|

Invoice

An invoice, bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products, quantities, and agreed-upon prices for products or services the seller had provided the buyer. Payment terms are usually stated on the invoice. These may specify that the buyer has a maximum number of days to pay and is sometimes offered a discount if paid before the due date. The buyer could have already paid for the products or services listed on the invoice. To avoid confusion and consequent unnecessary communications from buyer to seller, some sellers clearly state in large and capital letters on an invoice whether it has already been paid. From a seller's point of view, an invoice is a ''sales invoice''. From a buyer's point of view, an invoice is a ''purchase invoice''. The document indicates the buyer and seller, but the term ''invoice'' indicates money is owed ''or'' owing. Within the European Union, an invoice is primarily legally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pro Forma

The term ''pro forma'' (Latin for "as a matter of form" or "for the sake of form") is most often used to describe a practice or document that is provided as a courtesy or satisfies minimum requirements, conforms to a norm or doctrine, tends to be performed perfunctorily or is considered a formality. The term is used in legal and business fields to refer to various types of documents that are generated as a matter of course. Accounting The ''pro forma'' accounting is a statement of the company's financial activities while excluding "unusual and nonrecurring transactions" when stating how much money the company actually made. Examples of expenses often excluded from ''pro forma'' results are company restructuring costs, a decline in the value of the company's investments, or other accounting charges, such as adjusting the current balance sheet to fix faulty accounting practices in previous years. There was a boom in the reporting of ''pro forma'' results in the US starting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discounts And Allowances

Discounts and allowances are reductions to a basic price of goods or services. They can occur anywhere in the distribution channel, modifying either the manufacturer's list price (determined by the manufacturer and often printed on the package), the retail price (set by the retailer and often attached to the product with a sticker), or the list price (which is quoted to a potential buyer, usually in written form). There are many purposes for discounting, including to increase short-term sales, to move out-of-date stock, to reward valuable customers, to encourage distribution channel members to perform a function, or to otherwise reward behaviors that benefit the discount issuer. Some discounts and allowances are forms of sales promotion. Many are price discrimination methods that allow the seller to capture some of the consumer surplus. Types The most common types of discounts and allowances are listed below. Dealing with payment Prompt payment discount ''Trade disc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

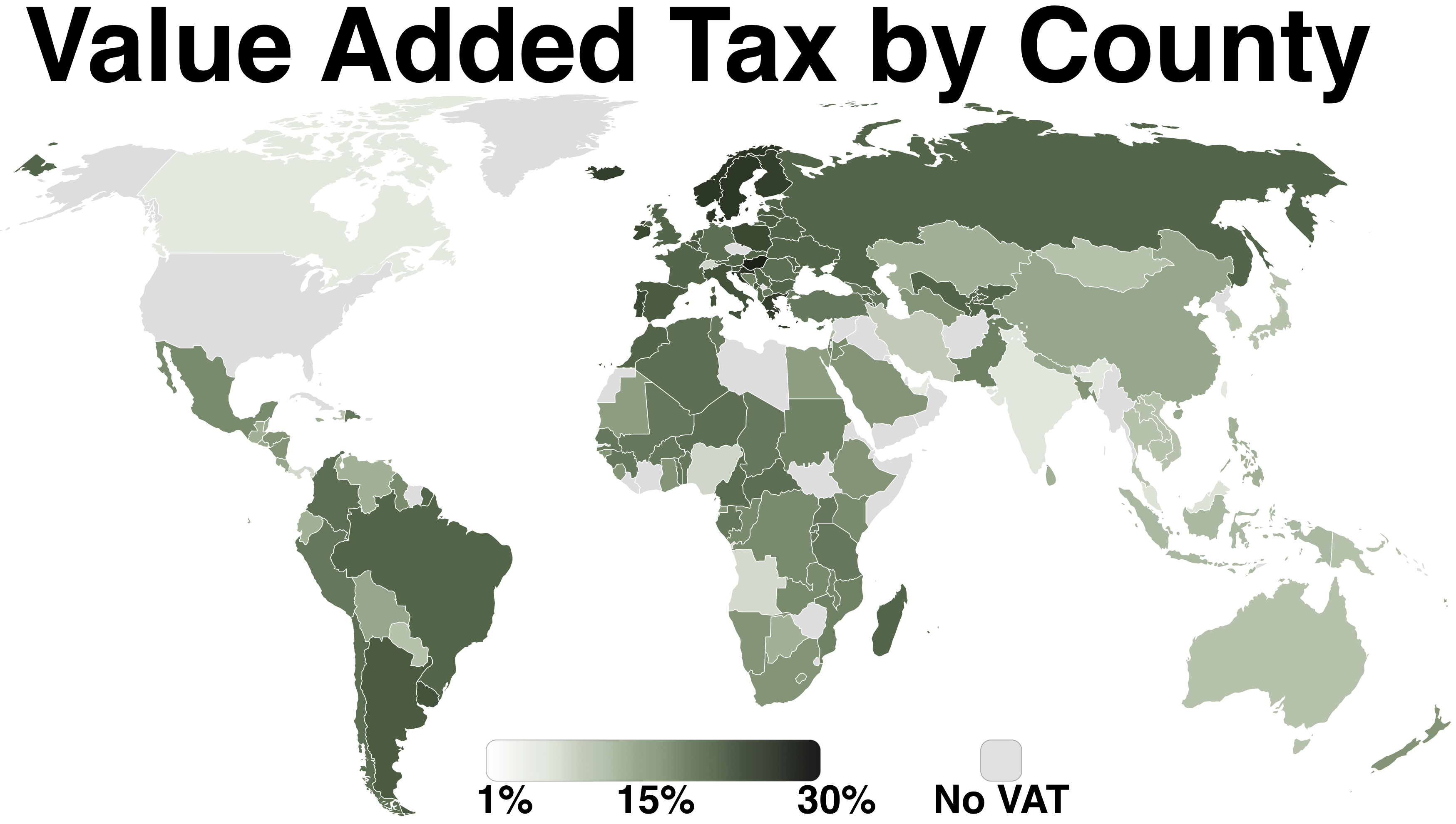

Value-added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Voucher

A voucher is a bond of the redeemable transaction type which is worth a certain monetary value and which may be spent only for specific reasons or on specific goods. Examples include housing, travel, and food vouchers. The term voucher is also a synonym for receipt and is often used to refer to receipts used as evidence of, for example, the declaration that a service has been performed or that an expenditure has been made. Voucher is a tourist guide for using services with a guarantee of payment by the agency. The term is also commonly used for school vouchers, which are somewhat different. In tourism Vouchers are used in the tourism sector primarily as proof of a named customer's right to take a service at a specific time and place. Service providers collect them to return to the tour operator or travel agent that has sent that customer, to prove they have given the service. So, the life of a voucher is as below: # Customer receives vouchers from tour operator or travel age ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

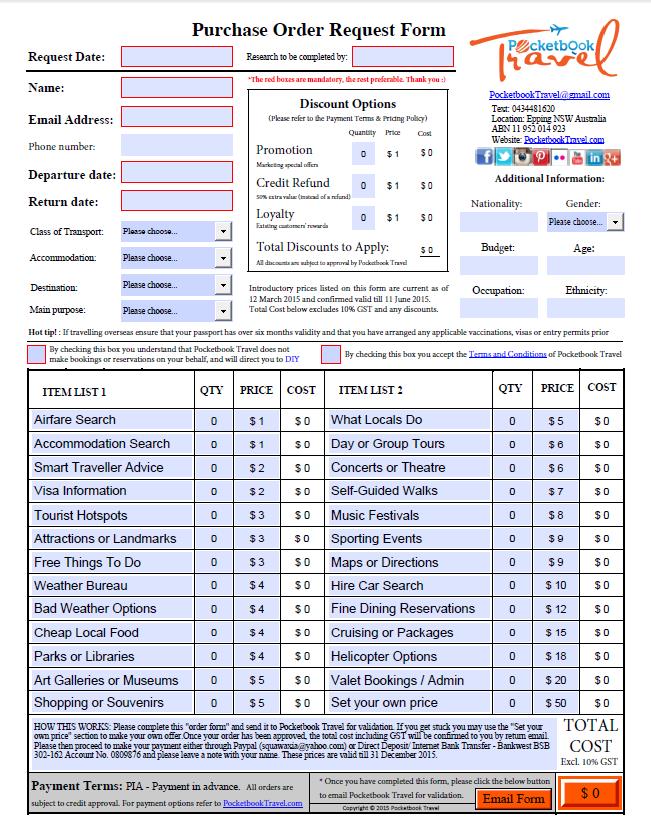

Purchase Order

A purchase order is a commercial document and first official offer issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders. An indent is a purchase order often placed through an agent (indent agent) under specified conditions of sale. The issue of a purchase order does not itself form a contract. If no prior contract exists, then it is the acceptance of the order by the seller that forms a contract between the buyer and seller. Overview Purchase orders allow buyers to clearly and openly communicate with the sellers to maintain transparency. They may also help a purchasing agent to manage incoming orders and pending orders. Sellers are also protected by the use of purchase orders, in case of a buyer's refusal to pay for goods or services. Purchase order ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a " resale certificate" by the taxing authority and required to provide the certificate (or its ID number) to a seller at the point of purchas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Business Number

The Australian Business Number (ABN) is a unique 11-digit identifier issued by the Australian Business Register (ABR) which is operated by the Australian Taxation Office (ATO). The ABN was introduced on 1 July 2000 by John Howard's Liberal government as part of a major tax reform, which included the introduction of a GST. The law requires each entity that carries on a business in Australia has an ABN and that the ABN appear on each tax invoice and other tax related documents issued by the entity. Australian Business Register The Australian Business Register (ABR) is maintained by the Registrar of the ABR, who is also the Commissioner of Taxation. The Registrar registers entities, issuing them with an ABN, while the Commissioner of Taxation issues the entity a tax file number. Entitlement to an ABN The Registrar issues ABNs only to entities that are entitled to an ABN, which can be: * an individual, * a body corporate, * a corporation sole, * a body politic, * a partnership, * a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payment

A payment is the voluntary tender of money or its equivalent or of things of value by one party (such as a person or company) to another in exchange for goods, or services provided by them, or to fulfill a legal obligation. The party making the payment is commonly called the payer, while the payee is the party receiving the payment. Payments can be effected in a number of ways, for example: * the use of money, cheque, or debit, credit, or bank transfers, whether through mobile payment or otherwise * the transfer of anything of value, such as stock, or using barter, the exchange of one good or service for another. In general, payees are at liberty to determine what method of payment they will accept; though normally laws require the payer to accept the country's legal tender up to a prescribed limit. Payment is most commonly effected in the local currency of the payee unless the parties agree otherwise. Payment in another currency involves an additional foreign exchange tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Buyer

Procurement is the method of discovering and agreeing to terms and purchasing goods, services, or other works from an external source, often with the use of a tendering or competitive bidding process. When a government agency buys goods or services through this practice, it is referred to as public procurement. Procurement as an organizational process is intended to ensure that the buyer receives goods, services, or works at the best possible price when aspects such as quality, quantity, time, and location are compared. Corporations and public bodies often define processes intended to promote fair and open competition for their business while minimizing risks such as exposure to fraud and collusion. Almost all purchasing decisions include factors such as delivery and handling, marginal benefit, and fluctuations in the prices of goods. Organisations which have adopted a corporate social responsibility perspective are also likely to require their purchasing activity to take wider ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound Sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$)) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance - i.e. legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term "c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax Identification Number

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. It confirms that the number is currently allocated and can provide the name or other identifying details of the entity to whom the identifier has been allocated. However, many national governments will not give out VAT identification numbers due to data protection laws. The full identifier starts with an ISO 3166-1 alpha-2 (2 letters) country code (except for Greece, which uses the ISO 639-1 language code ''EL'' for the Greek language, instead of its ISO 3166-1 alpha-2 country code ''GR'', and Northern Ireland, which uses the code ''XI'' when trading with the EU) and then has between 2 and 13 characters. The identifiers are composed of numeric digits in most countries, but in some countries th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |