|

List Of Stock Market Crashes And Bear Markets

This is a list of stock market and bear markets. The difference between the two relies on speed (how fast declines occur) and length (how long they last). Stock market crashes are quick and brief, while bear markets are slow and prolonged. Those two do not always happen within the same decline. Table See also * List of economic crises * List of recessions in the United States * List of recessions in the United Kingdom * 1991 Indian economic crisis * Economic bubble An economy is an area of the Production (economics), production, Distribution (economics), distribution and trade, as well as Consumption (economics), consumption of Goods (economics), goods and Service (economics), services. In general, it is ... * List of banking crises * List of largest daily changes in the Dow Jones Industrial Average * Stock market crashes in India References * {{Financial crises Stock market crashes Stock market crashes * * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

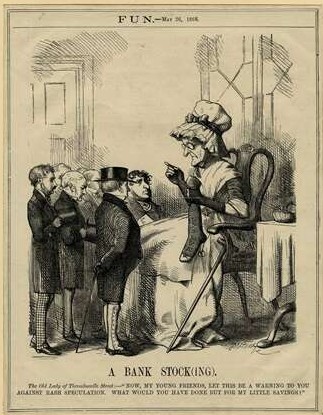

Stock Market Crash

A stock market crash is a sudden dramatic decline of stock prices across a major cross-section of a stock market, resulting in a significant loss of paper wealth. Crashes are driven by panic selling and underlying economic factors. They often follow speculation and economic bubbles. A stock market crash is a social phenomenon where external economic events combine with crowd psychology in a positive feedback loop where selling by some market participants drives more market participants to sell. Generally speaking, crashes usually occur under the following conditions: a prolonged period of rising stock prices (a bull market) and excessive economic optimism, a market where price–earnings ratios exceed long-term averages, and extensive use of margin debt and leverage by market participants. Other aspects such as wars, large corporate hacks, changes in federal laws and regulations, and natural disasters within economically productive areas may also influence a significant decline i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Panic Of 1819

The Panic of 1819 was the first widespread and durable financial crisis in the United States that slowed westward expansion in the Cotton Belt and was followed by a general collapse of the American economy that persisted through 1821. The Panic heralded the transition of the nation from its colonial commercial status with Europe toward an independent economy. Though the downturn was driven by global market adjustments in the aftermath of the Napoleonic Wars, its severity was compounded by excessive speculation in public lands, fueled by the unrestrained issue of paper money from banks and business concerns. The Second Bank of the United States (SBUS), itself deeply enmeshed in these inflationary practices, sought to compensate for its laxness in regulating the state bank credit market by initiating a sharp curtailment in loans by its western branches, beginning in 1818. Failing to provide gold specie from their reserves when presented with their own banknotes for redemption ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Alfredo D'Escragnolle Taunay, Viscount Of Taunay

Alfredo Maria Adriano d'Escragnolle Taunay, Viscount of Taunay (February 22, 1843 – January 25, 1899), was a Brazilian writer, musician, professor, military engineer, historian, politician, sociology, sociologist and nobleman. He is famous for the regionalist novel , considered a major forerunner of Naturalism (literature), naturalism in Brazil, and for ''A Retirada da Laguna'' (1874; originally written in 1872 in French as ''Le retraite de Laguna''), an account of an episode in the Paraguayan War. The Brazilianist Leslie Bethell has described it as "the one undoubted literary masterpiece produced by the Paraguayan War".Bethell, Leslie, ''The Paraguayan War (1864-1870'', Institute of Latin American Studies, 1996, p.6/ref> He founded and occupied the 13th chair of the Academia Brasileira de Letras, Brazilian Academy of Letters from 1897 until his death in 1899. Life Taunay was born in Rio de Janeiro, in 1843. His father was Félix Taunay, Baron of Taunay, Félix Taunay, Bar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Boom And Bust

Business cycles are intervals of general expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms. There are many definitions of a business cycle. The simplest defines recessions as two consecutive quarters of negative GDP growth. More satisfactory classifications are provided by, first including more economic indicators and second by looking for more data patterns than the two quarter definition. In the United States, the National Bureau of Economic Research oversees a Business Cycle Dating Committee that defines a recession as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." Business cycles are usually thought of as medium-term evo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Encilhamento

The Encilhamento was an economic bubble that boomed in the late 1880s and early 1890s in Brazil, bursting during the early years of the First Brazilian Republic (1889–1894) and leading to an institutional and a financial crisis. Two Finance Ministers, first the Viscount of Ouro Preto and then Ruy Barbosa, adopted a policy of unrestricted credit for industrial investments, backed by an abundant issuance of money, in order to encourage Brazil's industrialization. This policy of economic incentives created unbridled speculation and increased inflation, and encouraged fraudulent initial public offerings (IPOs) and takeovers. The name The word "encilhamento", literally "''saddling-up''", the act of girthing or mounting a horse, was a term borrowed from horse racing and used to refer to the speculative practice of seizing get-rich-quick opportunities whenever they unfold, in an analogy based on the popular Brazilian saying "An unmounted saddled horse doesn't appear twice." ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Panic Of 1884

The Panic of 1884 was an economic panic during the Depression of 1882–1885. It was unusual in that it struck at the end rather than the beginning of the recession. The panic created a credit shortage that led to a significant economic decline in the United States, turning a recession into a depression. Background In the late 19th century, the gold reserves of Europe were depleted and, as demand for it rose, more than $150 million in gold was exported from the United States between 1882 and 1884. The New York City national banks halted investments in the rest of the United States and called in outstanding loans. The Panic of 1873 was also a factor in the Panic of 1884. The 1873 panic was caused by practices including speculative bonds and overextension of credit to fund the construction of infrastructure. Part of the overextension of credit before 1873 was for railroads, particularly the Northern Pacific railroad, which was financed by Cooke & Co. In addition, the failure o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Paris Bourse Crash Of 1882

The Paris Bourse crash of 1882 was a stock market crash in France, and was the worst crisis in the French economy in the nineteenth century. The crash was triggered by the collapse of l'Union Générale in January. Around a quarter of the brokers on the bourse were on the brink of collapse. The closure of the exchange was prevented by a loan from the Banque de France which enabled sufficient liquidity to support settlement. Causes The stock price of l’Union Générale rose from 500 francs a share in 1879 to over 3,000 francs at its peak. Investors saw the booming market for new securities and jumped into the forward market. Speculators also printed counterfeit money; they renewed their forward contracts in hopes for a continuous rise in prices. As the market grew, so did the demand for cash, and interest rates began to rise to the point where lenders began demanding a premium. This situation foretold that a collapse would occur when investors would repay their loans, not want ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Long Depression

The Long Depression was a worldwide price and economic recession, beginning in Panic of 1873, 1873 and running either through March 1879, or 1899, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though it marked a period of general deflation and recession, a general contraction, it did not have the severe economic retrogression of the later Great Depression. The United Kingdom was the hardest hit; during this period it lost some of its large industrial lead over the economies of continental Europe. While it was occurring, the view was prominent that the British economy had been in continuous depression from 1873 to as late as 1896 and some texts refer to the period as the Great ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Panic Of 1873

The Panic of 1873 was a financial crisis that triggered an economic depression in Europe and North America that lasted from 1873 to 1877 or 1879 in France and in Britain. In Britain, the Panic started two decades of stagnation known as the "Long Depression" that weakened the country's economic leadership. In the United States, the Panic was known as the "Great Depression" until the events of 1929 and the early 1930s set a new standard. The Panic of 1873 and the subsequent depression had several underlying causes for which economic historians debate the relative importance. American inflation, rampant speculative investments (overwhelmingly in railroads), the demonetization of silver in Germany and the United States, ripples from economic dislocation in Europe resulting from the Franco-Prussian War (1870–1871), and major property losses in the Great Chicago Fire (1871) and the Great Boston Fire (1872) helped to place massive strain on bank reserves, which, in New York ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Black Friday (1869)

On September 24, 1869, a gold panic broke out in the United States, triggering a financial crisis. The panic, which became known as Black Friday, was the result of a conspiracy between two investors, Jay Gould, later joined by his partner James Fisk (financier), James Fisk, and Abel Corbin, a small time speculator who had married Virginia (Jennie) Grant, the younger sister of President Ulysses S. Grant. They formed the ''Gold Ring'' to Cornering the market, corner the gold market and force up the price of the metal on the New York Gold Exchange. The scandal took place during the Presidency of Ulysses S. Grant, Grant Presidency. The US Secretary of the Treasury, Secretary of the Treasury, George S. Boutwell, had a policy to sell Treasury gold at biweekly intervals for a sinking fund to pay off the US national debt, national debt. Along with other, non-routine gold sales, this infusion of cash acted to stabilize the dollar. The economy had gone through tremendous upheaval during the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Panic Of 1866

The Panic of 1866 was a financial downturn that accompanied the failure of Overend, Gurney and Company in London. In United Kingdom, Britain, the economic impacts are held partially responsible for public agitation for political reform in the months leading up to the 1867 Reform Act. The crisis led to a sharp rise in unemployment to 8% and a subsequent fall in wages across the country. Similar to the "knife and fork" motives of Chartism in the late 1830s and 1840s, the financial pressure on the British working class led to rising support for greater representation of the people. Groups such as the Reform League saw rapid increases in membership and the organisation spearheaded multiple demonstrations against the political establishment such as the Hyde Park riot of 1866. Ultimately the popular pressure that arose from the banking crisis and the recession that followed can be held partly responsible for the enfranchisement of 1.1 million people as a result of Reform Act 1867, Disr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

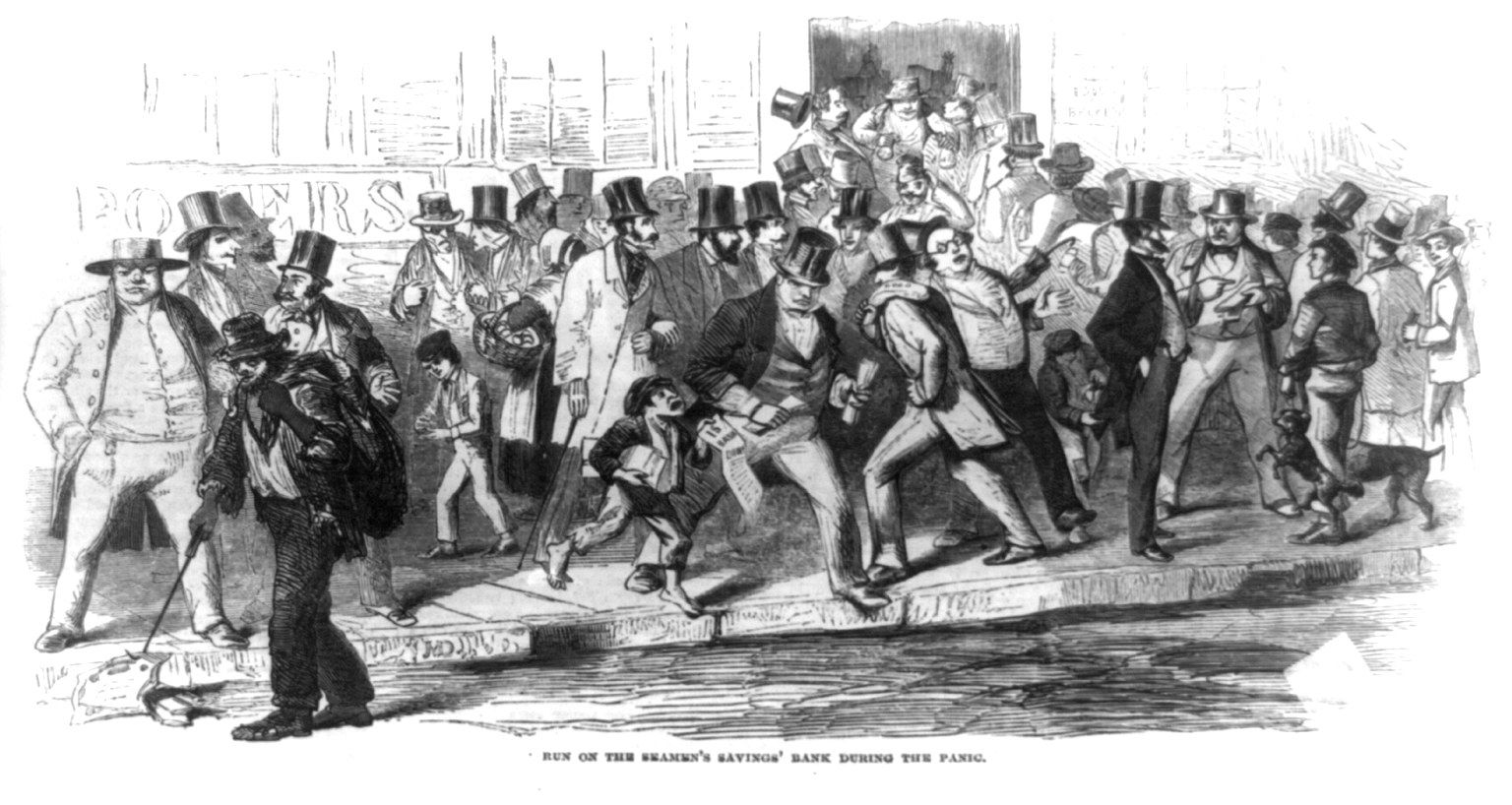

Panic Of 1857

The Panic of 1857 was a financial crisis in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph Telegraphy is the long-distance transmission of messages where the sender uses symbolic codes, known to the recipient, rather than a physical exchange of an object bearing the message. Thus flag semaphore is a method of telegraphy, whereas ... by Samuel F. Morse in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States. The world economy was more interconnected by the 1850s, which made the Panic of 1857 the first worldwide economic crisis. In Britain, the Henry John Temple, 3rd Viscount Palmerston, Palmerston government circumvented the requirements of the Bank Charter Act 1844, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain. B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |