|

Discounted Cash Flow

The discounted cash flow (DCF) analysis is a method in finance of valuing a security, project, company, or asset using the concepts of the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management and patent valuation. It was used in industry as early as the 1700s or 1800s, widely discussed in financial economics in the 1960s, and became widely used in U.S. courts in the 1980s and 1990s. Application To apply the method, all future cash flows are estimated and discounted by using cost of capital to give their present values (PVs). The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question; see aside. For further context see valuation overview; and for the mechanics see valuation using discounted cash flows, which includes modifications typical for startups, private equity and venture cap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

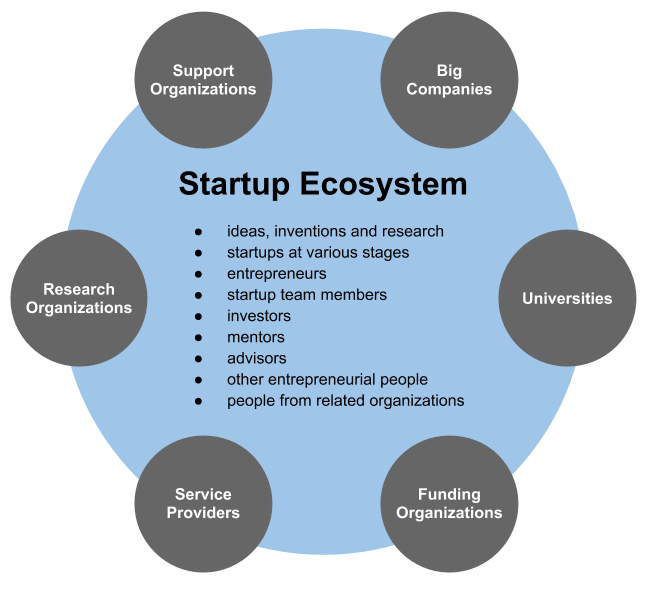

Startup

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Burr Williams

John Burr Williams (November 27, 1900 – September 15, 1989) was an American economist, recognized as an important figure in the field of fundamental analysis, and for his analysis of stock prices as reflecting their " intrinsic value". He is best known for his 1938 text ''The Theory of Investment Value'', based on his PhD thesis, in which he articulated the theory of discounted cash flow (DCF) based valuation, and in particular, dividend based valuation. Biography Williams studied mathematics and chemistry at Harvard University, and enrolled at Harvard Business School in 1923. After graduating, he worked as a security analyst, where he realised that "how to estimate the fair value was a puzzle indeed... To be a good investment analyst, one needs to be an expert economist also." In 1932 he enrolled at Harvard for a PhD in economics, with the hopes of learning what had caused the Wall Street Crash of 1929 and the subsequent economic depression of the 1930s. For his t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.Milton Friedman, ''Money Mischief: Episodes in Monetary History'', Houghton Mifflin Harcourt (1994) p. 37. Fisher made important contributions to utility theory and general equilibrium. He was also a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates. His research on the quantity theory of money inaugurated the school of macroeconomic thought known as "monetarism". Fisher was also a pioneer of econometrics, including the development of inde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Stock

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. "Share capital" may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). Commonly, the share capital is the total of the nominal share capital and the premium share capital. Most jurisdictions do not allow a company to issue shares below par value, but if permitted they are said to be issued at a discount or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wall Street Crash Of 1929

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed. It was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its aftereffects. The Great Crash is mostly associated with October 24, 1929, called ''Black Thursday'', the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called ''Black Tuesday'', when investors traded some 16 million shares on the New York Stock Exchange in a single day. The crash, which followed the London Stock Exchange's crash of September, signaled the beginning of the Great Depression. Background The "Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Amer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Otto Eduard Neugebauer

Otto Eduard Neugebauer (May 26, 1899 – February 19, 1990) was an Austrian-American mathematician and historian of science who became known for his research on the history of astronomy and the other exact sciences as they were practiced in antiquity and the Middle Ages. By studying clay tablets, he discovered that the ancient Babylonians knew much more about mathematics and astronomy than had been previously realized. The National Academy of Sciences has called Neugebauer "the most original and productive scholar of the history of the exact sciences, perhaps of the history of science, of our age." Career Neugebauer was born in Innsbruck, Austria. His father Rudolph Neugebauer was a railroad construction engineer and a collector and scholar of Oriental carpets. His parents died when he was quite young. During World War I, Neugebauer enlisted in the Austrian Army and served as an artillery lieutenant on the Italian front and then in an Italian prisoner-of-war camp alongside fe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Book Value

In accounting, book value is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made against the asset. Traditionally, a company's book value is its minus intangible assets and liabilities. However, in practice, depending on the source of the calculation, book value may variably include goodwill, intangible assets, or both.Graham and Dodd's ''Security Analysis'', Fifth Edition, pp 318 – 319 The value inherent in its workforce, part of the intellectual capital of a company, is always ignored. When intangible assets and goodwill are explicitly excluded, the metric is often specified to be ''tangible book value''. In the United Kingdom, the term net asset value may refer to the book value of a company. Asset book value An asset's initial book value is its actual cash value or its acquisition cost. Cash assets are recorded or "booked" at ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Babylonian Mathematics

Babylonian mathematics (also known as ''Assyro-Babylonian mathematics'') are the mathematics developed or practiced by the people of Mesopotamia, from the days of the early Sumerians to the centuries following the fall of Babylon in 539 BC. Babylonian mathematical texts are plentiful and well edited. With respect to time they fall in two distinct groups: one from the Old Babylonian period (1830–1531 BC), the other mainly Seleucid from the last three or four centuries BC. With respect to content, there is scarcely any difference between the two groups of texts. Babylonian mathematics remained constant, in character and content, for nearly two millennia. In contrast to the scarcity of sources in Egyptian mathematics, knowledge of Babylonian mathematics is derived from some 400 clay tablets unearthed since the 1850s. Written in Cuneiform script, tablets were inscribed while the clay was moist, and baked hard in an oven or by the heat of the sun. The majority of recovered clay tab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

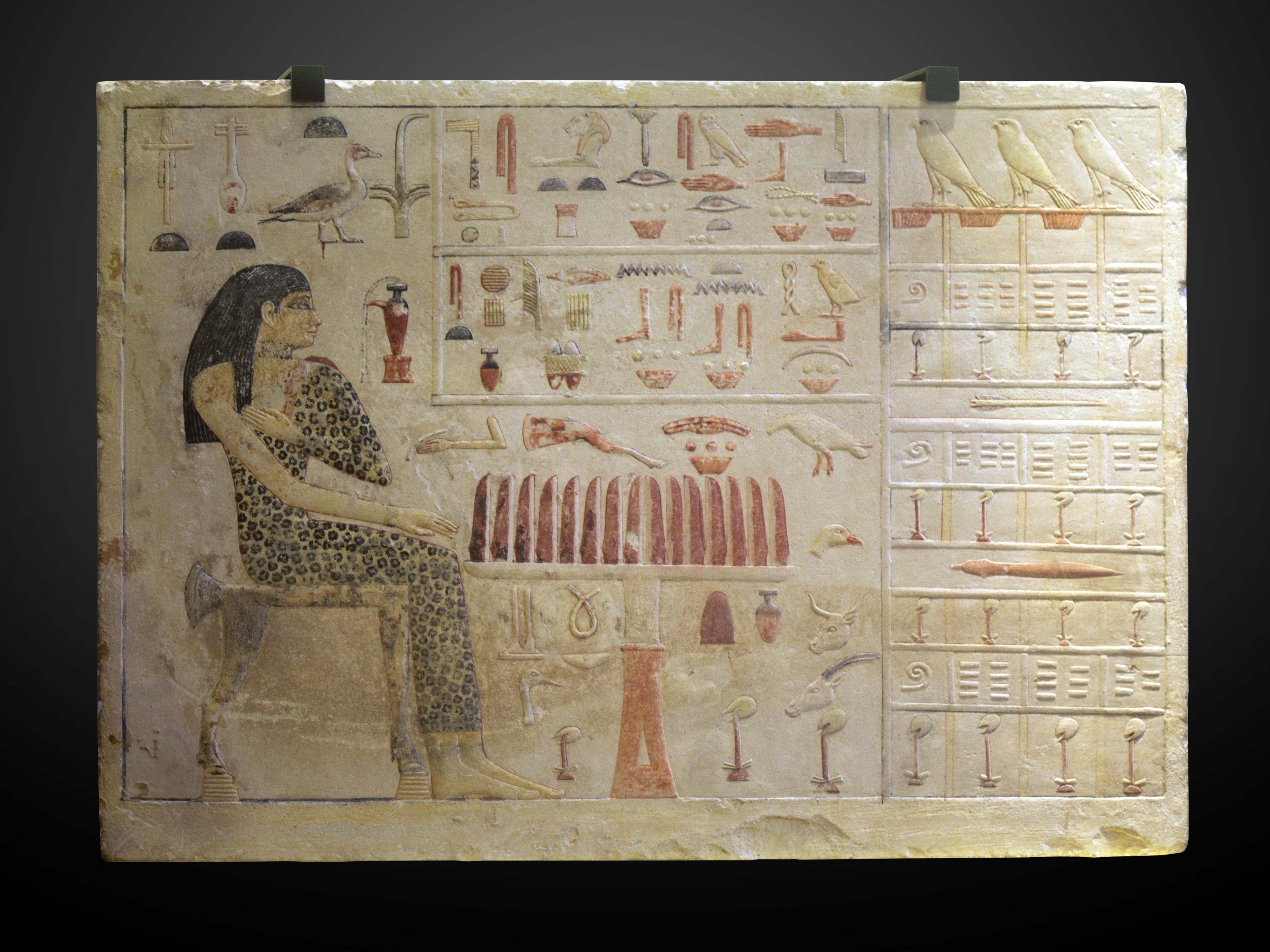

Ancient Egyptian Mathematics

Ancient Egyptian mathematics is the mathematics that was developed and used in Ancient Egypt 3000 to c. , from the Old Kingdom of Egypt In ancient Egyptian history, the Old Kingdom is the period spanning c. 2700–2200 BC. It is also known as the "Age of the Pyramids" or the "Age of the Pyramid Builders", as it encompasses the reigns of the great pyramid-builders of the Fourt ... until roughly the beginning of Hellenistic Egypt. The ancient Egyptians utilized Egyptian numerals, a numeral system for counting and solving written mathematical problems, often involving Ancient Egyptian multiplication, multiplication and Egyptian fractions, fractions. Evidence for Egyptian mathematics is limited to a scarce amount of List of ancient Egyptian papyri, surviving sources written on papyrus. From these texts it is known that ancient Egyptians understood concepts of Egyptian geometry, geometry, such as determining the surface area and volume of three-dimensional shapes useful for Anci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield (finance)

In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment, the other component being the change in the market price of the security. It is a measure applied to fixed income securities, common stocks, preferred stocks, convertible stocks and bonds, annuities and real estate investments. There are various types of yield, and the method of calculation depends on the particular type of yield and the type of security. Because of these differences, yield comparisons between different types of financial products should be treated with caution. Fixed income securities The coupon rate (or nominal rate) on a fixed income security is the interest that the issuer agrees to pay to the security holder each year, expressed as a percentage of the security's principal amount (par value). The current yield is the ratio of the annual interest (coupon) payment and the bond's market price. The yield to matu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of companies, other business organizations, or their operating units are transferred to or consolidated with another company or business organization. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is a legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. A deal may be euphemistically called a ''merger of equals'' if both CEOs agree that joining together is in the best interest of both of their companies. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. In most countries, mergers and acquisitions must c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |