|

California Insurance Code

The California Insurance Code are the codified California laws regarding insurance. The code not only covers requirements for home, auto, medical and business insurance policies, but also covers the licensing of bail bond agents, workers' compensation, motor club services, and other related business types. Topics include: classes of insurance, code provisions governing the insurance commissioner, laws pertaining to insurance adjusters, insurance contracts, liability limitations, and common carrier liability insurance. The California Department of Insurance oversees the enforcement of the code and execution of its policies. History Slavery Era Insurance Registry In September 2000, Governor Gray Davis signed State Bill 2199 into law, adding a provision into the California Insurance Code for creation of a Slavery Era Insurance Registry. The bill was created with the intent of preserving historical information regarding slave owners and their slaves in order to provide genealogical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

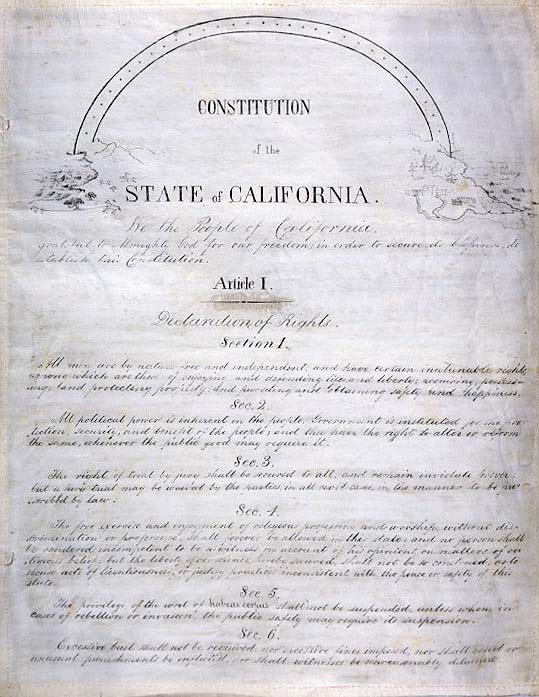

California Law

The law of California consists of several levels, including constitutional, statutory, and regulatory law, as well as case law. The California Codes form the general statutory law, and most state agency regulations are available in the California Code of Regulations. Sources of law The Constitution of California is the foremost source of state law. Legislation is enacted within the California Statutes, which in turn have been codified into the 29 California Codes. State agencies promulgate regulations with the California Regulatory Notice Register, which are in turn codified in the California Code of Regulations. California's legal system is based on common law, which is interpreted by case law through the decisions of the Supreme Court of California, California Courts of Appeal, and Appellate Divisions of the Superior Courts of California, and published in the '' California Reports'', '' California Appellate Reports'', and ''California Appellate Reports Supplement'', r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Department Of Insurance

The California Department of Insurance (CDI), established in 1868, is the agency charged with overseeing insurance regulations, enforcing statutes mandating consumer protections, educating consumers, and fostering the stability of insurance markets in California. The CDI has authority over how the insurance industry conducts business within California, and licenses and regulates the rates and practices of insurance companies, agents, and brokers in the state. CDI has over 1,300 employees charged with the responsibility of protecting consumer interests. Its budget is primarily derived from funds generated by license fees, assessments, and Proposition 103 recoupment fees. The CDI licenses over 1,500 insurance companies and more than 320,000 insurance agents and insurance brokers in the state of California, United States. The current California Insurance Commissioner is Ricardo Lara. History In the early 1900s, the California State Legislature transformed the CDI into a law enfo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gray Davis

Joseph Graham "Gray" Davis Jr. (born December 26, 1942) is an American attorney and former politician who served as the 37th governor of California from 1999 to 2003. In 2003, only a few months into his second term, Davis was recalled and removed from office. He is the second state governor in U.S. history to have been recalled. A member of the Democratic Party, Davis holds a Bachelor of Arts in history from Stanford University and a Juris Doctor from Columbia Law School. He was awarded a Bronze Star for his service as a captain in the Vietnam War. Prior to serving as governor, Davis was chief of staff to Governor Jerry Brown (1975–81), a California State Assemblyman (1983–87), California State Controller (1987–95) and the 44th lieutenant governor of California (1995–99). During his time as governor, Davis made education his top priority and California spent eight billion dollars more than was required under Proposition 98 during his first term. In California, unde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Slave Owners

The following is a list of slave owners, for which there is a consensus of historical evidence of slave ownership, in alphabetical order by last name. A * Adelicia Acklen (1817–1887), at one time the wealthiest woman in Tennessee, she inherited 750 enslaved people from her husband, Isaac Franklin. * Stair Agnew (1757–1821), land owner, judge and political figure in New Brunswick, he enslaved people and participated in court cases testing the legality of slavery in the colony. * William Aiken (1779–1831), founder and president of the South Carolina Canal and Rail Road Company, enslaved hundreds on his rice plantation. * William Aiken Jr. (1806–1887), 61st Governor of South Carolina, state legislator and member of the U.S. House of Representatives, recorded in the 1850 census as enslaving 878 people. * Isaac Allen (1741–1806), New Brunswick judge, he dissented in an unsuccessful 1799 case challenging slavery (''R v Jones''), freeing his own slaves a short time la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reparations For Slavery

Reparations for slavery is the application of the concept of reparations to victims of slavery and/or their descendants. There are concepts for reparations in legal philosophy and reparations in transitional justice. Reparations can take numerous forms, including: affirmative action, individual monetary payments, settlements, scholarships, waiving of fees, and systemic initiatives to offset injustices, land-based compensation related to independence, apologies and acknowledgements of the injustices, token measures, such as naming a building after someone, or the removal of monuments and renaming of streets that honor slave owners and defenders of slavery. There are instances of reparations for slavery, relating to the Atlantic slave trade, dating back to at least 1783 in North America, with a growing list of modern day examples of reparations for slavery in the United States in 2020 as the call for reparations in the US has been bolstered by protests around police brutality a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Slavery In The United States

The legal institution of human chattel slavery, comprising the enslavement primarily of Africans and African Americans, was prevalent in the United States of America from its founding in 1776 until 1865, predominantly in the South. Slavery was established throughout European colonization in the Americas. From 1526, during early colonial days, it was practiced in what became Britain's colonies, including the Thirteen Colonies that formed the United States. Under the law, an enslaved person was treated as property that could be bought, sold, or given away. Slavery lasted in about half of U.S. states until abolition. In the decades after the end of Reconstruction, many of slavery's economic and social functions were continued through segregation, sharecropping, and convict leasing. By the time of the American Revolution (1775–1783), the status of enslaved people had been institutionalized as a racial caste associated with African ancestry. During and immediately ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Law Of California

The law of California consists of several levels, including constitutional, statutory, and regulatory law, as well as case law. The California Codes form the general statutory law, and most state agency regulations are available in the California Code of Regulations. Sources of law The Constitution of California is the foremost source of state law. Legislation is enacted within the California Statutes, which in turn have been codified into the 29 California Codes. State agencies promulgate regulations with the California Regulatory Notice Register, which are in turn codified in the California Code of Regulations. California's legal system is based on common law, which is interpreted by case law through the decisions of the Supreme Court of California, California Courts of Appeal, and Appellate Divisions of the Superior Courts of California, and published in the ''California Reports'', '' California Appellate Reports'', and ''California Appellate Reports Supplement'', respe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Law

Insurance law is the practice of law surrounding insurance, including insurance policies and claims. It can be broadly broken into three categories - regulation of the business of insurance; regulation of the content of insurance policies, especially with regard to consumer policies; and regulation of claim handling wise. History The earliest form of insurance is probably marine insurance, although forms of mutuality (group self-insurance) existed before that. Marine insurance originated with the merchants of the Hanseatic league and the financiers of Lombardy in the 12th and 13th centuries, recorded in the name of Lombard Street in the City of London, the oldest trading insurance market. In those early days, insurance was intrinsically coupled with the expansion of mercantilism, and exploration (and exploitation) of new sources of gold, silver, spices, furs and other precious goods - including slaves - from the New World. For these merchant adventurers, insurance was the "mean ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Law

Insurance law is the practice of law surrounding insurance, including insurance policies and claims. It can be broadly broken into three categories - regulation of the business of insurance; regulation of the content of insurance policies, especially with regard to consumer policies; and regulation of claim handling wise. History The earliest form of insurance is probably marine insurance, although forms of mutuality (group self-insurance) existed before that. Marine insurance originated with the merchants of the Hanseatic league and the financiers of Lombardy in the 12th and 13th centuries, recorded in the name of Lombard Street in the City of London, the oldest trading insurance market. In those early days, insurance was intrinsically coupled with the expansion of mercantilism, and exploration (and exploitation) of new sources of gold, silver, spices, furs and other precious goods - including slaves - from the New World. For these merchant adventurers, insurance was the "mean ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |