|

Discounted Cash Flow

The discounted cash flow (DCF) analysis, in financial analysis, is a method used to value a security, project, company, or asset, that incorporates the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. Used in industry as early as the 1700s or 1800s, it was widely discussed in financial economics in the 1960s, and U.S. courts began employing the concept in the 1980s and 1990s. Application In discount cash flow analysis, all future cash flows are estimated and discounted by using cost of capital to give their present values (PVs). The sum of all future cash flows, both incoming and outgoing, is the net present value (NPV), which is taken as the value of the cash flows in question; see aside. For further context see ; and for the mechanics see valuation using discounted cash flows, which includes modifications typical for startups, private equity and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Analysis

Financial analysis (also known as financial statement analysis, accounting analysis, or analysis of finance) refers to an assessment of the viability, stability, and profitability of a business, sub-business, project or investment. It is performed by professionals who prepare reports using ratios and other techniques, that make use of information taken from financial statements and other reports. These reports are usually presented to top management as one of their bases in making business decisions. Financial analysis may determine if a business will: *Continue or discontinue its main operation or part of its business; *Make or purchase certain materials in the manufacture of its product; *Acquire or rent/lease certain machineries and equipment in the production of its goods; *Issue shares or negotiate for a bank loan to increase its working capital; *Make decisions regarding investing or lending capital; *Make other decisions that allow management to make an informed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Present Value

The net present value (NPV) or net present worth (NPW) is a way of measuring the value of an asset that has cashflow by adding up the present value of all the future cash flows that asset will generate. The present value of a cash flow depends on the interval of time between now and the cash flow because of the Time value of money (which includes the annual effective discount rate). It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time, as in loans, investments, payouts from insurance contracts plus many other applications. Time value of money dictates that time affects the value of cash flows. For example, a lender may offer 99 cents for the promise of receiving $1.00 a month from now, but the promise to receive that same dollar 20 years in the future would be worth much less today to that same person (lender), even if the payback in both cases was equally certain. This decrease in the current value of future c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Otto Eduard Neugebauer

Otto Eduard Neugebauer (May 26, 1899 – February 19, 1990) was an Austrian-American mathematician and historian of science who became known for his research on the history of astronomy and the other exact sciences as they were practiced in antiquity and the Middle Ages. By studying clay tablets, he discovered that the ancient Babylonians knew much more about mathematics and astronomy than had been previously realized. The National Academy of Sciences has called Neugebauer "the most original and productive scholar of the history of the exact sciences, perhaps of the history of science, of our age." Career Neugebauer was born in Innsbruck, Austria. His father Rudolph Neugebauer was a railroad construction engineer and a collector and scholar of Oriental carpets. His parents died when he was quite young. During World War I, Neugebauer enlisted in the Austrian Army and served as an artillery lieutenant on the Italian front and then in an Italian prisoner-of-war camp alongside fel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Book Value

In accounting, book value (or carrying value) is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made against the asset. Traditionally, a company's book value is its minus intangible assets and liabilities. However, in practice, depending on the source of the calculation, book value may variably include goodwill, intangible assets, or both.Graham and Dodd's ''Security Analysis'', Fifth Edition, pp 318 – 319 The value inherent in its workforce, part of the intellectual capital of a company, is always ignored. When intangible assets and goodwill are explicitly excluded, the metric is often specified to be ''tangible book value''. In the United Kingdom, the term net asset value may refer to the book value of a company. Asset book value An asset's initial book value is its actual cash value or its acquisition cost. Cash assets are record ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

British Accounting Review

The ''British Accounting Review'' is an academic journal of the British Accounting and Finance Association that was established in 1969. Serving its purpose to educate and connect users, the ''British Accounting Review'' helps uphold the mission of the British Accounting and Finance Association. Even though the journal was founded in the UK, the academic journal accepts UK and non-UK sourced research, reflecting the multinational users of the academic journal. Besides the British Accounting and Finance Association, creditable accounting agencies, like the American Accounting Association, use the ''British Accounting Review''. The journal is freely accessible and can include anything relating to the widespread areas of accounting or finance, such as financial & management accounting, auditing, finance and financial management, taxation, AIS, Fintech, green finance, public sector accounting, sustainability reporting, and accounting history. Some of the most cited articles from the ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Babylonian Mathematics

Babylonian mathematics (also known as Assyro-Babylonian mathematics) is the mathematics developed or practiced by the people of Mesopotamia, as attested by sources mainly surviving from the Old Babylonian period (1830–1531 BC) to the Seleucid from the last three or four centuries BC. With respect to content, there is scarcely any difference between the two groups of texts. Babylonian mathematics remained constant, in character and content, for over a millennium. In contrast to the scarcity of sources in Egyptian mathematics, knowledge of Babylonian mathematics is derived from hundreds of clay tablets unearthed since the 1850s. Written in cuneiform, tablets were inscribed while the clay was moist, and baked hard in an oven or by the heat of the sun. The majority of recovered clay tablets date from 1800 to 1600 BC, and cover topics that include fractions, algebra, quadratic and cubic equations and the Pythagorean theorem. The Babylonian tablet YBC 7289 gives an approxim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ancient Egyptian Mathematics

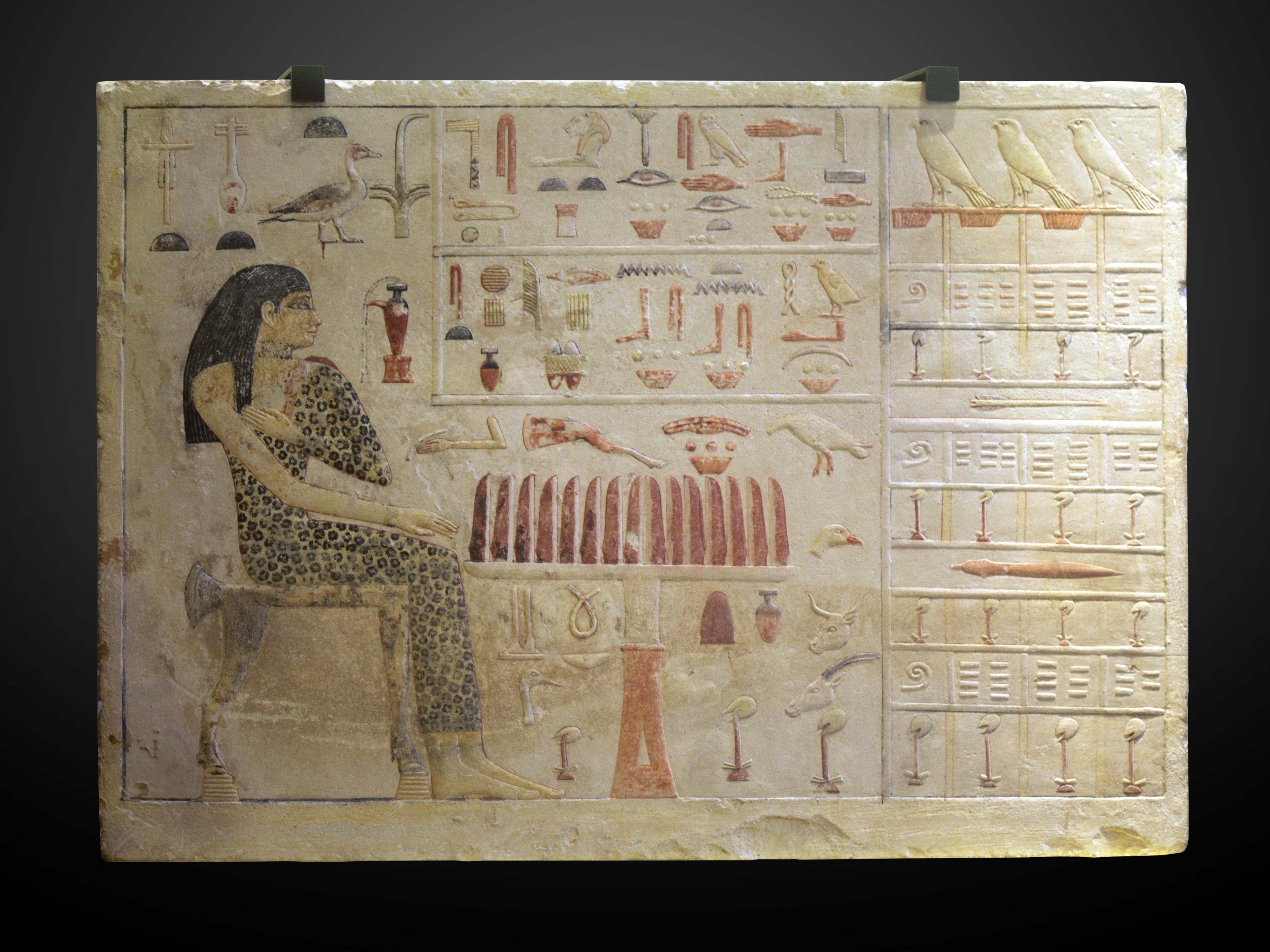

Ancient Egyptian mathematics is the mathematics that was developed and used in Ancient Egypt 3000 to c. , from the Old Kingdom of Egypt until roughly the beginning of Hellenistic Egypt. The ancient Egyptians utilized a numeral system for counting and solving written mathematical problems, often involving multiplication and fractions. Evidence for Egyptian mathematics is limited to a scarce amount of surviving sources written on papyrus. From these texts it is known that ancient Egyptians understood concepts of geometry, such as determining the surface area and volume of three-dimensional shapes useful for architectural engineering, and algebra, such as the false position method and quadratic equations. Overview Written evidence of the use of mathematics dates back to at least 3200 BC with the ivory labels found in Tomb U-j at Abydos. These labels appear to have been used as tags for grave goods and some are inscribed with numbers. Further evidence of the use of the base 10 nu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield (finance)

In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment, the other component being the change in the market price of the security. It is a measure applied to fixed income securities, common stocks, preferred stocks, convertible stocks and bonds, annuities and real estate investments. There are various types of yield, and the method of calculation depends on the particular type of yield and the type of security. Fixed income securities The coupon rate (or nominal rate) on a fixed income security is the interest that the issuer agrees to pay to the security holder each year, expressed as a percentage of the security's principal amount (par value). The current yield is the ratio of the annual interest (coupon) payment and the bond's market price. The yield to maturity is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of a company, business organization, or one of their operating units is transferred to or consolidated with another entity. They may happen through direct absorption, a merger, a tender offer or a hostile takeover. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is the legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. Most countries require mergers and acquisitions to comply with antitrust or competition law. In the United States, for example, the Cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (VC) is a form of private equity financing provided by firms or funds to start-up company, startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Venture capital firms or funds invest in these early-stage companies in exchange for Equity (finance), equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because Startup company, startups face high uncertainty, VC investments have high rates of failure. Start-ups are usually based on an innovation, innovative technology or business model and often come from high technology industries such as information technology (IT) or biotechnology. Pre-seed and seed money, seed rounds are the initial stages of funding for a startup company, typically occurring earl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |