|

Long Squeeze

A long squeeze is a situation in which investors who hold long positions feel the need to sell into a falling market to limit their losses. This pressure to sell usually leads to a further decline in market prices caused by the supply/demand-imbalance. This situation is less common than the opposite short squeeze, because in a short squeeze, the traders who have bought the short contracts have a legal obligation to settle with the promised shares. A trader who is 'long' in a long squeeze has no such obligation, but may sell out of fear of further losses. Other investors may see the rapid decline in price as irrational and a buying opportunity (more often than a rapid rise in price seen as a shorting opportunity). However, in times of significant market turmoil, identifying a long squeeze becomes of more practical interest rather than merely an investment opportunity. In 2008, Bear Stearns was wiped out after market rumors that the company had cash concerns. Investors started selling ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Types of investments include Stock, equity, Bond (finance), debt, Security (finance), securities, real estate, infrastructure, currency, commodity, Exonumia, token, derivatives such as put and call Option (finance), options, Futures contract, futures, Forward contract, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder. Types of investors There are two types of investors: retail investors and institutional investors. Retail investor * Individual investors (including Trust law, trusts on behalf of individuals, and umbr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Position

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means the holder of the position is obliged to buy the underlying instrument at the contract price at expiry. The holder of the position will profit if the price of the underlying instrument goes up, as the price he will pay will be less than the market price. Option An options investor goes long in an underlying investment (in technical jar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Price

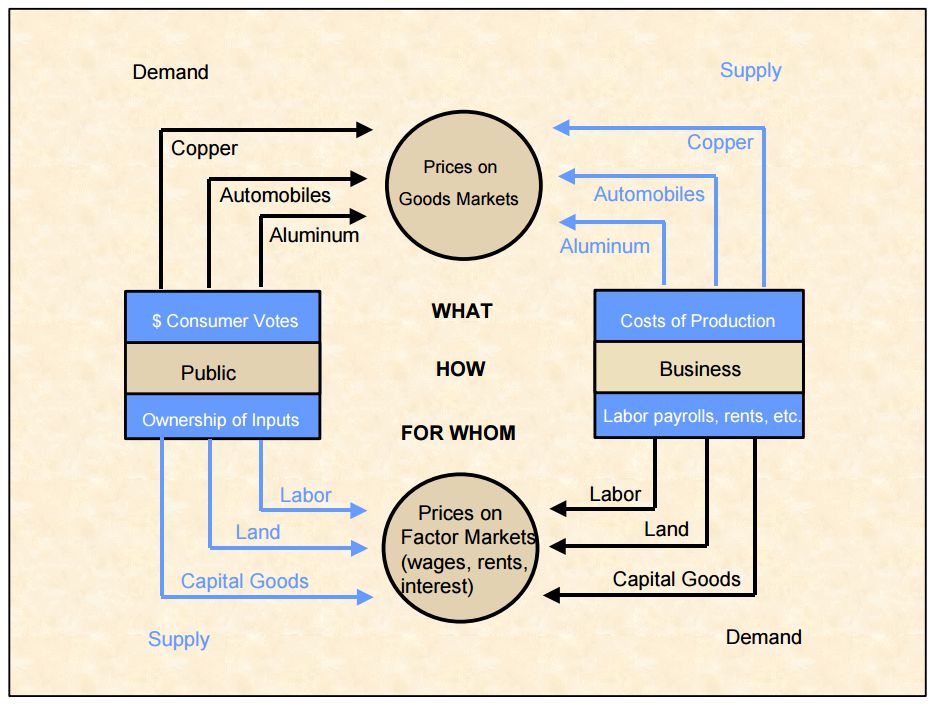

A price is the (usually not negative) quantity of payment or Financial compensation, compensation given by one Party (law), party to another in return for Good (economics), goods or Service (economics), services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply (economics), supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted to currency, quantities of goods or vouchers. * In modern Economy, economies, prices are generally expressed in units of some form of currency. (More specifically, for Raw material, raw m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short Squeeze

In the stock market, a short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying Fundamental analysis, fundamentals. A short squeeze occurs when there is a lack of Supply and demand, supply and an excess of Supply and demand, demand for the stock due to short sellers having to buy stocks to cover their short positions. Overview Short selling is a finance practice in which an investor, known as the short-seller, borrows shares and immediately sells them, hoping to buy them back later ("covering") at a lower price. As the shares were borrowed, the short-seller must eventually return them to the lender (plus interest and dividend, if any), and therefore makes a profit if they spend less buying back the shares than they earned when selling them. However, an unexpected piece of favorable news can cause a jump in the stock's share price, resulting in a loss rather than a profit. Short-sellers might then be tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trader (finance)

A trader is a person, firm, or entity in finance who buys and sells financial instruments, such as forex, cryptocurrencies, stocks, bonds, commodities, derivatives, and mutual funds in the capacity of agent, hedger, arbitrageur, or speculator. Duties and types Traders buy and sell financial instruments traded in the stock markets, derivatives markets and commodity markets, comprising the stock exchanges, derivatives exchanges, and the commodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, including: * Bond trader * Floor trader *Hedge fund trader * High-frequency trader *Market maker * Pattern day trader * Principal trader *Proprietary trader * Rogue trader * Scalper * Stock trader Income According to the Wall Street Journal in 2004, a managing director convertible bond trader was earning between $700,000 and $900,000 on average. See also * Commodities exchange *Commodity market *Derivatives market * List of co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional " long" position, where the investor will profit if the value of the asset rises. There are a number of ways of achieving a short position. The most fundamental method is "physical" selling short or short-selling, which involves borrowing assets (often securities such as shares or bonds) and selling them. The investor will later purchase the same number of the same type of securities in order to return them to the lender. If the price has fallen in the meantime, the investor will have made a profit equal to the difference. Conversely, if the price has risen then the investor will bear a loss. The short seller must usually pay a fee to borrow the securities (charged at a particular rate over time, similar to an interest payment), and reimburse the lender for any cash returns such as dividends that were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share (finance)

In financial markets, a share is a unit of equity ownership in the capital stock of a corporation, and can refer to units of mutual funds, limited partnerships, and real estate investment trusts. Share capital refers to all of the shares of an enterprise. The owner of shares in a company is a shareholder (or stockholder) of the corporation. A share is an indivisible unit of capital, expressing the ownership relationship between the company and the shareholder. The denominated value of a share is its face value, and the total of the face value of issued shares represent the capital of a company, which may not reflect the market value of those shares. The income received from the ownership of shares is a dividend. There are different types of shares such as equity shares, preference shares, deferred shares, redeemable shares, bonus shares, right shares, and employee stock option plan shares. Valuation Shares are valued according to the various principles in different market ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Stearns

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis. In the years leading up to the failure, Bear Stearns was heavily involved in securitization and issued large amounts of asset-backed securities which were, in the case of mortgages, pioneered by Lewis Ranieri, "the father of mortgage securities". As investor losses mounted in those markets in 2006 and 2007, the company actually increased its exposure, especially to the mortgage-backed assets that were central to the subprime mortgage crisis. In March 2008, the Federal Reserve Bank of New York provided an emergency loan to try to avert a su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scrip

A scrip (or '' chit'' in India) is any substitute for legal tender. It is often a form of credit. Scrips have been created and used for a variety of reasons, including exploitive payment of employees under truck systems; or for use in local commerce at times when regular currency was unavailable, for example in remote coal towns, military bases, ships on long voyages, or occupied countries in wartime. Besides company scrip, other forms of scrip include land scrip, vouchers, token coins such as subway tokens, IOUs, arcade tokens and tickets, and points on some credit cards. Scrips have gained historical importance and become a subject of study in numismatics and exonumia due to their wide variety and recurring use. Scrip behaves similarly to a currency, and as such can be used to study monetary economics. History A variety of forms of scrip were used at various times in the 19th and 20th centuries. Company scrip Company scrip was a credit against the accrued wag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order (exchange)

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders. Market order A market order is a buy or sell order to be executed immediately at the ''current'' ''market'' prices. As long as there are willing sellers and buyers, market orders are filled. Market orders are used when certainty of execution is a priority over the price of execution. A market order is the simplest of the order types. This order type does not allow any control over the price received. The order is filled at the best price available at the relevant time. In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. A market order may b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract traded on the New York Mercantile Exchange (NYMEX). The WTI oil grade is also known as Texas light sweet, oil produced from any location can be considered WTI if the oil meets the required qualifications. Spot and futures prices of WTI are used as a benchmark in oil pricing. This grade is described as light crude oil because of its low density and sweet because of its low sulfur content. The price of WTI is often included in news reports on oil prices, alongside the price of Brent crude from the North Sea. Other important oil markers include the Dubai crude, Oman crude, Urals oil, and the OPEC reference basket. WTI is lighter and sweeter, containing less sulfur than Brent, and considerably lighter and sweeter than Dubai or Oman. WTI ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)

.jpg)