|

California Proposition 13 (1978)

Proposition 13 (officially named the People's Initiative to Limit Property Taxation) is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978. It was upheld as constitutional by the United States Supreme Court in the case of ''Nordlinger v. Hahn'', . Proposition 13 is embodied in Article XIII A of the Constitution of the State of California. The most significant portion of the act is the first paragraph, which limits the tax rate for real estate: The proposition decreased property taxes by assessing values at their 1976 value and restricted annual increases of assessed value to an inflation factor, not to exceed 2% per year. It prohibits reassessment of a new base year value except in cases of (a) change in ownership, or (b) completion of new construction. These rules apply equally to all real estate, residential and commercial—whether owned by individuals or c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Constitution Of California

The Constitution of California ( es, Constitución de California) is the primary organizing law for the U.S. state of California, describing the duties, powers, structures and functions of the government of California. California's original constitution was drafted in both English language, English and Spanish language, Spanish by American pioneers, European-American, European settlers, and Californios (Hispanics and Latinos in California, Hispanics of California) and adopted at the Constitutional Convention (California)#Monterey Convention of 1849, 1849 Constitutional Convention of Monterey, following the American Conquest of California and the Mexican-American War and in advance of California's Admission to the Union in 1850. The constitution was amended and ratified on 7 May 1879, following the Constitutional Convention (California)#Sacramento Convention of 1878-79, Sacramento Convention of 1878-79. The Constitution of California is one of the longest collections of laws in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Howard Jarvis

Howard Arnold Jarvis (September 22, 1903 – August 12, 1986) was an American businessman, lobbyist, and politician. He was a tax policy activist responsible for passage of California's Proposition 13 in 1978. Early life and education Jarvis was born in Magna, Utah, and died in Los Angeles, California. He graduated from Utah State University. In Utah he had some political involvement working with his father's campaigns and his own. His father was a state Supreme Court judge and, unlike Jarvis, a member of the Democratic Party. Howard Jarvis was active in the Republican Party and also ran small town newspapers. Although raised Mormon, he smoked cigars and drank vodka as an adult. He moved to California in the 1930s due to a suggestion by Earl Warren. Jarvis bought his home at 515 North Crescent Heights Boulevard in Los Angeles for $8,000 in 1941. By 1976, it was assessed at $80,000. He married his third wife, Estelle Garcia, around 1965. Political career Jarvis was a Repu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Case–Shiller Index

The Standard & Poor's CoreLogic Case–Shiller Home Price Indices are repeat-sales house price indices for the United States. There are multiple Case–Shiller home price indices: A national home price index, a 20-city composite index, a 10-city composite index, and twenty individual metro area indices. These indices were first produced commercially by Case Shiller Weiss. They are now calculated and kept monthly by Standard & Poor's, with data calculated for January 1987 to present. The indices kept by Standard & Poor are normalized to a value of 100 in January 2000. They are based on original work by economists Karl Case and Robert Shiller, whose team calculated the home price index back to 1890. Case and Shiller's index is normalized to a value of 100 in 1890. The Case-Shiller index on Shiller's website is updated quarterly. The two datasets can greatly differ due to different reference points and calculations. For example, in the 4th quarter of 2013, the Standard and Poor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

WalletHub

WalletHub (formerly CardHub.com) is a personal finance website that was launched in August 2013. It is based in Miami and owned by Evolution Finance, Inc. WalletHub offers free consumer tools, such as its WalletLiteracy Quiz and its Financial Fitness Tool, which provides users with credit reports, scores and monitoring. The company also successfully overcame a public trademark dispute with Major League Baseball, brought on behalf of the Washington Nationals and Chicago Cubs. History According to Web reports, WalletHub initially positioned itself as a “personal finance social network” with a focus on reviews for financial advisors. The company also produces research reports, including a quarterly credit card debt report and reports comparing cities and states in financially relevant categories. For example, in mid-November 2021, a weekly New York Times feature used Wallethub's' data for what the Times ''The Times'' is a British daily national newspaper based in Lon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Income Tax

In addition to federal income tax collected by the United States, most individual U.S. states collect a state income tax. Some local governments also impose an income tax, often based on state income tax calculations. Forty-two states and many localities in the United States impose an income tax on individuals. Eight states impose no state income tax, and a ninth, New Hampshire, imposes an individual income tax on dividends and interest income but not other forms of income (though it will be phased out by 2027). Forty-seven states and many localities impose a tax on the income of corporations. State income tax is imposed at a fixed or graduated rate on taxable income of individuals, corporations, and certain estates and trusts. These tax rates vary by state and by entity type. Taxable income conforms closely to federal taxable income in most states with limited modifications. States are prohibited from taxing income from federal bonds or other federal obligations. Most states do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) tax-exempt non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Legal Reform. The group is known for its annual reports such as ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941, and its " Tax Freedom Day" brochures, which it has produced since the early 1970s. History The Tax Foundation was organized on December 5, 1937, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Howard Jarvis Taxpayers Association

The Howard Jarvis Taxpayers Association is a California-based nonprofit lobbying and policy organization that advocates for Proposition 13 and Proposition 218. Officially nonpartisan, the organization also advocates against raising taxes in California. History Following the passage of Proposition 13 in June 1978, anti-tax activist Howard Jarvis founded an organization called the California Tax Reduction Movement. The goals of this organization were to protect Proposition 13 and further the " taxpayer revolt." Upon Jarvis's death in 1986, his former personal assistant, Joel Fox, took over as the organization's head, formally incorporating and changing its name to Howard Jarvis Taxpayers Association. Mission The Howard Jarvis Taxpayers Association is known for its strong support of Proposition 13, which was approved by California voters in June 1978. Proposition 13 significantly limited real property tax increases for California homeowners and businesses. The association o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

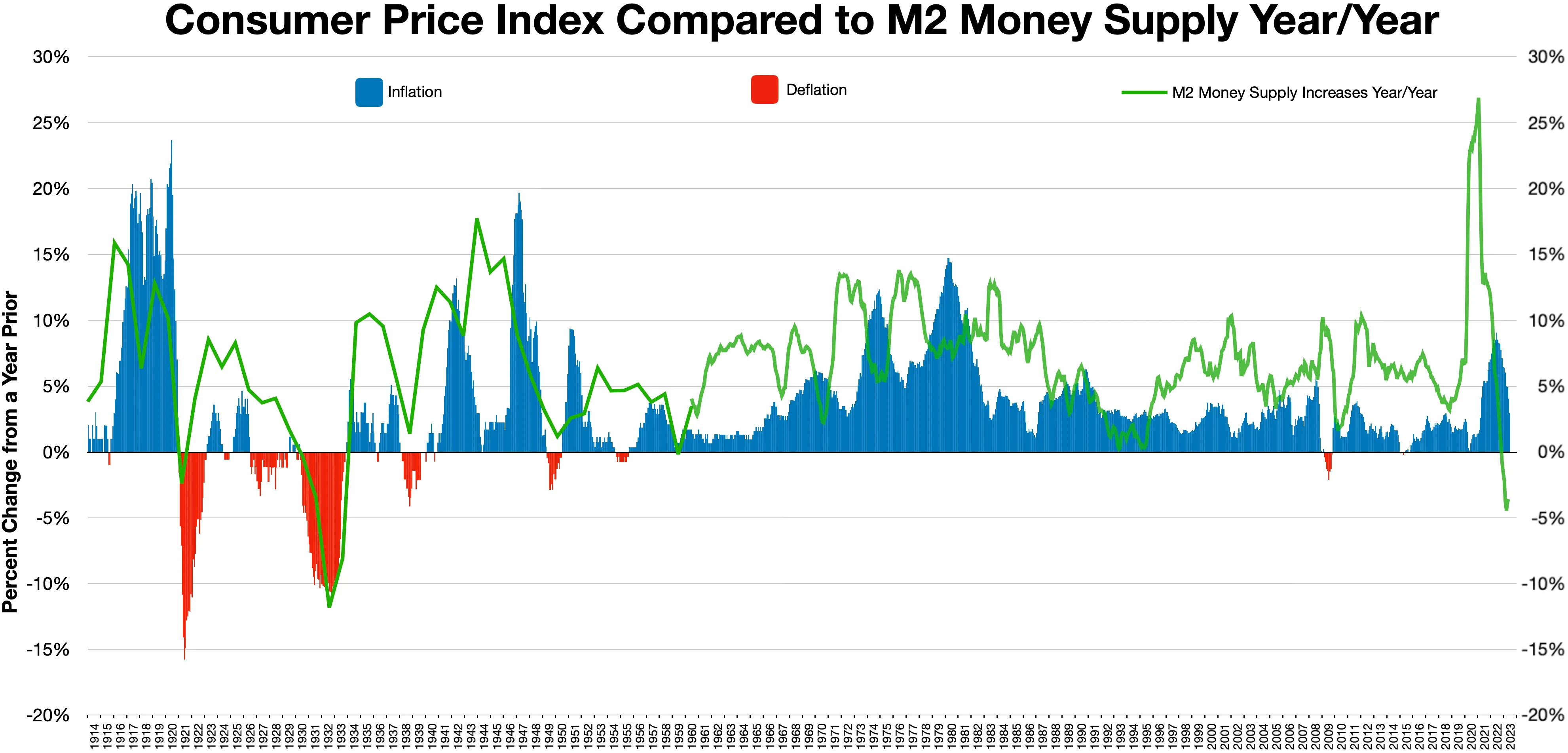

Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the Real versus nominal value (economics), real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral. Some economists argue that prolonged deflationary periods are related to the underlying of technological progress in an economy, because as productivity increases (Total factor productivity, TFP), t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Board Of Equalization (California)

The California State Board of Equalization (BOE) is a public agency charged with tax administration and fee collection in the state of California in the United States. The authorities of the Board fall into four broad areas: sales and use taxes, property taxes, special taxes, and acting as an appellate body for franchise and income tax appeals (these taxes are collected by the Franchise Tax Board).State Board of EqualizationAbout BOE/ref> The BOE is the only publicly elected tax commission in the United States.State Board of Equalization/ref> It is made up of four directly elected members, each representing a district for four-year terms, along with the State Controller, who is elected on a statewide basis, serving as the fifth member. In June 2017, Governor Jerry Brown signed legislation stripping the Board of many of its powers, returning the agency to its original core responsibilities (originating in the State Constitution in 1879). History The State Board of Equalizatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Proposition 8 (November 1978)

Proposition 8 (or Senate Constitutional Amendment No. 67) was an amendment of the Constitution of California relating to the assessment of property values. It was proposed by the California State Legislature and approved by voters in a referendum held on 7 November 1978. The amendment was necessitated by the passage of Proposition 13 in June of the same year. Proposition 8 allowed for a reassessment of real property values in a declining market. For this purpose it amended Article 13A of the state constitution, which had been added by Proposition 13. Today a reassessment based on a decline in market value is called a "Proposition 8" reassessment. External links * (excerpt on Proposition 8)California Voters Pamphlet, November 1978(in full) 1978 California ballot propositions Taxation in California 1978 Events January * January 1 – Air India Flight 855, a Boeing 747 passenger jet, crashes off the coast of Bombay, killing 213. * January 5 – Bülent Ecevit, of Re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Petition

A petition is a request to do something, most commonly addressed to a government official or public entity. Petitions to a deity are a form of prayer called supplication. In the colloquial sense, a petition is a document addressed to some official and signed by numerous individuals. A petition may be oral rather than written, or may be transmitted via the Internet. Legal ''Petition'' can also be the title of a legal pleading that initiates a legal case. The initial pleading in a civil lawsuit that seeks only money (damages) might be called (in most U.S. courts) a ''complaint''. An initial pleading in a lawsuit that seeks non-monetary or "equitable" relief, such as a request for a writ of '' mandamus'' or ''habeas corpus'', custody of a child, or probate of a will, is instead called a ''petition''. Act on petition is a "summary process" used in probate, ecclesiastical and divorce cases, designed to handle matters which are too complex for simple motion. The parties in a case exc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |