|

London Bullion Market

The London bullion market is a wholesale over-the-counter (finance), over-the-counter market for the trading of gold, silver, platinum and palladium. Trading is conducted amongst members of the London Bullion Market Association (LBMA), tightly overseen by the Bank of England. Most of the members are major international banks or bullion dealers and refiners. The physical characteristics of gold and silver bars used in settlement in market is described by the Good Delivery specification which is a set of rules issued by the LBMA. It also puts forth requirements for listing on the LBMA Good Delivery#LBMA Good Delivery List, Good Delivery List of approved refineries. Gold trading Internationally, gold is traded via Over-the-counter (finance), over-the-counter (OTC) transactions, with trading on the New York Mercantile Exchange (NYMEX) and Tokyo Commodity Exchange (TOCOM). Twice daily, at 10:30 AM and 3:00 PM (local time). the LBMA publishes the gold price in US dollars. These forwar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Over-the-counter (finance)

Over-the-counter (OTC) or off-exchange trading or pink sheet trading is done directly between two parties, without the supervision of an exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, providing transparency, and maintaining the current market price. In an OTC trade, the price is not necessarily publicly disclosed. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivatives of such products. Products traded on traditional stock exchanges, and other regulated bourse platforms, must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in stock exchange-based equities trading. The OTC market does not have this limitation. Parties may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than Equity (finance), equity and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., Warrant (finance), equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic (Dematerialization (securities), dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Platinum And Palladium Market

The London Platinum and Palladium Market (LPPM) is an over-the-counter trading centre for platinum and palladium and a commodity trading association. London has always been a centre for the research in and development of most of the platinum group metals. Trade was established in the early 20th century, typically by existing dealers of gold and silver. The LPPM has been involved in fixing the world market prices of platinum and palladium since 1989. History Trading on the London Platinum and Palladium Market has a much shorter history than the trading on the London Bullion Market, which is performed since the 17th century. London has been a historically important centre for platinum and palladium. The trading was initiated at the beginning of the 20th century, alongside the longer-established bullion metals. In 1973, metal dealers established "London Platinum and Palladium Quotation"—a forerunner of the fixings. The prices for platinum and palladium were settled twice a day on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

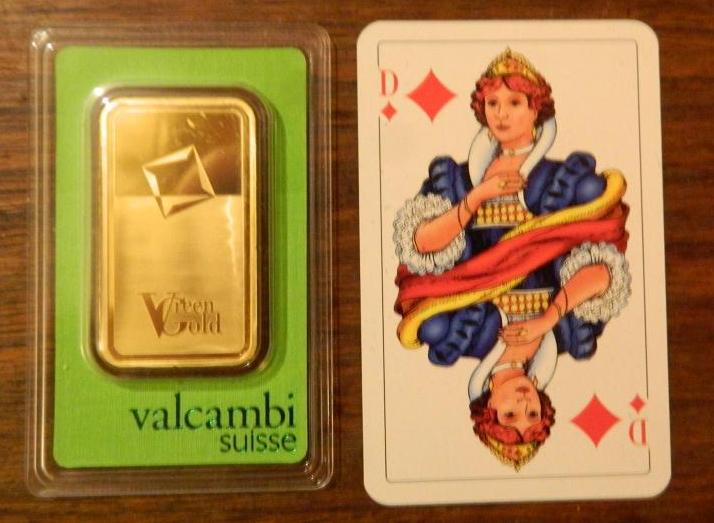

Bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from the Anglo-Norman term for a melting-house where metal was refined, and earlier from French , "boiling". Although precious metal bullion is no longer used to make coins for general circulation, it continues to be held as an investment with a reputation for stability in periods of economic uncertainty. To assess the purity of gold bullion, the centuries-old technique of fire assay is still employed, together with modern spectroscopic instrumentation, to accurately determine its quality. As investment The specifications of bullion are often regulated by market bodies or legislation. In the European Union, the minimum purity for gold to be referred to as "bullion", which is treated as investment gold with regard to taxation, is 99.5% for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Silver As An Investment

Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed country, developed countries when the use of the silver standard came to an end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values. In 2009, the main demand for silver was for: industrial applications (40%), jewellery, bullion coins and silver exchange-traded product, exchange-traded products. In 2011, the global silver reserves amounted to 530,000 tonnes. Millions of Canadian Silver Maple Leaf coins and American Silver Eagle coins are purchased as investments each year. While these bullion coins are legal tender, they are rarely used at shops. However, "junk silver" coins, which were originally minted for circulation, can still be found in circulation, albeit rarely, and are common targets in the practice ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gold As An Investment

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries. Gold price Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. Many European countries implemented gold standards in the latter part of the 19th century until these were temporarily suspended in the financial crises involving World War I. After World War II, the Bretton Woods system pegged the United States dollar to gold at a rate of US$35 per troy ounce. The system existed until the 1971 Nixon shock, when the US unilaterally suspended the direct convertib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Base Metal

A base metal is a common and inexpensive metal, as opposed to a precious metal such as gold or silver. In numismatics, coins often derived their value from the precious metal content; however, base metals have also been used in coins in the past and today. Specific definitions In contrast to noble metals, base metals may be distinguished by oxidizing or corroding relatively easily and reacting variably with diluted hydrochloric acid (HCl) to form hydrogen. Examples include iron, nickel, lead and zinc. Copper is also considered a base metal because it oxidizes relatively easily, although it does not react with HCl. In mining and economics, the term base metals refers to industrial non-ferrous metals excluding precious metals. These include copper, lead, nickel and zinc. The U.S. Customs and Border Protection agency is more inclusive in its definition of commercial base metals. Its list includes—in addition to copper, lead, nickel, and zinc—the following metals: iron and ste ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Non-profit, member-owned futures exchanges benefit their members, who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

London Metal Exchange

The London Metal Exchange (LME) is a futures and forwards exchange in London, United Kingdom with the world's largest market in standardised forward contracts, futures contracts and options on base metals. The exchange also offers contracts on ferrous metals and precious metals. The company also allows for cash trading. It offers hedging, worldwide reference pricing, and the option of physical delivery to settle contracts. Overview Ring trading Trading times are 11:40 to 17:00. The LME is the last exchange in Europe where open-outcry trading takes place.BBC Radio 4 '' Today'', broadcast 25 October 2011. The ring was temporarily closed in March 2020 due to the COVID-19 pandemic. In January 2021, LME proposed closing the ring, Europe's last open-outcry trading floor, and moving permanently to an electronic system. However, the ring reopened in September of the same year after resistance from members. In addition to the 9 companies that have exclusive rights to trade in the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Philip Klapwijk

Philip Andrew Klapwijk is a British economist in precious metals commodities markets. After studies at the London School of Economics and the College of Europe in Bruges where he obtained degrees in economics, he started work as an analyst with Gold Fields Mineral Services (now GFMS). Following the management buyout of GFMS in 1988 with Paul Walker and Hester le Roux he became Executive Chairman and Global Head of Metals Analytics. In 2011 GFMS became part of Thomson Reuters. After leaving GFMS Philip Klapwijk became Managing Director of Precious Metals Insights Limited, a Hong Kong–based precious metals consultancy company. In the 2009 London bullion market LBMA Forecast Philip Klapwijk was awarded the prizes for the year's most accurate economic forecaster for both gold and silver prices and was the LBMA first prize winner for most accurate platinum forecast for 2014. References {{DEFAULTSORT:Klapwijk, Philip Alumni of the London School of Economics College of Europe a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Run

A bank run or run on the bank occurs when many Client (business), clients withdraw their money from a bank, because they believe Bank failure, the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system (where banks normally only keep a small proportion of their assets as cash), numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvency, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |