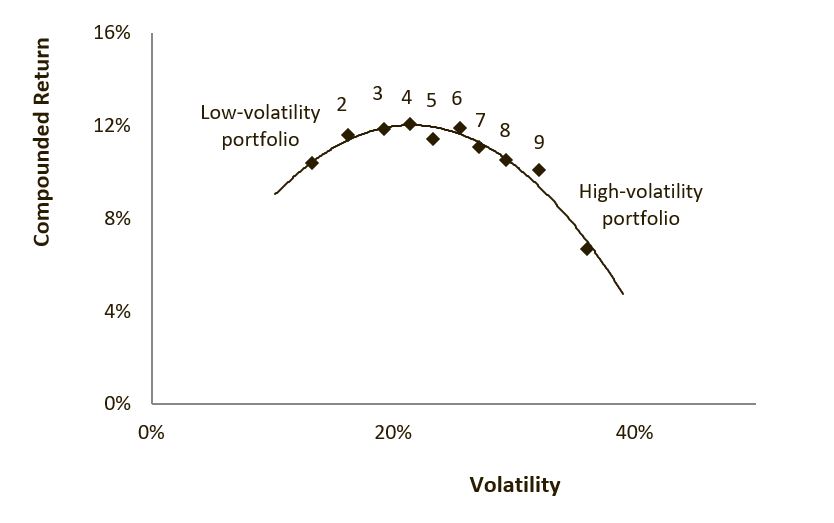

In investing and finance, the low-volatility anomaly is the observation that low-volatility stocks have higher returns than high-volatility stocks in most markets studied. This is an example of a stock market anomaly since it contradicts the central prediction of many financial theories that taking higher risk must be compensated with higher returns. Furthermore, the Capital Asset Pricing Model (CAPM) predicts a positive relation between the systematic risk-exposure of a stock (also known as the stock beta) and its expected future returns. However, some narratives of the low-volatility anomaly falsify this prediction of the CAPM by showing that stocks with higher beta have historically under-performed the stocks with lower beta. Other narratives of this anomaly show that even stocks with higher idiosyncratic risk are compensated with lower returns in comparison to stocks with lower idiosyncratic risk. The low-volatility anomaly has also been referred to as the low-beta, m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investing

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investing Daily

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Attentional Bias

Attentional bias refers to how a person's perception is affected by selective factors in their attention. Attentional biases may explain an individual's failure to consider alternative possibilities when occupied with an existing train of thought. For example, cigarette smokers have been shown to possess an attentional bias for smoking-related cues around them, due to their brain's altered reward sensitivity. Attentional bias has also been associated with clinically relevant symptoms such as anxiety and depression. In decision making A commonly studied experiment to test for attentional bias is one in which there are two variables, a factor (A) and a result (B). Both can be either present (P) or not present (N). This results in four possible combinations: #Both the factor and result are present (AP/BP) #Both the factor and result are not present (AN/BN) #While the factor is present, the result is not (AP/BN) #While the result is present, the factor is not (AN/BP) The four combina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Representativeness Heuristic

The representativeness heuristic is used when making judgments about the probability of an event under uncertainty. It is one of a group of heuristics (simple rules governing judgment or decision-making) proposed by psychologists Amos Tversky and Daniel Kahneman in the early 1970s as "the degree to which n event(i) is similar in essential characteristics to its parent population, and (ii) reflects the salient features of the process by which it is generated". Heuristics are described as "judgmental shortcuts that generally get us where we need to go – and quickly – but at the cost of occasionally sending us off course." Heuristics are useful because they use effort-reduction and simplification in decision-making. When people rely on representativeness to make judgments, they are likely to judge wrongly because the fact that something is more representative does not actually make it more likely. The representativeness heuristic is simply described as assessing similarity of obj ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overconfidence Effect

The overconfidence effect is a well-established bias in which a person's subjective ''confidence'' in his or her judgments is reliably greater than the objective ''accuracy'' of those judgments, especially when confidence is relatively high. Overconfidence is one example of a miscalibration of subjective probabilities. Throughout the research literature, overconfidence has been defined in three distinct ways: (1) ''overestimation'' of one's actual performance; (2) ''overplacement'' of one's performance relative to others; and (3) ''overprecision'' in expressing unwarranted certainty in the accuracy of one's beliefs. The most common way in which overconfidence has been studied is by asking people how confident they are of specific beliefs they hold or answers they provide. The data show that confidence systematically exceeds accuracy, implying people are more sure that they are correct than they deserve to be. If human confidence had perfect calibration, judgments with 100% confide ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nicholas Barberis

Nicholas C. Barberis (born September 1971) is the Stephen & Camille Schramm Professor of Finance at the Yale School of Management. Professor Barberis' research focuses on behavioral finance and in particular, on applications of cognitive psychology to understanding the pricing of financial assets. Barberis attended Eltham College in London, UK, earned his B.A. from Jesus College, Cambridge in 1991 and Ph.D. from Harvard University Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of high ... in 1996. References External links Official website at Yale University 1971 births Living people British economists Alumni of Jesus College, Cambridge Harvard Graduate School of Arts and Sciences alumni People educated at Eltham College Yale University faculty {{UK-economist-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lottery

A lottery is a form of gambling that involves the drawing of numbers at random for a prize. Some governments outlaw lotteries, while others endorse it to the extent of organizing a national or state lottery. It is common to find some degree of regulation of lottery by governments. The most common regulation is prohibition of sale to minors, and vendors must be licensed to sell lottery tickets. Although lotteries were common in the United States and some other countries during the 19th century, by the beginning of the 20th century, most forms of gambling, including lotteries and sweepstakes, were illegal in the U.S. and most of Europe as well as many other countries. This remained so until well after World War II. In the 1960s, casinos and lotteries began to re-appear throughout the world as a means for governments to raise revenue without raising taxes. Lotteries come in many formats. For example, the prize can be a fixed amount of cash or goods. In this format, there is risk ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Turan G

Turan ( ae, Tūiriiānəm, pal, Tūrān; fa, توران, Turân, , "The Land of Tur") is a historical region in Central Asia. The term is of Iranian origin and may refer to a particular prehistoric human settlement, a historic geographical region, or a culture. The original Turanians were an Iranian tribe of the Avestan age. Overview In ancient Iranian mythology, Tūr or Turaj (''Tuzh'' in Middle Persian) is the son of the emperor Fereydun. According to the account in the ''Shahnameh'', the nomadic tribes who inhabited these lands were ruled by Tūr. In that sense, the Turanians could be members of two Iranian peoples both descending from Fereydun, but with different geographical domains and often at war with each other. Turan, therefore, comprised five areas: the Kopet Dag region, the Atrek valley, parts of Bactria, Sogdia and Margiana. A later association of the original Turanians with Turkic peoples is based primarily on the subsequent Turkification of Central Asia, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital') and open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond or fixed income funds, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. Primary structures of mutual funds are open-end funds, closed-end funds, unit investment trusts. Open-end funds are purchased from or sold to the issuer at the net asset value of each share as of the cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eric Falkenstein

Eric Falkenstein (born 14 August 1965) is an American financial economist and an expert in the field of low-volatility investing. He is an academic researcher, blogger, quant portfolio manager, and book author. Education Falkenstein received his economics PhD from Northwestern University in 1994, and wrote his dissertation on the low return to high volatility stocks. Career He was a teaching assistant for Hyman Minsky at Washington University in St. Louis. He set up a value at risk system for trading operations at KeyCorp bank, then a firm-wide economic risk capital allocation methodology. He was a founding researcher of RiskCalc, Moody's private firm default probability model, the premier private firm default model in the world. He has been an equity portfolio manager at Pine River Capital Management and developed trading algorithms for Walleye Software. He is currently working on Ethereum contracts. Writing Falkenstein has blogged for many years and was among the top ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benchmark

Benchmark may refer to: Business and economics * Benchmarking, evaluating performance within organizations * Benchmark price * Benchmark (crude oil), oil-specific practices Science and technology * Benchmark (surveying), a point of known elevation marked for the purpose of surveying * Benchmarking (geolocating), an activity involving finding benchmarks * Benchmark (computing), the result of running a computer program to assess performance * Benchmark, a best-performing, or gold standard test in medicine and statistics Companies * Benchmark Electronics, an electronics manufacturer * Benchmark (venture capital firm), a venture capital firm * Benchmark Recordings, a music label with CDs by the Fabulous Thunderbirds and Mike Bloomfield Other uses * ''Benchmarking'' (journal), a bimonthly peer-reviewed academic journal relating to the field of quality management * McAfee's Benchmark, a brand of bourbon * ''Benchmark'' (game show), on UK Channel 4 See also * Specification (technic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lasse Heje Pedersen

Lasse Heje Pedersen (born October 3, 1972) is a Danish financial economist known for his research on liquidity risk and asset pricing. He is Professor of Finance at the Copenhagen Business School. Before that, he held the position of a Professor of Finance and Alternative Investments at the New York University Stern School of Business. He has also served in the monetary policy panel and liquidity working group at the Federal Reserve Bank of New York and is a principal at AQR Capital Management. He was the winner of the 2011 Germán Bernácer Prize, awarded annually to the best European economist under the age of 40, for his original research contributions on how the interaction between market liquidity risk and funding liquidity risk can create liquidity spirals and systemic financial crises. Education and academic career After completing his bachelor's and master's degrees in mathematics and economics at the University of Copenhagen in 1997, he went to Stanford Univers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |