|

Gemini (cryptocurrency Exchange)

Gemini Trust Company, LLC (Gemini) is an American cryptocurrency exchange and custodian bank. It was founded in 2014 by Cameron and Tyler Winklevoss. History Launch Tyler and Cameron Winklevoss announced Gemini in June 2013 and the company went live on October 25, 2015. Gemini began to facilitate the purchase and storage of Bitcoin through a complex system of private keys and password-protected environments. Gemini holds a Limited Purpose Trust Charter from the New York Department of Financial Services granted in October 2015. Gemini began adding to the financial services it offers thereafter, some of which include FIX and API support. On May 5, 2016, Governor Andrew Cuomo of New York State announced the approval of Gemini as the first licensed Ethereum exchange based in the United States. Additionally, in 2016, Gemini announced it would allow users to withdraw Ethereum Classic (ETC) from the exchange, following a hard fork in Ethereum's code. Development In October 2017 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cryptocurrency Exchange

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees. Some brokerages which also focus on other assets such as stocks, let users purchase but not withdraw cryptocurrencies to cryptocurrency wallets while dedicated cryptocurrency exchanges do allow cryptocurrency withdrawals. Operation A cryptocurrency exchange can typically send cryptocurrency to a user's personal cryptocurrency wallet. Some can convert digital currency balances into anonymous prepaid cards which can be used to withdraw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ethereum Classic

Ethereum Classic is a blockchain-based distributed computing platform that offers smart contract (scripting) functionality. It is open source and supports a modified version of Nakamoto consensus via transaction-based state transitions executed on a public Ethereum Virtual Machine (EVM). Ethereum Classic maintains the original, unaltered history of the Ethereum network. The Ethereum project's mainnet was initially released via Frontier on 30 July 2015. However, due to a hack of a third-party project, The DAO, the Ethereum Foundation created a new version of the Ethereum mainnet on 20 July 2016 with an ''irregular state change'' implemented that erased the DAO theft from the Ethereum blockchain history. The Ethereum Foundation applied their trademark to the new, altered version of the Ethereum blockchain. The older, unaltered version of Ethereum was renamed and continued on as Ethereum Classic. Ethereum Classic's native Ether token is a cryptocurrency traded on digital curre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Broker

An insurance broker is an intermediary who sells, solicits, or negotiates insurance on behalf of a client for compensation. An insurance broker is distinct from an insurance agent in that a broker typically acts on behalf of a client by negotiating with multiple insurers, while an agent represents one or more specific insurers under a contract. As of 2019, the largest insurance brokers in the world by revenue are Marsh & McLennan, Aon plc, Willis Towers Watson, Arthur J. Gallagher and Hub International. In Australia In Australia, all insurance brokers are required under the Financial Services Reform Act 2001 to be licensed by the federal government's Australian Securities and Investments Commission (ASIC). Reputable and experienced insurance brokers in Australia will generally also hold additional qualifications such as a certificate or diploma in financial services which requires the completion of in depth studies in a specific area, the most common being general insura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance In The United States

Insurance in the United States refers to the market for risk in the United States, the world's largest insurance market by premium volume. According to Swiss Re, of the $7.186 trillion of global direct premiums written worldwide in 2023, $3.226 trillion (44.9%) were written in the United States. Insurance, generally, is a contract in which the insurer agrees to compensate or indemnify another party (the insured, the policyholder or a beneficiary) for specified loss or damage to a specified thing (e.g., an item, property or life) from certain perils or risks in exchange for a fee (the insurance premium). For example, a property insurance company may agree to bear the risk that a particular piece of property (e.g., a car or a house) may suffer a specific type or types of damage or loss during a certain period of time in exchange for a fee from the policyholder who would otherwise be responsible for that damage or loss. That agreement takes the form of an insurance policy. His ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Dollar

The United States dollar (Currency symbol, symbol: Dollar sign, $; ISO 4217, currency code: USD) is the official currency of the United States and International use of the U.S. dollar, several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish dollar, Spanish silver dollar, divided it into 100 cent (currency), cents, and authorized the Mint (facility), minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The U.S. dollar was originally defined under a bimetallism, bimetallic standard of (0.7734375 troy ounces) fine silver or, from Coinage Act of 1834, 1834, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, its equivalence to gold was revised to $35 per troy ounce. In 1971 all links to gold were repealed. The U.S. dollar became an important intern ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency Peg

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold or silver. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stablecoin

A stablecoin is a type of cryptocurrency where the value of the digital asset is supposed to be pegged to a reference asset, which is either fiat money, exchange-traded commodities (such as precious metals or industrial metals), or another cryptocurrency. In theory, 1:1 backing by a reference asset could make a stablecoin value track the value of the peg and not be subject to the radical changes in value common in the market for many digital assets. In practice, stablecoin issuers have yet to be proven to maintain adequate reserves to support a stable value, and there have been a number of failures with investors losing the entirety of the (fiat currency) value of their holdings. Background Stablecoins have several purported purposes. They can be used for payments and are more likely to retain value than highly volatile cryptocurrencies. In practice, many stablecoins have failed to retain their "stable" value. Stablecoins are typically non-interest bearing and therefore do no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cryptocurrency

A cryptocurrency (colloquially crypto) is a digital currency designed to work through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. Individual coin ownership records are stored in a digital ledger or blockchain, which is a computerized database that uses a consensus mechanism to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. The two most common consensus mechanisms are proof of work and proof of stake. Despite the name, which has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdictions, including classification as commodities, securities, and currencies. Cryptocurrencies are generally viewed as a distinct asset class in practice. The first cryptocu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zcash

Zcash is a privacy-focused cryptocurrency based on Bitcoin's codebase. It shares many similarities, such as a fixed total supply of 21 million units. Transactions can be transparent, similar to bitcoin transactions, or they can be shielded transactions which use a type of zero-knowledge proof to provide anonymity in transactions. Zcash coins are either in a transparent pool or a shielded pool. Zcash offers private transactors the option of "selective disclosure," allowing users to prove payment for auditing purposes. One such reason is to make it easier for private transactors to comply with anti-money laundering laws and tax regulations. Use Zcash transactions can be transparent, similar to bitcoin transactions, in which case they are controlled by a "t-addr" or shielded and controlled by a "z-addr." A shielded transaction uses a type of zero-knowledge proof, specifically a non-interactive zero-knowledge proof, called "zk-SNARK," which provides anonymity to the coin hold ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Manipulation

In economics and finance, market manipulation occurs when someone intentionally alters the supply or demand of a security to influence its price. This can involve spreading misleading information, executing misleading trades, or manipulating quotes and prices. Market manipulation is prohibited in most countries, in particular, it is prohibited in the United States under Section 9(a)(2) of the Securities Exchange Act of 1934, in the European Union under Article 12 of the ''Market Abuse Regulation'', in Australia under Section 1041A of the Corporations Act 2001, and in Israel under Section 54(a) of the securities act of 1968. In the US, market manipulation is also prohibited for wholesale electricity markets under Section 222 of the Federal Power Act and wholesale natural gas markets under Section 4A of the Natural Gas Act. Examples Pools Agreements, often written, among a group of traders to delegate authority to a single manager to trade in a specific stock for a work per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

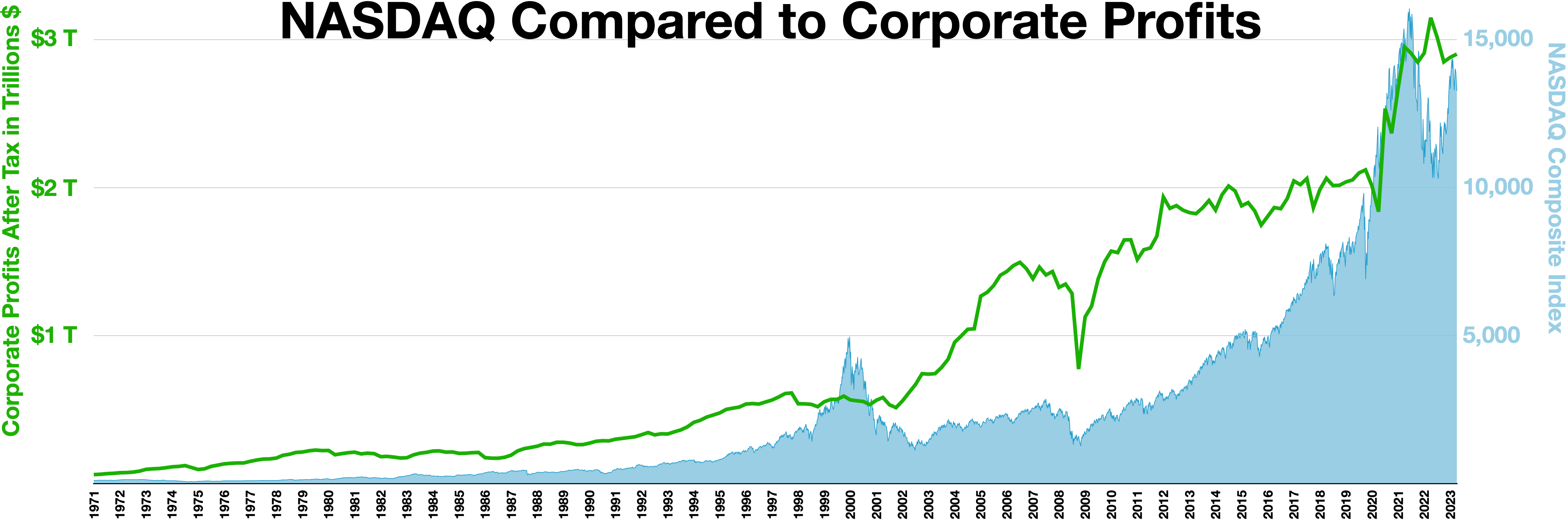

NASDAQ

The Nasdaq Stock Market (; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. The exchange platform is owned by Nasdaq, Inc. (which the exchange also lists; ticker symbol NDAQ), which also owns the Nasdaq Nordic stock market network and several U.S.-based stock and options exchanges. Although it trades stock of healthcare, financial, media, entertainment, retail, hospitality, and food businesses, it focuses more on technology stocks. The exchange is made up of both American and foreign firms, with China and Israel being the largest foreign sources. History 1972–2000 Nasdaq, Inc. was founded in 1971 by the National Association of Securities Dealers (NASD), which is now known as the Financial Industry Regulatory A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |