|

Indirect Tax

An indirect tax (such as a sales tax, per unit tax, value-added tax (VAT), excise tax, consumption tax, or tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., the effect and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect. An indirect tax is collected by an intermediary (such as a retail store) from the person (such as the consumer) who pays the tax included in the price of a purchased good. The intermediary later files a tax return and forwards the tax proceeds to government with the return. In this sense, the term indirect tax is contrasted with a direct tax, which is collected directly by government from the persons (legal or natural) on whom it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Tax

A sales tax is a tax paid to a governing body for the sales of certain goods and services. Usually laws allow the seller to collect funds for the tax from the consumer at the point of purchase. When a tax on goods or services is paid to a governing body directly by a consumer, it is usually called a use tax. Often laws provide for the Tax exemption, exemption of certain goods or services from sales and use tax, such as food, education, and medicines. A value-added tax (VAT) collected on goods and services is related to a sales tax. See Value-added tax#Comparison with sales tax, Comparison with sales tax for key differences. Types Conventional or retail sales tax is levied on the sale of a good to its final good, final end-user and is charged every time that item is sold retail. Sales to businesses that later resell the goods are not charged the tax. A purchaser who is not an end-user is usually issued a "resale certificate" by the taxing authority and required to provide the cer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Incidence

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom the tax is initially imposed. The tax burden measures the true economic effect of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, and taking into account how the tax causes prices to change. For example, if a 10% tax is imposed on sellers of butter, but the market price rises 8% as a result, most of the tax burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 191 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate economic stability, stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and poverty reduction, reduce poverty around the world." Established in July 1944 at the Bretton Woods Conference, primarily according to the ideas of Harry Dexter White and John Maynard Keynes, it started with 29 member countries and the goal of reconstructing the international monetary systems, international monetary system after World War II. In its early years, the IMF primarily focused on facilitating fixed exchange rates across the developed worl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Tax In The United States

Excise tax in the United States is an indirect tax on listed items. Excise taxes can be and are made by federal, state, and local governments and are not uniform throughout the United States. Certain goods, such as gasoline, diesel fuel, alcohol, and tobacco products, are taxed by multiple governments simultaneously. Some excise taxes are collected from the producer or retailer and not paid directly by the consumer, and as such, often remain "hidden" in the price of a product or service rather than being listed separately. Federal excise taxes and revenues Federal excise taxes raised $86.8 billion in fiscal year 2020 or 2.5% of total federal tax revenue. These data come from Tables 2.1 through 2.4. Fuel Federal excise taxes have been stable at 18.4¢ per gallon for gasoline and 24.4¢ per gallon for diesel fuel since 1993. This raised $37.4 billion in fiscal year 2015. These fuel taxes raised 90% of the Highway Trust Fund. The average of state taxes on fuel was 31.02¢ per ga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Constitutional Law

The constitutional law of the United States is the body of law governing the interpretation and implementation of the United States Constitution. The subject concerns the scope of power of the United States federal government compared to the individual states and the fundamental rights of individuals. The ultimate authority upon the interpretation of the Constitution and the constitutionality of statutes, state and federal, lies with the Supreme Court of the United States. The Supreme Court Judicial review Early in its history, in ''Marbury v. Madison'' (1803) and ''Fletcher v. Peck'' (1810), the Supreme Court of the United States declared that the judicial power granted to it by Article III of the United States Constitution included the power of judicial review, to consider challenges to the constitutionality of a State or Federal law. The holding in these cases empowered the Supreme Court to strike down enacted laws that were contrary to the Constitution. In this role, for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Income Taxes

A corporate tax, also called corporation tax or company tax or corporate income tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax. The purpose of corporate tax is to generate revenue for the government by taxing the profits earned by corporations. The tax rate varies from country to country and is usually calculated as a percentage of the corporation's net income or capital. Corporate tax rates may also differ for domestic and foreign corporations. Some countries have tax laws that require corporations to pay taxes on their worldwide income, regardless of where the income is earned. However, most countries have territorial tax systems, which only require corporations to pay taxes on income earned withi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Personal Income Tax

In economics, personal income refers to the total earnings of an individual from various sources such as wages, investment ventures, and other sources of income. It encompasses all the products and money received by an individual. Personal income can be defined in different ways: * It refers to the income received by individuals or households in a country from all sources during a specific year. * It includes earned income or transferred income received by households within the country or even from outside sources. * It represents the total capital an individual receives from various sources over a certain period or throughout their life. Personal income encompasses various forms of income beyond just wages. It can include dividends, transfers, pension payments, government benefits, and rental income, among others. Taxes charged to an individual are typically not deducted when calculating personal income. Personal income serves as an indicator of the real well-being of people and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ad Valorem Tax

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ''ad valorem'' tax may also be imposed annually, as in the case of a real or personal property tax, or in connection with another significant event (e.g. inheritance tax, expatriation tax, or tariff). In some countries, a stamp duty is imposed as an ''ad valorem'' tax. Operation All ad valorem taxes are collected according to the determined value of the taxed item. In the most common application of ad valorem taxes, namely municipal property taxes, public tax assessors regularly assess the property owner's real estate in order to determine its current value. The determined value of the property is used to calculate the annual tax collected by the municipality or any other government entity upon the property owner. Ad valorem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Per Unit Tax

A per unit tax, or specific tax, is a tax that is defined as a fixed amount for each unit of a good or service sold, such as cents per kilogram. It is thus proportional to the particular quantity of a product sold, regardless of its price. Excise taxes, for instance, fall into this tax category. By contrast, an ad valorem An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of a property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). A ... tax is a charge based on a fixed percentage of the product value. Per unit taxes have administrative advantages when it is easy to measure quantities of the product or service being sold. Effect on supply curve Any tax will raise cost of production hence shift the supply curve to the left. In the case of specific tax, the shift will be purely parallel because the amount of tax is the same at all prices. That amou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value.Paul Krugman and Robin Wells Krugman, Robin Wells (2006). ''Economics'', New York, Worth Publishers. The first known use of the term by economists was in 1958,Francis M. Bator (1958). "The Anatomy of Market Failure," ''Quarterly Journal of Economics'', 72(3) pp351–379(press +). but the concept has been traced back to the Victorian writers John Stuart Mill and Henry Sidgwick.Steven G. Medema (2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure," ''History of Political Economy'', 39(3)pp. 331��358. 200Online Working Paper. Market failures are often associated with public goods, time-inconsistent preferences, Information asymmetry, information asymmetries, Market structure, failures of competition, principal–agent problems, externalities,Jean-Jacques L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

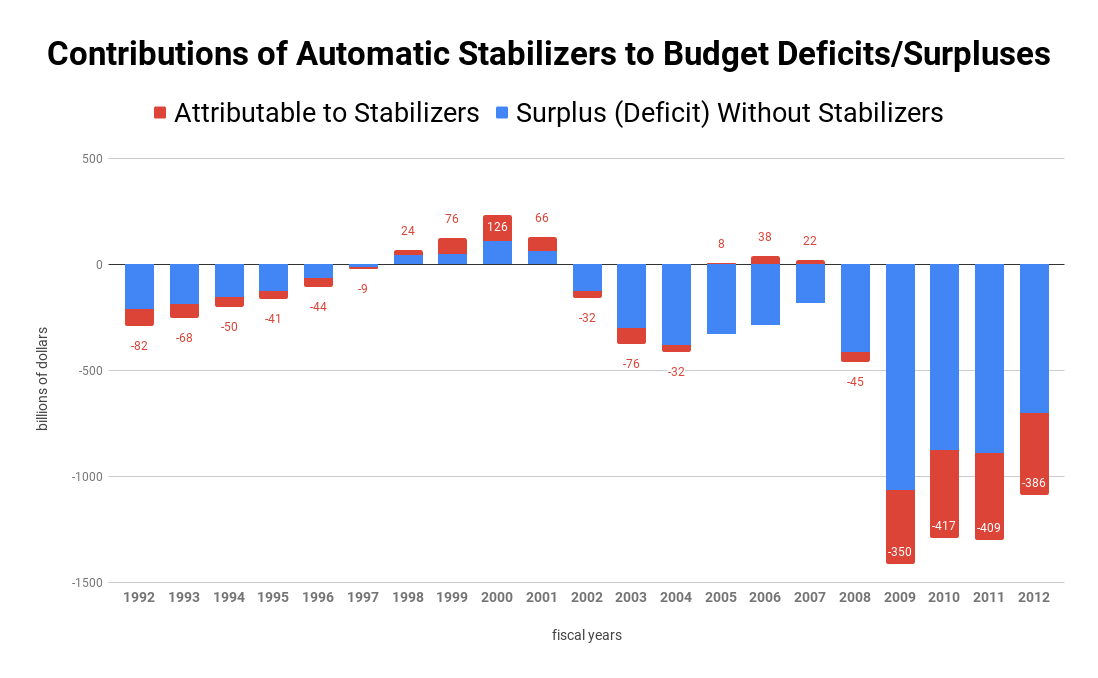

Automatic Stabilizer

In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and Welfare (financial aid), welfare spending, that act to damp out fluctuations in real GDP. The size of the government budget deficit tends to increase when a country enters a recession, which tends to keep national income higher by maintaining aggregate demand. There may also be a multiplier (economics), multiplier effect. This effect happens automatically depending on GDP and household income, without any explicit policy action by the government, and acts to reduce the severity of recessions. Similarly, the budget deficit tends to decrease during booms, which pulls back on aggregate demand. Therefore, automatic stabilizers tend to reduce the size of the fluctuations in a country's GDP. Induced taxes Tax revenues generally depend on household income and the pace of economic activity. Household incomes fall and the economy slows down during a recession, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |