|

Corporate Credit Union

A corporate credit union, also known as a central credit union, provides services to natural person (consumer) credit unions. In the credit union industry, they are sometimes referred to as "the credit union’s credit union". In the United States, corporate credit unions may either be chartered by the National Credit Union Administration (NCUA), or under state authority if permitted under that state's financial services laws. Corporate credit unions are owned by the credit unions that choose to do business with them and provide short term (federal funds) and long term investments (in government approved instruments). Corporate credit unions also provide financial settlement services through the clearing of payments (check clearing), ACH (Automated Clearing House), electronic funds transfers (EFT) and ATM transaction services and networks. Originally, most states operated their own corporate credit union, which had strong ties to the credit union league operating in that state. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative to credit unions and were two and a ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consolidation (business)

In business, consolidation or amalgamation is the merger and acquisition of many smaller companies into a few much larger ones. In the context of financial accounting, ''consolidation'' refers to the aggregation of financial statements of a group company as consolidated financial statements. The taxation term of consolidation refers to the treatment of a group of companies and other entities as one entity for tax purposes. Under the Halsbury's Laws of England, 'amalgamation' is defined as "a blending together of two or more undertakings into one undertaking, the shareholders of each blending company, becoming, substantially, the shareholders of the blended undertakings. There may be amalgamations, either by transfer of two or more undertakings to a new company or the transfer of one or more companies to an existing company". Overview Consolidation is the practice, in business, of legally combining two or more organizations into a single new one. Upon consolidation, the origi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union Service Organization

Credit union service organizations (CUSOs) are corporate entities in the United States that are owned by federally chartered or federally insured, state chartered credit unions. Under US federal law and the National Credit Union Administration regulations Part 712, federal credit unions may make an investment in or a loan to a CUSO. Aggregate investments in CUSOs by federal credit unions may not exceed 1% of paid in and unimpaired capital, and aggregate loans to CUSOs may not exceed 1% of paid in and unimpaired capital. (State chartered credit unions will follow state law and in some instances, these limitations may be different.) Every CUSO must be subject to a legal opinion to ensure the proposed structure is permissible and does not engage in unauthorized activities and to ensure that potential liabilities are limited to the funds invested or loaned to it. Furthermore, every CUSO must explicitly allow the National Credit Union Administration the right to review its boo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union League

A credit union league or credit union central is cooperative federation for credit unions. Canada In Canada there is generally one credit union central per province (with exceptions). Except for the Desjardins Group (primarily operating in Quebec, but also French-speaking areas of New Brunswick and Ontario) which is separate, they are all members the Canadian Credit Union Association, the national trade association for credit unions. The Canadian Central is itself a member of the Canadian Co-operative Association, while Desjardins is a member of the '' Conseil canadien de la coopération et de la mutualité''. United States In the United States a credit union league is a state-level trade association for credit unions, which are not-for-profit financial cooperatives. Credit union leagues hold a primary interest in the Credit Union National Association (CUNA). Many credit union leagues were formed through the efforts of the Credit Union National Extension Bureau in the 1920s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NCUA Corporate Stabilization Program

The NCUA Corporate Stabilization Program was created on January 28, 2009, in response to investment losses incurred at U.S. Central Credit Union. U.S. Central was a third-level corporate credit union that provided services to other corporate credit unions, which in turn served public-facing credit unions. The National Credit Union Administration (NCUA) is an autonomous agency of the United States federal government, and is responsible for regulating and insuring all federally insured credit unions in the United States. The NCUA's plan calls for all federally insured natural-person credit unions in the U.S. to pay an increased insurance premium to the National Credit Union Share Insurance Fund (NCUSIF) in 2009 to make up for the investment losses at U.S. Central, to which the NCUSIF has written a $1 billion capital note. However, NCUA has provided no assurances that the capital losses of the corporate credit unions to be covered through the planned assessment in 2009 will be adequat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conservatorship

Under U.S. law, conservatorship is the appointment of a guardian or a protector by a judge to manage the financial affairs and/or daily life of another person due to old age or physical or mental limitations. A person under conservatorship is a "conservatee", a term that can refer to an adult. A person under guardianship is a "ward", a term that can also refer to a minor child. Conservatorship may also apply to corporations and organizations. The conservator may be only of the "estate" (financial affairs), but may be also of the "person", wherein the conservator takes charge of overseeing the daily activities, such as health care or living arrangements of the conservatee. A conservator of the person is more typically called a legal guardian. Appointment Conservatorship is established either by court order (with regard to individuals) or via a statutory or regulatory authority (with regard to organizations such as business entities). In other legal terms, a conservatorship may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Western Corporate Federal Credit Union

Western Bridge Corporate Federal Credit Union, or WesCorp, was a financial services cooperative headquartered in San Dimas, California. As a corporate credit union, WesCorp provided services to natural person (consumer) credit unions. WesCorp served America's credit union industry as an aggregator of financial products and services for the purpose of delivering cost-savings and greater efficiencies to more than 950 member/owner credit unions throughout the United States. On March 20, 2009, NCUA placed WesCorp into conservatorship. The company was officially dissolved on July 6, 2012. Corporate history California Central Federal Credit Union In 1969, the leaders of California's credit union movement collectively recognized the need for a non-competitive service provider. From this common vision, the California Central Federal Credit Union was chartered. The nation's first federally chartered central credit union, California Central FCU was originally created to serve the liqui ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements. Internal fraud, also known as "insider fraud", is fraud committed or attempted by someone within an organisation such as an employee. A hoax is a distinct concept that involves deliberate deception without the intention of gain or of materially damaging or depriving a vi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Credit Union Administration

The National Credit Union Administration (NCUA) is a government-backed insurer of credit unions in the United States, one of two agencies that provide deposit insurance to depositors in U.S. depository institutions, the other being the Federal Deposit Insurance Corporation, which insures commercial banks and savings institutions. The NCUA is an independent federal agency created by the United States Congress to regulate, charter, and supervise federal credit unions. With the backing of the full faith and credit of the U.S. government, the NCUA operates and manages the National Credit Union Share Insurance Fund, insuring the deposits of more than 124 million account holders in all federal credit unions and the overwhelming majority of state-chartered credit unions. Besides the Share Insurance Fund, the NCUA operates three other funds: the NCUA Operating Fund, the Central Liquidity Facility (CLF), and the Community Development Revolving Loan Fund (CDRLF). The NCUA Operating F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union League

A credit union league or credit union central is cooperative federation for credit unions. Canada In Canada there is generally one credit union central per province (with exceptions). Except for the Desjardins Group (primarily operating in Quebec, but also French-speaking areas of New Brunswick and Ontario) which is separate, they are all members the Canadian Credit Union Association, the national trade association for credit unions. The Canadian Central is itself a member of the Canadian Co-operative Association, while Desjardins is a member of the '' Conseil canadien de la coopération et de la mutualité''. United States In the United States a credit union league is a state-level trade association for credit unions, which are not-for-profit financial cooperatives. Credit union leagues hold a primary interest in the Credit Union National Association (CUNA). Many credit union leagues were formed through the efforts of the Credit Union National Extension Bureau in the 1920s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

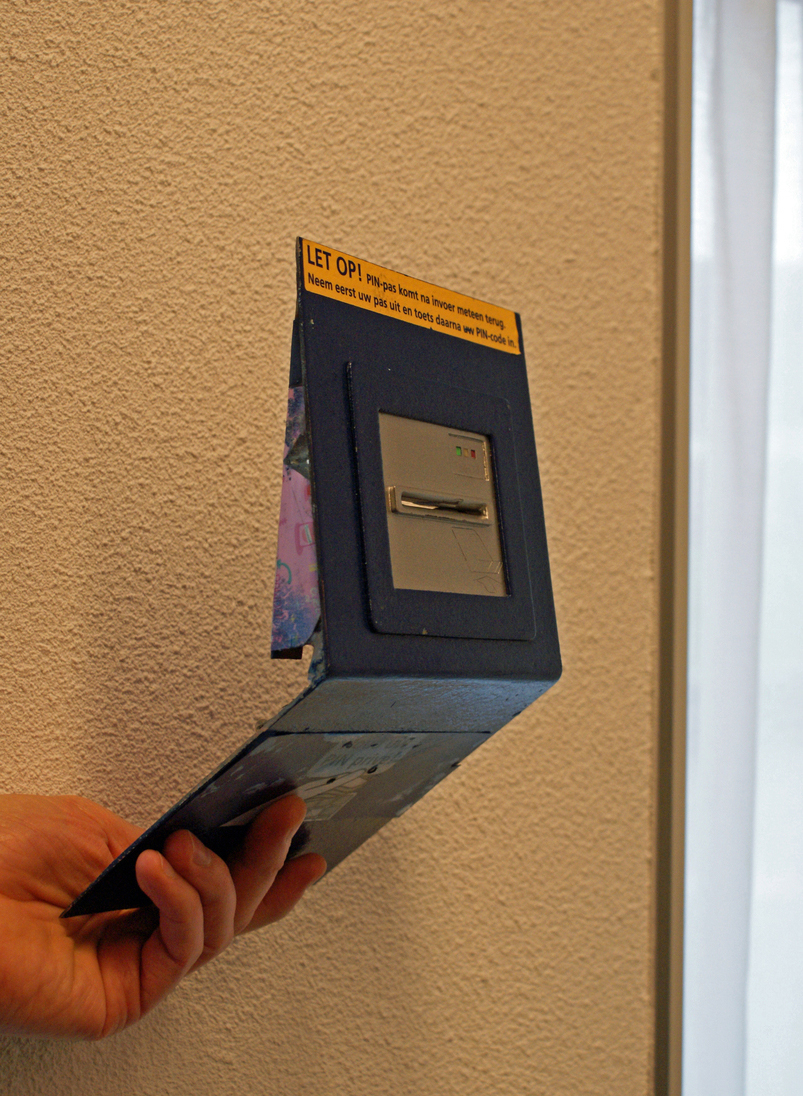

Automatic Teller Machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of names, including automatic teller machine (ATM) in the United States (sometimes redundantly as "ATM machine"). In Canada, the term ''automated banking machine'' (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM over ABM. In British English, the terms ''cashpoint'', ''cash machine'' and ''hole in the wall'' are most widely used. Other terms include ''any time money'', ''cashline'', ''tyme machine'', ''cash dispenser'', ''cash corner'', ''bankomat'', or ''bancomat''. ATMs that are not operated by a financial i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |