|

Income Tax In The United Kingdom

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government (HM Revenue & Customs), devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion. History A uniform Land tax, originally was introduced in England during the late 17th century, formed the main source of government revenue throughout the 18th century and the early 19th century. Stephen Dowell, ''History of Taxation and Taxes in England'' (Routledg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of The United Kingdom

ga, Rialtas a Shoilse gd, Riaghaltas a Mhòrachd , image = HM Government logo.svg , image_size = 220px , image2 = Royal Coat of Arms of the United Kingdom (HM Government).svg , image_size2 = 180px , caption = Royal Arms , date_established = , state = United Kingdom , address = 10 Downing Street, London , leader_title = Prime Minister ( Rishi Sunak) , appointed = Monarch of the United Kingdom ( Charles III) , budget = 882 billion , main_organ = Cabinet of the United Kingdom , ministries = 23 ministerial departments, 20 non-ministerial departments , responsible = Parliament of the United Kingdom , url = The Government of the United Kingdom (commonly referred to as British Government or UK Government), officially His Majesty's Government (abbreviated to HM Government), is the central executive authority of the United Kingdom of Great Britain and Northern Ireland. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kingdom Of Great Britain

The Kingdom of Great Britain (officially Great Britain) was a sovereign country in Western Europe from 1 May 1707 to the end of 31 December 1800. The state was created by the 1706 Treaty of Union and ratified by the Acts of Union 1707, which united the kingdoms of England (which included Wales) and Scotland to form a single kingdom encompassing the whole island of Great Britain and its outlying islands, with the exception of the Isle of Man and the Channel Islands. The unitary state was governed by a single parliament at the Palace of Westminster, but distinct legal systems – English law and Scots law – remained in use. The formerly separate kingdoms had been in personal union since the 1603 " Union of the Crowns" when James VI of Scotland became King of England and King of Ireland. Since James's reign, who had been the first to refer to himself as "king of Great Britain", a political union between the two mainland British kingdoms had been repeatedly at ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax Act 1842

The Income Tax Act 1842The citation of this Act by this short title was authorised by the Short Titles Act 1896, section 1 and the first schedule. Due to the repeal of those provisions it is now authorised by section 19(2) of the Interpretation Act 1978. (citation 5 & 6 Vict c. 35) was an Act of the Parliament of the United Kingdom, passed under the government of Robert Peel, which re-introduced an income tax in Britain, at the rate of 7 pence (2.9%, there then being 240 pence in the pound) in the pound on all annual incomes greater than £150. It was the first imposition of income tax in Britain outside of wartime. Although promoted as a temporary measure, income tax has been levied continually in Britain ever since. In its detail, the Act of 1842 was substantially similar to the Income Tax Act 1803 introduced by Henry Addington during the Napoleonic Wars The Napoleonic Wars (1803–1815) were a series of major global conflicts pitting the French Empire and its allies, l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert Peel

Sir Robert Peel, 2nd Baronet, (5 February 1788 – 2 July 1850) was a British Conservative statesman who served twice as Prime Minister of the United Kingdom (1834–1835 and 1841–1846) simultaneously serving as Chancellor of the Exchequer (1834–1835) and twice as Home Secretary (1822–1827 and 1828–1830). He is regarded as the father of modern British policing, owing to his founding of the Metropolitan Police Service. Peel was one of the founders of the modern Conservative Party. The son of a wealthy textile manufacturer and politician, Peel was the first prime minister from an industrial business background. He earned a double first in classics and mathematics from Christ Church, Oxford. He entered the House of Commons in 1809, and became a rising star in the Tory Party. Peel entered the Cabinet as Home Secretary (1822–1827), where he reformed and liberalised the criminal law and created the modern police force, leading to a new type of officer known in tribut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Window Tax

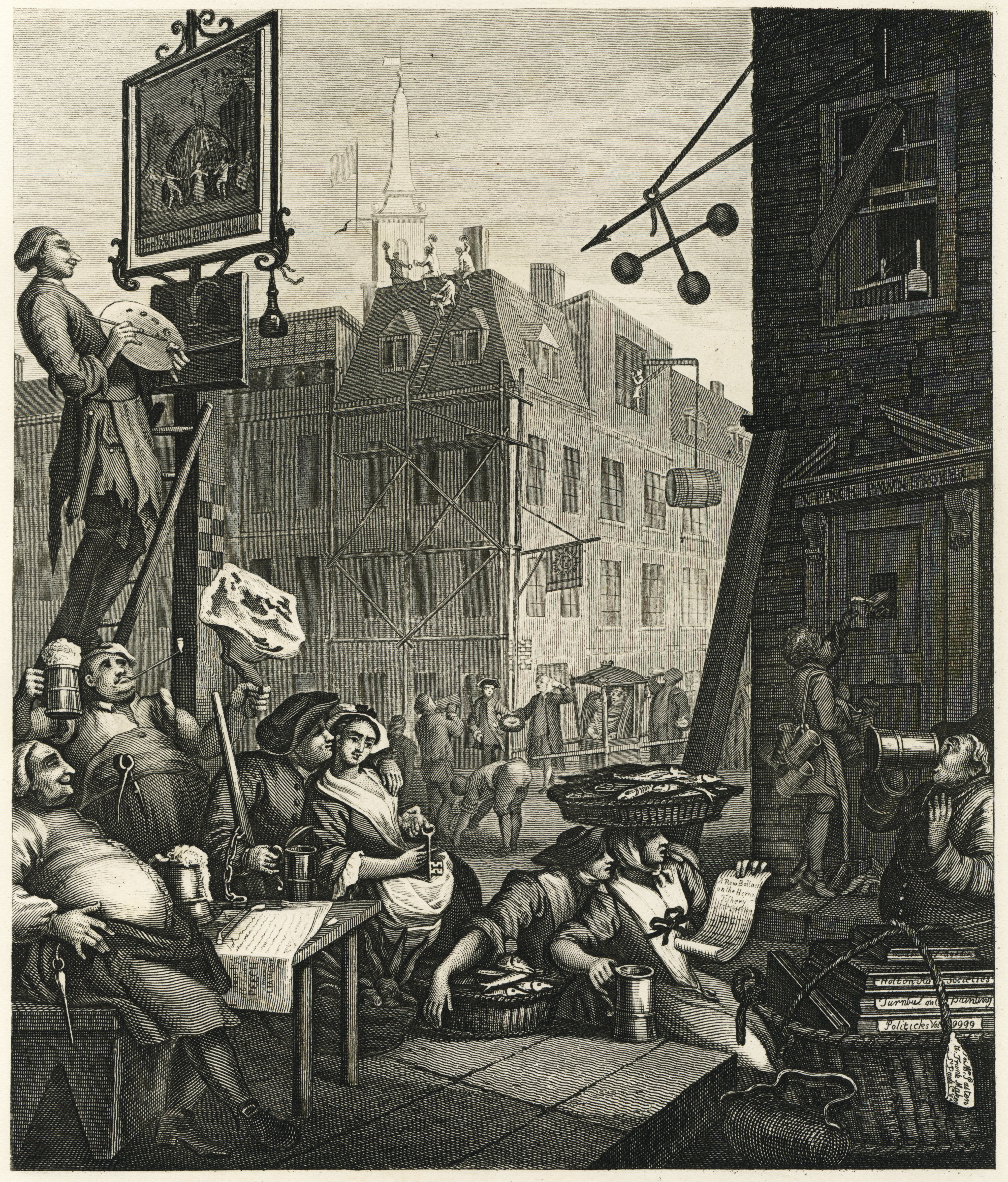

Window tax was a property tax based on the number of windows in a house. It was a significant social, cultural, and architectural force in England, France, and Ireland during the 18th and 19th centuries. To avoid the tax, some houses from the period can be seen to have bricked-up window-spaces (ready to be glazed or reglazed at a later date). In England and Wales it was introduced in 1696 and was repealed 155 years later, in 1851. In France it was established in 1798 and was repealed in 1926. Scotland had window tax from 1748 until 1798. History The tax was introduced in England and Wales in 1696 under King William III and was designed to impose tax relative to the prosperity of the taxpayer, but without the controversy that then surrounded the idea of income tax. At that time, many people in Britain opposed income tax, on principle, because the disclosure of personal income represented an unacceptable governmental intrusion into private matters, and a potential threat to per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Malt Tax

A malt tax is a tax upon the making or sale of Malted grain, which has been prepared using a process of steeping and drying to encourage germination and the conversion of its starch into sugars. Used in the production of beer and whisky for centuries, it is also an ingredient in modern foods. Background Until the late 19th century, lack of access to clean drinking water meant particularly in urban areas, it was often safer to drink so-called small beer. These had relatively low levels of alcohol and were routinely drunk throughout the day by both workers and children; in 1797, one educationalist suggested for '...more robust children, water is preferable, and for the weaker ones, small beer ...'. This meant malt was seen as an essential part of dietary health for the poor and taxing it caused widespread dissent. Taxation In England, malt was first taxed in 1644 by the Crown to help finance the English Civil War. Article 14 of the 1707 Acts of Union between England and Scotla ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Battle Of Waterloo

The Battle of Waterloo was fought on Sunday 18 June 1815, near Waterloo (at that time in the United Kingdom of the Netherlands, now in Belgium). A French army under the command of Napoleon was defeated by two of the armies of the Seventh Coalition. One of these was a British-led coalition consisting of units from the United Kingdom, the Netherlands, Hanover, Brunswick, and Nassau, under the command of the Duke of Wellington (referred to by many authors as ''the Anglo-allied army'' or ''Wellington's army''). The other was composed of three corps of the Prussian army under the command of Field Marshal von Blücher (the fourth corps of this army fought at the Battle of Wavre on the same day). The battle marked the end of the Napoleonic Wars. The battle was contemporaneously known as the Battle of Mont Saint-Jean (France) or La Belle Alliance ("the Beautiful Alliance" – Prussia). Upon Napoleon's return to power in March 1815, many states that had previously opposed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peace Of Amiens

The Treaty of Amiens (french: la paix d'Amiens, ) temporarily ended hostilities between France and the United Kingdom at the end of the War of the Second Coalition. It marked the end of the French Revolutionary Wars; after a short peace it set the stage for the Napoleonic Wars. Britain gave up most of its recent conquests; France was to evacuate Naples and Egypt. Britain retained Ceylon (Sri Lanka) and Trinidad. It was signed in the city of Amiens on 25 March 1802 (4 Germinal X in the French Revolutionary calendar) by Joseph Bonaparte and Marquess Cornwallis as a "Definitive Treaty of Peace". The consequent peace lasted only one year (18 May 1803) and was the only period of general peace in Europe between 1793 and 1814. Under the treaty, Britain recognised the French Republic. Together with the Treaty of Lunéville (1801), the Treaty of Amiens marked the end of the Second Coalition, which had waged war against Revolutionary France since 1798. National goals Great Brit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Addington

Henry Addington, 1st Viscount Sidmouth, (30 May 175715 February 1844) was an English Tory statesman who served as Prime Minister of the United Kingdom from 1801 to 1804. Addington is best known for obtaining the Treaty of Amiens in 1802, an unfavourable peace with Napoleonic France which marked the end of the Second Coalition during the French Revolutionary Wars. When that treaty broke down he resumed the war, but he was without allies and conducted relatively weak defensive hostilities, ahead of what would become the War of the Third Coalition. He was forced from office in favour of William Pitt the Younger, who had preceded Addington as Prime Minister. Addington is also known for his reactionary crackdown on advocates of democratic reforms during a ten-year spell as Home Secretary from 1812 to 1822. He is the longest continuously serving holder of that office since it was created in 1782. Family Henry Addington was the son of Anthony Addington, Pitt the Elder's physicia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shilling

The shilling is a historical coin, and the name of a unit of modern currencies formerly used in the United Kingdom, Australia, New Zealand, other British Commonwealth countries and Ireland, where they were generally equivalent to 12 pence or one-twentieth of a pound before being phased out during the 20th century. Currently the shilling is used as a currency in five east African countries: Kenya, Tanzania, Uganda, Somalia, as well as the ''de facto'' country of Somaliland. The East African Community additionally plans to introduce an East African shilling. History The word ''shilling'' comes from Old English "Scilling", a monetary term meaning twentieth of a pound, from the Proto-Germanic root skiljaną meaning 'to separate, split, divide', from (s)kelH- meaning 'to cut, split.' The word "Scilling" is mentioned in the earliest recorded Germanic law codes, those of Æthelberht of Kent. There is evidence that it may alternatively be an early borrowing of Phoenic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (abbreviation: stg; Other spelling styles, such as STG and Stg, are also seen. ISO code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound ( sign: £) is the main unit of sterling, and the word "pound" is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency that is still in use and that has been in continuous use since its inception. It is currently the fourth most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and Renminbi, it forms the basket of currencies which calculate the value of IMF special drawing rights. As of mid-2021, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Pence

The British pre-decimal penny was a denomination of sterling coinage worth of one pound or of one shilling. Its symbol was ''d'', from the Roman denarius. It was a continuation of the earlier English penny, and in Scotland it had the same monetary value as one pre-1707 Scottish shilling. The penny was originally minted in silver, but from the late 18th century it was minted in copper, and then after 1860 in bronze. The plural of "penny" is "pence" when referring to an amount of money, and "pennies" when referring to a number of coins. Thus 8''d'' is eight pence, but "eight pennies" means specifically eight individual penny coins. Before Decimal Day in 1971, sterling used the Carolingian monetary system ( £sd), under which the largest unit was a pound (£) divisible into 20 shillings (s), each of 12 pence (d). The penny was withdrawn in 1971 due to decimalisation, and replaced (in effect) by the decimal half new penny, with p being worth 1.2''d''. History The kingdo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)