|

Investment Rating For Real Estate

An investment rating of a real estate property measures the property's risk-adjusted returns, relative to a completely risk-free asset. Mathematically, a property's investment rating is the return a risk-free asset would have to yield to be termed as good an investment as the property whose rating is being calculated. The underlying drivers for property ratings are the dividends (net operating income) and capital gains over a certain holding period, and their associated risks or variances. Similar to other financial ratings developed for mutual funds and stocks, it can be assumed that investors have constant relative risk aversion over the wealth derived from other sources and from their investments. For simplicity, it can also be assumed that the investment return is not correlated with other sources of wealth but represents 100% of the investor's wealth. A property's investment rating is then a transformation of the risk-adjusted averaged return to a single number that conveys t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Price

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services. In some situations, especially when the product is a service rather than a physical good, the price for the service may be called something else such as "rent" or "tuition". Prices are influenced by production costs, supply of the desired product, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted in currency, quantities of goods or vouchers. * In modern economies, prices are generally expressed in units of some form of currency. (More specifically, for raw materials they are expressed as currency per unit weight, e.g. euros per kilogram or Rands per KG.) * Although prices could be quoted as quantities of other goods or services, this sort of barter exchange is rarely seen. Prices are sometimes quoted in terms of vouch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Case–Shiller Index

The Standard & Poor's CoreLogic Case–Shiller Home Price Indices are repeat-sales house price index, house price indices for the United States. There are multiple Case–Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area indices. These indices were first produced commercially by Case Shiller Weiss. They are now calculated and kept monthly by Standard & Poor's, with data calculated for January 1987 to present. The indices kept by Standard & Poor are normalized to a value of 100 in January 2000. They are based on original work by economists Karl E. Case, Karl Case and Robert J. Shiller, Robert Shiller, whose team calculated the home price index back to 1890. Case and Shiller's index is normalized to a value of 100 in 1890. The Case-Shiller index on Shiller's website is updated quarterly. The two datasets can greatly differ due to different reference points and calculations. For example ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Crystal Ball

A crystal ball is a crystal or glass ball commonly used in fortune-telling. It is generally associated with the performance of clairvoyance and scrying through crystal gazing. Used since Antiquity, crystal balls have had a broad reputation with witchcraft, including modern times with charlatan acts and amusements at circus venues, festivals, etc. Other names for the object include crystal sphere, orbuculum, scrying ball, shew/show(ing) stone, and more variants by dialect. History By the fifth century AD, scrying using crystal balls was widespread within the Roman Empire and was condemned by the early Christian Church as heretical (magic had been condemned since the Apostolic Era with e.g. Chapter 2 of the Didache). The tomb of Childeric I, a fifth-century king of the Franks, contained a 3.8 cm (1½ inch) diameter transparent beryl globe. The object is similar to other globes that were later found in tombs from the Merovingian period in Gaul and the Saxon period in En ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home Insurance

Home insurance, also commonly called homeowner's insurance (often abbreviated in the US real estate industry as HOI), is a type of property insurance that covers a private residence. It is an insurance policy that combines various personal insurance protections, which can include losses occurring to one's home, its contents, loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory. Additionally, homeowner's insurance provides financial protection against disasters. A standard home insurance policy covers the home and the belongings inside it. Overview Homeowner's policy is a multiple-line insurance policy, meaning that it includes both property insurance and liability coverage, with an indivisible premium, meaning that a single premium is paid for all risks. This means that it covers damage to one's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Management

Property management is the operation, control, maintenance, and oversight of real estate and physical property. This can include residential, commercial, and land real estate. Management indicates the need for real estate to be cared for and monitored, with accountability for and attention to its useful life and condition. This is much akin to the role of management in any business. Property management is the administration of personal property, equipment, tooling, and physical capital assets acquired and used to build, repair, and maintain end-item deliverables. Property management involves the processes, systems, and workforce required to manage the life cycle of all acquired property as defined above, including acquisition, control, accountability, responsibility, maintenance, utilization, and disposition. An owner of a single-family home, condominium, or multi-family building may engage the services of a professional property management company. The company will then adver ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Tax

A property tax (whose rate is expressed as a percentage or per mille, also called ''millage'') is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or Wealth tax, net wealth, taxes on the change of ownership of property through Inheritance tax, inheritance or Gift tax, gift and Financial transaction tax, taxes on financial and capital transactions" (see: ), but this article only covers taxes on realty. The tax is levied by the governing authority of the jurisdiction in which the property is located. This can be a national government, a federated state, a county or other Region, geographical region, or a Local government, municipality. Multiple jurisdictions may tax the same property. Often a property tax is levied on real estate. It may be imposed annually or at the time of a real estate transaction, such as in real estate transfer tax. This tax can be contrasted with a rent tax, which is based ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair Market Value

The fair market value of property is the price at which it would change hands between a willing and informed buyer and seller. The term is used throughout the Internal Revenue Code, as well as in bankruptcy laws, in many state laws, and by several regulatory bodies. In litigation in many jurisdictions in the United States the fair market value is determined at a hearing. In certain jurisdictions, the courts are required to hold fair market hearings, even if the borrowers or the loans guarantors waived their rights to such a hearing in the loan documents. FMV is often used for taxation purposes, determining the value of charitable donations, estate planning, and other financial transactions. The specific methods used to determine FMV may vary depending on the type of property or asset involved. Fair market value is subjective and can fluctuate based on market conditions, supply and demand, location, and other factors. Definition United States The fair market value is the pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money. *Cash flow, in its narrow sense, is a payment (in a currency), especially from one central bank account to another. The term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain, and therefore need to be forecast with cash flows. *A cash flow is determined by its time , nominal amount , currency , and account ; symbolically, . Cash flows are narrowly interconnected with the concepts of value, interest rate, and liquidity. A cash flow that shall happen on a future day can be transformed into a cash flow of the same value in . This transformation process is known as discounting, and it takes into account the time value of money by adjusting the nominal amount of the cash flow based on the prevailing interest rates at the time. Cash flow analy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Earnings Before Interest And Taxes

In accounting and finance, earnings before interest and taxes (EBIT) is a measure of a firm's profit that includes all incomes and expenses (operating and non-operating) except interest expenses and income tax expenses. Operating income and operating profit are sometimes used as a synonym for EBIT when a firm does not have non-operating income and non-operating expenses. Formula *EBIT = (net income) + interest + taxes = EBITDA – (depreciation and amortization expenses) *operating income = (gross income) – OPEX = EBIT – (non-operating profit) + (non-operating expenses) where *EBITDA = earnings before interest, taxes, depreciation, and amortization *OPEX = operating expense Overview A professional investor contemplating a change to the capital structure of a firm (e.g., through a leveraged buyout) first evaluates a firm's fundamental earnings potential (reflected by earnings before interest, taxes, depreciation and amortization (EBITDA) and EBIT), and then determines the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Investment

Real estate investing involves purchasing, owning, managing, renting, or selling real estate to generate profit or long-term wealth. A real estate investor or entrepreneur may participate actively or passively in real estate transactions. The primary goal of real estate investing is to increase value or generate a profit through strategic decision-making and market analysis. Investors analyze real estate projects by identifying property types, as each type requires a unique investment strategy. Valuation is a critical factor in assessing real estate investments, as it determines a property’s true worth, guiding investors in purchases, sales, financing, and risk management. Accurate valuation helps investors avoid overpaying for assets, maximize returns, and minimize financial risk. Additionally, proper valuation plays a crucial role in securing financing, as lenders use valuations to determine loan amounts and interest rates. Financing is fundamental to real estate investing, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

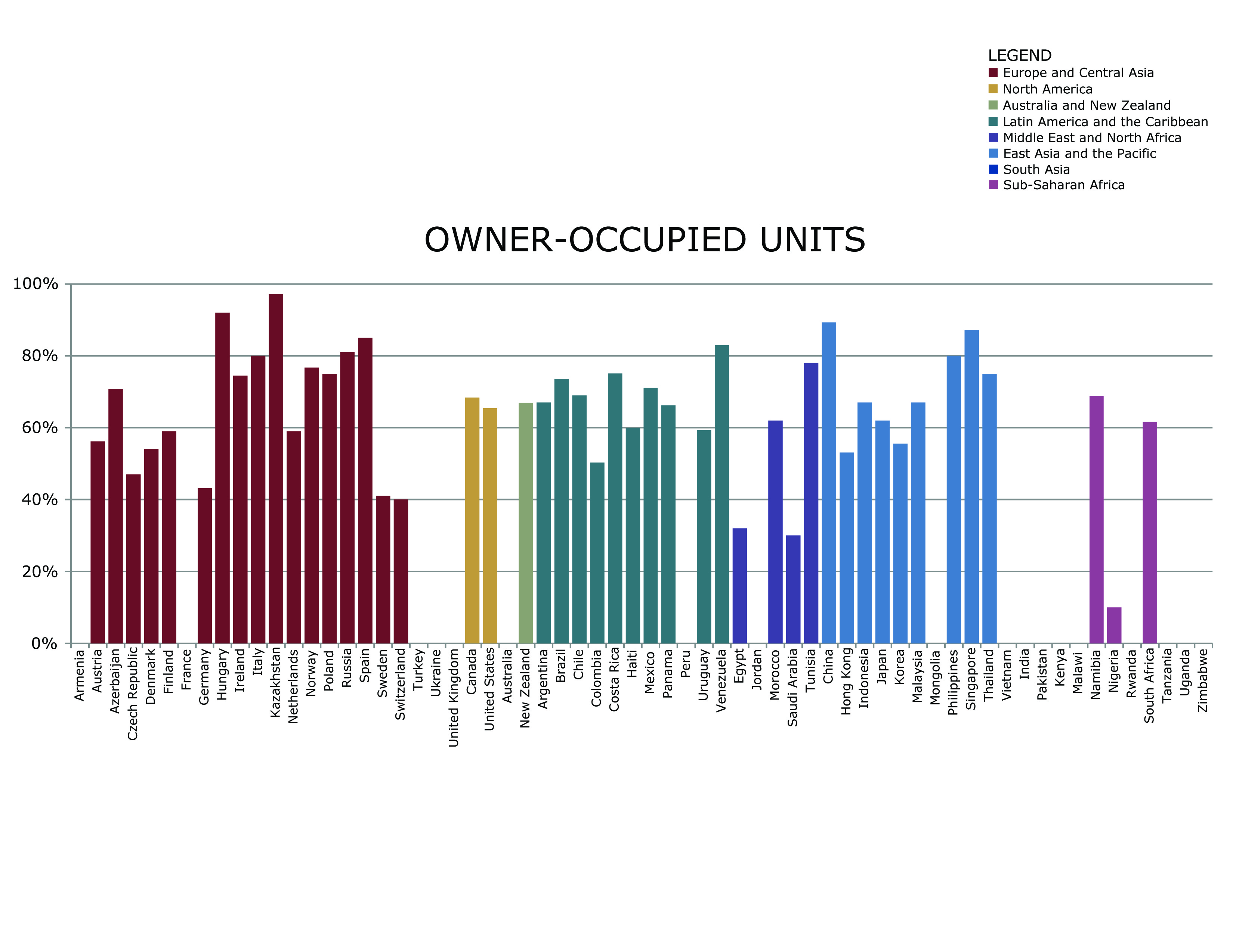

Owner-occupier

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the homeowner fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |