|

Cheque Truncation System

Cheque Truncation System (CTS) or Image-based Clearing System (ICS), in India, is a project of the Reserve Bank of India (RBI), commenced in 2010, for faster clearing of cheques. CTS is based on a cheque truncation or online image-based cheque clearing system where cheque images and magnetic ink character recognition (MICR) data are captured at the collecting bank branch and transmitted electronically. Cheque truncation means stopping the flow of the physical cheques issued by a drawer to the drawee branch. The physical instrument is truncated at some point in route to the drawee branch and an electronic image of the cheque is sent to the drawee branch along with the relevant information like the MICR fields, date of presentation, presenting banks etc. This would eliminate the need to move the physical instruments across branches, except in exceptional circumstances, resulting in an effective reduction in the time required for payment of cheques, the associated cost of transit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of India

The Reserve Bank of India, chiefly known as RBI, is India's central bank and regulatory body responsible for regulation of the Indian banking system. It is under the ownership of Ministry of Finance, Government of India. It is responsible for the control, issue and maintaining supply of the Indian rupee. It also manages the country's main payment systems and works to promote its economic development. Bharatiya Reserve Bank Note Mudran (BRBNM) is a specialised division of RBI through which it prints and mints Indian currency notes (INR) in two of its currency printing presses located in Nashik (Western India) and Dewas (Central India). RBI established the National Payments Corporation of India as one of its specialised division to regulate the payment and settlement systems in India. Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialised division for the purpose of providing insurance of deposits and guaranteeing of credit fa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque Truncation

Cheque truncation (check truncation in American English) is a cheque clearance system that involves the digitization of a physical paper cheque into a substitute electronic form for transmission to the paying bank. The process of cheque clearance, involving data matching and verification, is done using digital images instead of paper copies. Cheque truncation reduces or eliminates the physical movement of paper cheques and reduces the time and cost of cheque clearance. Cheque truncation also offers the potential reduction in settlement periods with the electronic processing of the cheque payment system. History For cheque clearance, a cheque has to be presented to the drawee bank for payment. Originally this was done by taking the cheque to the drawee bank, but as cheque usage increased this became cumbersome and banks arranged to meet each day at a central location to exchange cheques and receive payment in money. This became known as central clearing. Bank customers who rec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Magnetic Ink Character Recognition

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the ''MICR line'', is at the bottom of cheques and other vouchers and typically includes the document-type indicator, bank code, bank account number, cheque number, cheque amount (usually added after a cheque is presented for payment) and a control indicator. The format for the bank code and bank account number is country-specific. The technology allows MICR readers to scan and read the information directly into a data-collection device. Unlike barcode and similar technologies, MICR characters can be read easily by humans. MICR encoded documents can be processed much faster and more accurately than conventional OCR encoded documents. Pre-Unicode standard representation The ISO standard ISO 2033:1983, and the corresponding Japanese Ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque Truncation

Cheque truncation (check truncation in American English) is a cheque clearance system that involves the digitization of a physical paper cheque into a substitute electronic form for transmission to the paying bank. The process of cheque clearance, involving data matching and verification, is done using digital images instead of paper copies. Cheque truncation reduces or eliminates the physical movement of paper cheques and reduces the time and cost of cheque clearance. Cheque truncation also offers the potential reduction in settlement periods with the electronic processing of the cheque payment system. History For cheque clearance, a cheque has to be presented to the drawee bank for payment. Originally this was done by taking the cheque to the drawee bank, but as cheque usage increased this became cumbersome and banks arranged to meet each day at a central location to exchange cheques and receive payment in money. This became known as central clearing. Bank customers who rec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MICR

Magnetic ink character recognition code, known in short as MICR code, is a character recognition technology used mainly by the banking industry to streamline the processing and clearance of cheques and other documents. MICR encoding, called the ''MICR line'', is at the bottom of cheques and other vouchers and typically includes the document-type indicator, bank code, bank account number, cheque number, cheque amount (usually added after a cheque is presented for payment) and a control indicator. The format for the bank code and bank account number is country-specific. The technology allows MICR readers to scan and read the information directly into a data-collection device. Unlike barcode and similar technologies, MICR characters can be read easily by humans. MICR encoded documents can be processed much faster and more accurately than conventional OCR encoded documents. Pre-Unicode standard representation The ISO standard ISO 2033:1983, and the corresponding Japanese Ind ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Capital Region (India)

The National Capital Region (NCR) is a planning region centred upon the National Capital Territory (NCT) of Delhi in India. It encompasses Delhi and several districts surrounding it from the states of Haryana, Uttar Pradesh and Rajasthan. The NCR and the associated National Capital Region Planning Board (NCRPB) were created in 1985 to plan the development of the region and to evolve ''harmonized policies for the control of land-uses and development of infrastructure'' in the region. Prominent cities of NCR include Delhi, Faridabad, Ghaziabad, Gurugram, and Noida. The NCR is a ''rural-urban'' region, with a population of over 46,069,000 and an urbanisation level of 62.6%. As well as the cities and towns, the NCR contains ecologically sensitive areas like the Aravalli ridge, forests, wildlife and bird sanctuaries. The Delhi Extended Urban Agglomeration, a part of the NCR, had an estimated GDP of $370 billion (measured in terms of GDP PPP) in 2015–16. History The National Ca ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Delhi

New Delhi (, , ''Naī Dillī'') is the capital of India and a part of the National Capital Territory of Delhi (NCT). New Delhi is the seat of all three branches of the government of India, hosting the Rashtrapati Bhavan, Parliament House, and the Supreme Court of India. New Delhi is a municipality within the NCT, administered by the NDMC, which covers mostly Lutyens' Delhi and a few adjacent areas. The municipal area is part of a larger administrative district, the New Delhi district. Although colloquially ''Delhi'' and ''New Delhi'' are used interchangeably to refer to the National Capital Territory of Delhi, both are distinct entities, with both the municipality and the New Delhi district forming a relatively small part of the megacity of Delhi. The National Capital Region is a much larger entity comprising the entire NCT along with adjoining districts in neighbouring states, including Ghaziabad, Noida, Gurgaon and Faridabad. The foundation stone of New De ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chennai

Chennai (, ), formerly known as Madras ( the official name until 1996), is the capital city of Tamil Nadu, the southernmost Indian state. The largest city of the state in area and population, Chennai is located on the Coromandel Coast of the Bay of Bengal. According to the 2011 Indian census, Chennai is the sixth-most populous city in the country and forms the fourth-most populous urban agglomeration. The Greater Chennai Corporation is the civic body responsible for the city; it is the oldest city corporation of India, established in 1688—the second oldest in the world after London. The city of Chennai is coterminous with Chennai district, which together with the adjoining suburbs constitutes the Chennai Metropolitan Area, the 36th-largest urban area in the world by population and one of the largest metropolitan economies of India. The traditional and de facto gateway of South India, Chennai is among the most-visited Indian cities by foreign tourists. It was ranked the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customer Satisfaction

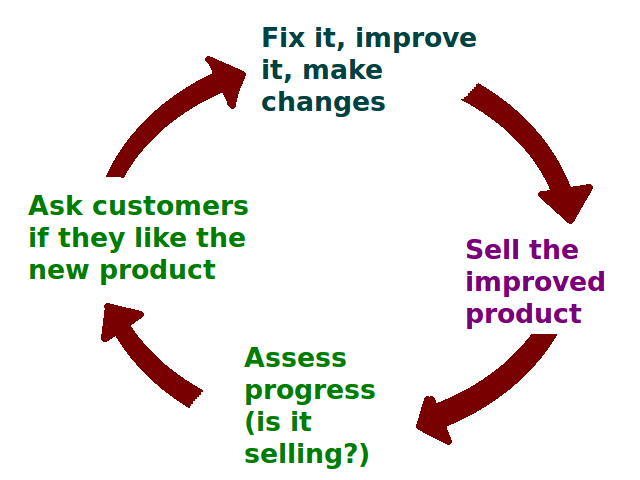

Customer satisfaction (often abbreviated as CSAT) is a term frequently used in marketing. It is a measure of how products and services supplied by a company meet or surpass customer expectation. Customer satisfaction is defined as "the number of customers, or percentage of total customers, whose reported experience with a firm, its products, or its services (ratings) exceeds specified satisfaction goals."Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). ''Marketing Metrics: The Definitive Guide to Measuring Marketing Performance.'' Upper Saddle River, New Jersey: Pearson Education, Inc. . Customers play an important role and are essential in keeping a product or service relevant; it is, therefore, in the best interest of the business to ensure customer satisfaction and build customer loyalty. The Marketing Accountability Standards Board (MASB) endorses the definitions, purposes, and measures that appear in ''Marketing Metrics'' as part of its ongoin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque Fraud

Cheque fraud (Commonwealth English), or check fraud (American English), refers to a category of criminal acts that involve making the unlawful use of cheques in order to illegally acquire or borrow funds that do not exist within the account balance or account-holder's legal ownership. Most methods involve taking advantage of the ''float'' (the time between the negotiation of the cheque and its clearance at the cheque writer's financial institution) to draw out these funds. Specific kinds of cheque fraud include cheque kiting, where funds are deposited before the end of the float period to cover the fraud, and paper hanging, where the float offers the opportunity to write fraudulent cheques but the account is never replenished. Types of cheque fraud Cheque kiting Cheque kiting full refers to use of the float to take advantage and delay the notice of non-existent funds. Embezzlement While some cheque kiters fully intend to bring their accounts into good standing, others, often ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheques

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)