|

Ireland As A Tax Haven

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven. Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD Hierarchy Of Taxes

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irish Section 110 Special Purpose Vehicle (SPV)

An Irish Section 110 special purpose vehicle (SPV) or section 110 company, is an Irish tax resident company, which qualifies under ''Section 110'' of the '' Irish Taxes Consolidation Act 1997'' (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties. Section 110 was created in 1997 to help International Financial Services Centre (IFSC) legal and accounting firms compete for the administration of global securitisation deals, and by 2017 was the largest structured finance vehicle in EU securitisation. Section 110 SPVs have made the IFSC the third largest global Shadow Banking OFC. While they pay no Irish tax, they contribute €100 million annually to the Irish economy in fees paid to IFSC legal and accounting firms. In June 2016, it was discovered that US distressed debt funds used Section 110 SPVs, structured by IFSC service firms, to avoid Irish taxes on €80 billion of Irish domestic investments. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Offshore Magic Circle

The offshore magic circle is the set of the largest multi-jurisdictional law firms who specialise in offshore financial centres, especially the laws of the British Overseas Territories of Bermuda, Cayman Islands, and British Virgin Islands, and the Crown dependencies of Jersey and Guernsey. The same firms are also increasingly advising on the laws of onshore financial centres, especially Ireland and Luxembourg. Definition The term is a derivation of the widely-recognised London 'magic circle' of top law firms, and is widely used in the offshore legal industry. The term has also become used to describe the offshore legal industry in a more pejorative sense (e.g. when the general media reports on Paradise Papers–type offshore financial scandals), and is therefore more sparingly used, or found, in major legal publications (e.g. ''Legal Business''). There is no consensus definition over which firms belong in the offshore magic circle. A 2008 article in the publication ''Leg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ICAV

Qualifying Investor Alternative Investment Fund or QIAIF is a Central Bank of Ireland regulatory classification established in 2013 for Ireland's five tax-free legal structures for holding assets. The Irish Collective Asset-management Vehicle or ICAV is the most popular of the five Irish QIAIF structures, it is the main tax-free structure for foreign investors holding Irish assets. In 2018, the Central Bank of Ireland expanded the Loan Originating QIAIF or L–QIAIF regime which enables the five tax-free structures to be used for closed-end debt instruments. The L–QIAIF is Ireland's main debt–based BEPS tool as it overcomes the lack of confidentiality and tax secrecy of the Section 110 SPV. It is asserted that many assets in QIAIFs and LQIAIFs are Irish assets being shielded from Irish taxation. Irish QIAIFs and LQIAIFs can be integrated with Irish corporate base erosion and profit shifting ("BEPS") tax tools to create confidential routes out of the Irish tax system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HMRC

, patch = , patchcaption = , logo = HM Revenue & Customs.svg , logocaption = , badge = , badgecaption = , flag = , flagcaption = , image_size = , commonname = , abbreviation = , motto = , formed = , preceding1 = Inland Revenue , preceding2 = HM Customs and Excise , dissolved = , superseding = , employees = 63,042 FTE , volunteers = , budget = (2018–2019) , country = United Kingdom , constitution1 = Commissioners for Revenue and Customs Act 2005 , speciality1 = customs , speciality2 = tax , headquarters = 100 Parliament Street, London, SW1A 2BQ , sworntype = , sworn = , unsworntype = , unsworn = , minister1name = Andrew Griffith MP , minister1pfo = Economic Secretary to the Treasury and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Inversion

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign parent, and the original parent company becomes a subsidiary of the foreign parent, thus moving its tax residence to the foreign country. Executives and operational headquarters can stay in the original country. The US definition requires that the original shareholders remain a majority control of the post-inverted company. The majority of the less than 100 material tax inversions recorded since 1993 have been of US corporations (85 inversions), seeking to pay less to the US corporate tax system. The only other jurisdiction to experience a material outflow of tax inversions was the United Kingdom from 2007 to 2010 (22 inversions); however, UK inversions largely ceased post the reform of the UK corporate tax code from 2009 to 2012. The first inversion was McDermott International in 1983. Reforms by US Congress in 2004 hal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lidl

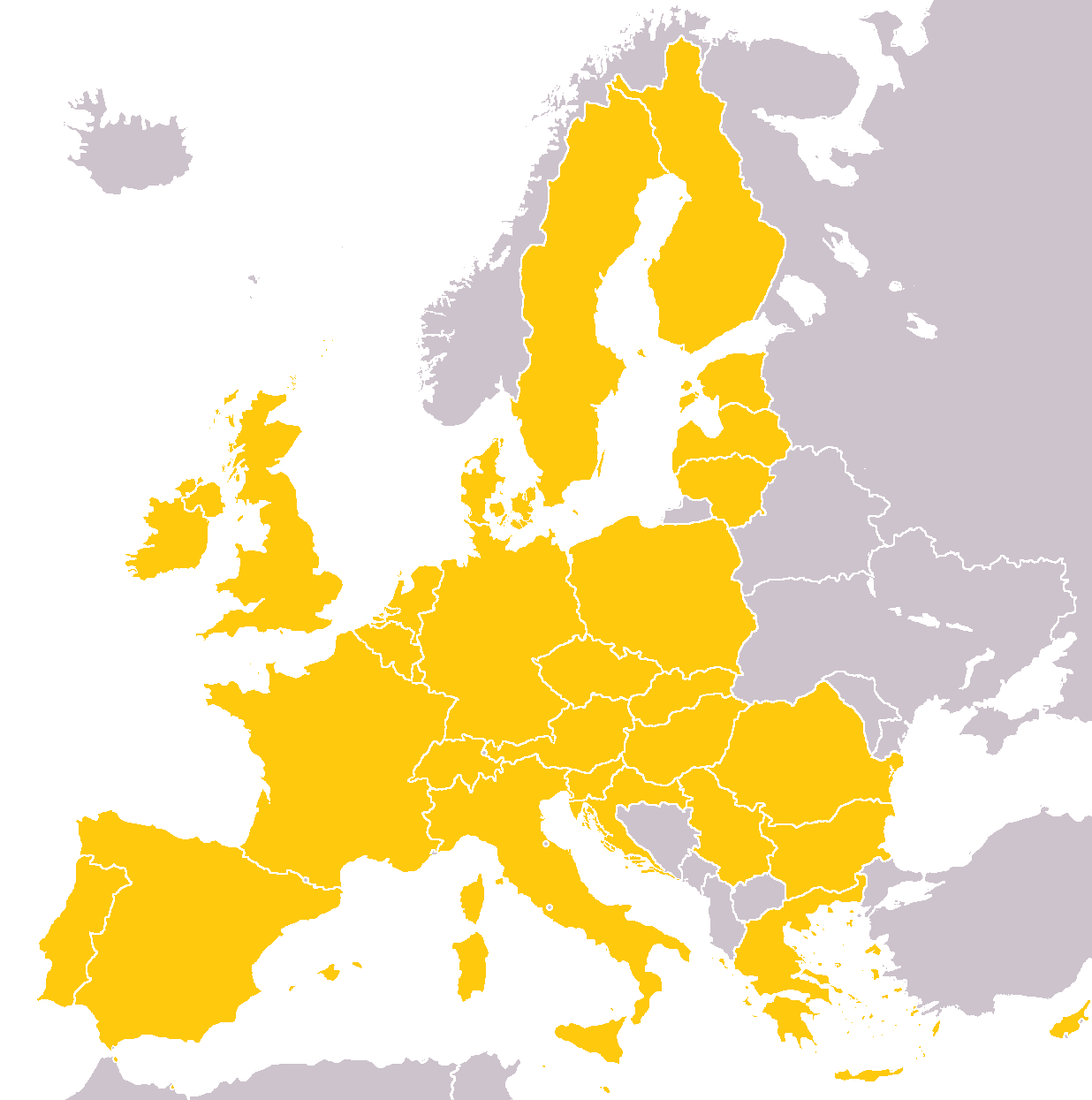

Lidl Stiftung & Co. KG (; ) is a German international discount retailer chain that operates over 11,000 stores across Europe and the United States. Headquartered in Neckarsulm, Baden-Württemberg, the company belongs to the Schwarz Group, which also operates the hypermarket chain Kaufland. Lidl is the chief competitor of the similar German discount chain Aldi in several markets. There are Lidl stores in every member state of the European Union as well as in Serbia, Switzerland, the United Kingdom and the United States. In October 2021, Lidl also announced that it intended to open its first store in Ukraine, but there has been no progress due to the 2022 Russian invasion of Ukraine. History In 1932, Josef Schwarz became a partner in Südfrüchte Großhandlung Lidl & Co., a fruit wholesaler, and he developed the company into a general food wholesaler. In 1977, under his son Dieter Schwarz, the Schwarz-Gruppe began to focus on discount markets, larger supermarkets, and cash ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Table 1

Table may refer to: * Table (furniture), a piece of furniture with a flat surface and one or more legs * Table (landform), a flat area of land * Table (information), a data arrangement with rows and columns * Table (database), how the table data arrangement is used within databases * Calligra Tables, a spreadsheet application * Mathematical table * Table (parliamentary procedure) * Tables (board game) * Table, surface of the sound board (music) of a string instrument * ''Al-Ma'ida'', the fifth ''surah'' of the Qur'an, usually translated as “The Table” * Water table See also * Spreadsheet, a computer application * Table cut, a type of diamond cut * The Table (other) * Table Mountain (other) * Table Rock (other) * Tabler (other) * Tablet (other) Tablet may refer to: Medicine * Tablet (pharmacy), a mixture of pharmacological substances pressed into a small cake or bar, colloquially called a "pill" Computing * Tablet computer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Green Jersey

In road bicycle racing (e.g. Grand Tour stage races) the green jersey is a distinctive racing jersey worn by the most consistent highest finisher in the competition. While the overall race leader in the Tour de France will wear the yellow jersey, or "maillot jaune", the green jersey ("maillot vert") will be worn by the leader in the points competition. Since 2009, the Vuelta a España has also used the green jersey to signify the leader of the points competition. In the Giro d'Italia, the green jersey was, from 1974 to 2011, worn by the King of the Mountains, the leader in the competition for climbing specialists. Classification guide The following events use the "green jersey" to signify the current leader and/or final winner of the overall classification by points (often known as the sprinters' competition): * Tour de France (known as the "maillot vert") (see also Points classification in the Tour de France) * Vuelta a España * Critérium du Dauphiné Libéré * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medtronic

Medtronic plc is an American medical device company. The company's operational and executive headquarters are in Minneapolis, Minnesota, and its legal headquarters are in Ireland due to its acquisition of Irish-based Covidien in 2015. While it primarily operates in the United States, it operates in more than 150 countries and employs over 90,000 people. It develops and manufactures healthcare technologies and therapies. History Medtronic was founded in 1949 in Minneapolis by Earl Bakken and his brother-in-law, Palmer Hermundslie, as a medical equipment repair shop. Bakken invented several medical technology devices that continue to be used around the world today. Through his repair business, Bakken came to know C. Walton Lillehei, a doctor of heart surgery at the University of Minnesota Medical School. The deficiencies of the artificial pacemakers of the day were made painfully obvious following a power outage over Halloween in 1957, which affected large sections of Minn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pfizer

Pfizer Inc. ( ) is an American multinational pharmaceutical and biotechnology corporation headquartered on 42nd Street in Manhattan, New York City. The company was established in 1849 in New York by two German entrepreneurs, Charles Pfizer (1824–1906) and his cousin Charles F. Erhart (1821–1891). Pfizer develops and produces medicines and vaccines for immunology, oncology, cardiology, endocrinology, and neurology. The company has several blockbuster drugs or products that each generate more than billion in annual revenues. In 2020, 52% of the company's revenues came from the United States, 6% came from each of China and Japan, and 36% came from other countries. Pfizer was a component of the Dow Jones Industrial Average stock market index from 2004 to August 2020. The company ranks 64th on the Fortune 500 and 49th on the Forbes Global 2000. History 1849–1950: Early history Pfizer was founded in 1849 by Charles Pfizer and Charles F. Erhart, two cousins who ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) tax-exempt non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Legal Reform. The group is known for its annual reports such as ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941, and its " Tax Freedom Day" brochures, which it has produced since the early 1970s. History The Tax Foundation was organized on December 5, 1937, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)