|

Income Tax Audit

In the United States of America, an income tax audit is the examination of a business or individual tax return by the Internal Revenue Service (IRS) or state tax authority. The IRS and various state revenue departments use the terms audit, examination, review, and notice to describe various aspects of enforcement and administration of the tax laws. The IRS enforces the U.S. Federal tax law primarily through the examination of tax returns that have the highest potential for noncompliance. According to the IRS, " is identification is determined using risk-based scoring mechanisms, data driven algorithms, third party information, whistleblowers and information provided by the taxpayer. The objective of an examination is to determine if income, expenses and credits are being reported accurately." Audit process Selection process Generally, the IRS will contact a taxpayer who has been selected for audit by mail, rather than initiating an audit by phone call or in person. Providi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certified Public Accountant

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. It is generally equivalent to the title of chartered accountant in other English-speaking countries. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, all states except Hawaii have passed mobility laws to allow CPAs from other states to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150 semester units of college education, and one year of accounting-related experience. Continuing professional education (CPE) is also required to maintain licensure. Individuals who have been awarded the CPA but have lapsed in the fulfillment of the required CPE or who have requested conversion to inactive status are in many states permitt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contingent Workforce

Contingent work, casual work, or contract work, is an employment relationship with limited job security, payment on a piece work basis, typically part-time (typically with variable hours) that is considered non-permanent. Although there is less job security, freelancers often report incomes higher than their former traditional jobs. Contingent workers are also often called consultants, freelancers, independent contractors, independent professionals, temporary contract workers or temps. According to the US Bureau of Labor Statistics (BLS), the nontraditional workforce includes "multiple job holders, contingent and part-time workers, and people in alternative work arrangements". These workers currently represent a substantial portion of the US workforce, and "nearly four out of five employers, in establishments of all sizes and industries, use some form of nontraditional staffing". "People in alternative work arrangements" includes independent contractors, employees of contract ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Performance Bond

A performance bond, also known as a contract bond, is a surety bond issued by an insurance company or a bank to guarantee satisfactory completion of a project by a contractor. The term is also used to denote a collateral deposit of good faith money, intended to secure a futures contract, commonly known as margin. History Performance bonds have been around since 2,750 BC. The Romans developed laws of surety around 150 AD, the principles of which still exist. Overview A job requiring a payment and performance bond will usually require a bid bond, to bid the job. When the job is awarded to the winning bid, a payment and performance bond will then be required as a security to the job completion. For example, a contractor may cause a performance bond to be issued in favour of a client for whom the contractor is constructing a building. If the contractor fails to construct the building according to the specifications laid out by the contract (most often due to the bankruptcy of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax In The United States

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return. Some corporate transactions are not taxable. These include most formations and some types of mergers, acquisition ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll Taxes In The United States

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the employer, but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction, and falls largely or entirely on workers in the form of lower wages. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education. National payroll tax systems Australia The Australian federal government ( ATO) requires withholding tax on employment income (payroll taxes of the first type), under a system known as pay-as-you-go (PAYG). The individual states impose payroll taxes of the second type. Bermuda In Bermuda, payroll tax accounts for over a third of the annual national b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion In The United States

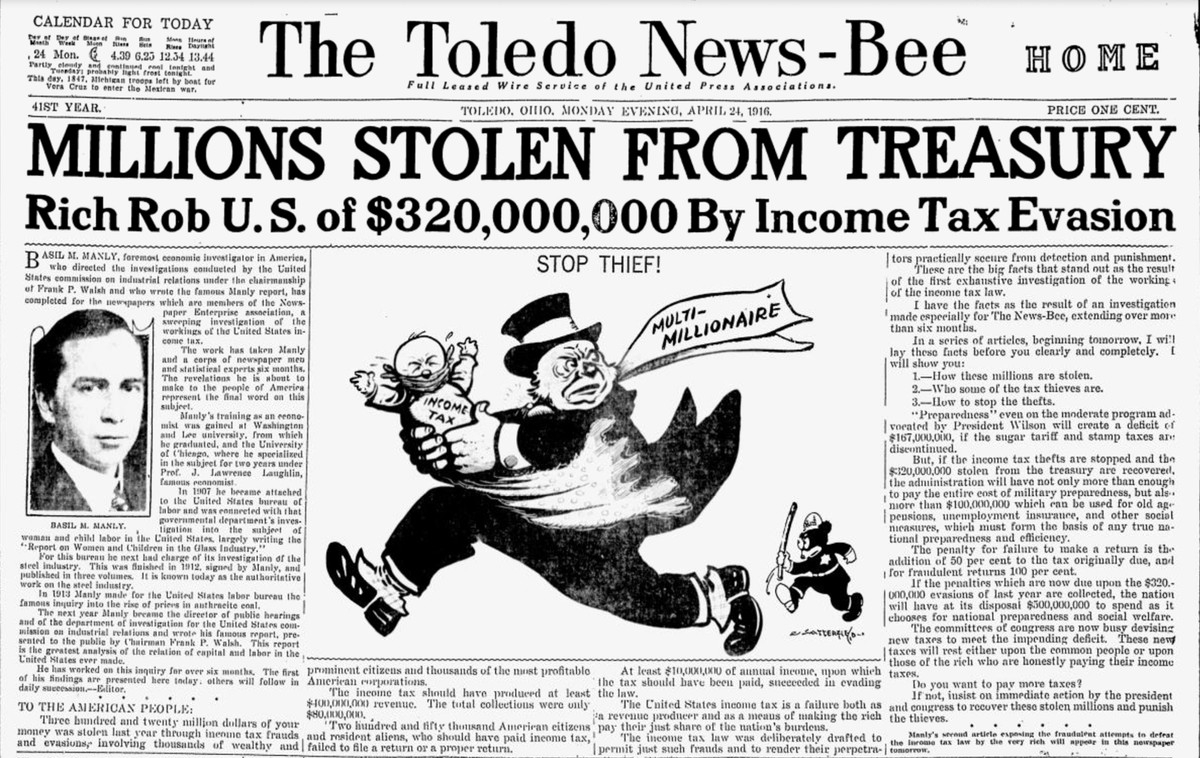

Under the federal law of the United States of America, tax evasion or tax fraud, is the purposeful illegal attempt of a taxpayer to evade assessment or payment of a tax imposed by Federal law. Conviction of tax evasion may result in fines and imprisonment. Compared to other countries, Americans are more likely to pay their taxes on time and law-abidingly. Tax evasion is separate from tax avoidance, which is the legal utilization of the tax regime to one's own advantage in order to reduce the amount of tax that is payable by means that are within the law. For example, a person can legally avoid some taxes by refusing to earn more taxable income, or by buying fewer things subject to sales taxes. Tax evasion is illegal, while tax avoidance is legal. In '' Gregory v. Helvering'' the US Supreme Court concurred with Judge Learned Hand's statement that: "Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will bes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can be said to be "taxed" at a high rate, compared to other forms of personal expenditure which are formally recognized as investments. Taxes are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Attorneys In The United States

An attorney at law (or attorney-at-law) in the United States is a practitioner in a court of law who is legally qualified to prosecute and defend actions in court on the retainer of clients. Alternative terms include counselor (or counsellor-at-law) and lawyer. As of April 2011, there were 1,225,452 licensed attorneys in the United States. A 2012 survey conducted by LexisNexis Martindale-Hubbell determined 58 million consumers in the U.S. sought an attorney in the last year and that 76 percent of consumers used the Internet to search for an attorney. The United States legal system does not draw a distinction between lawyers who plead in court and those who do not, unlike many other common law jurisdictions. For example, jurisdictions in the United Kingdom distinguish between solicitors who do not plead in court, and the barristers of the English and Welsh system and the Northern Ireland system and the advocates of the Scottish system, who do plead in court. Likewise, civ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure provided over a fifth of the Union's war expenses before being allowed to expire a decade later. In 1913, the Sixteenth Amendment to the U.S. Constitut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |