|

Econometric Modeling

Econometrics is an application of Statistics, statistical methods to economic data in order to give Empirical evidence, empirical content to economic relationships.M. Hashem Pesaran (1987). "Econometrics", ''The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 [pp. 8–22]. Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1 [pp. 1–34].Abstract (The New Palgrave Dictionary of Economics, 2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic Phenomenon, phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used toda ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistics

Statistics (from German language, German: ', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a scientific, industrial, or social problem, it is conventional to begin with a statistical population or a statistical model to be studied. Populations can be diverse groups of people or objects such as "all people living in a country" or "every atom composing a crystal". Statistics deals with every aspect of data, including the planning of data collection in terms of the design of statistical survey, surveys and experimental design, experiments. When census data (comprising every member of the target population) cannot be collected, statisticians collect data by developing specific experiment designs and survey sample (statistics), samples. Representative sampling assures that inferences and conclusions can reasonably extend from the sample ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bias Of An Estimator

In statistics, the bias of an estimator (or bias function) is the difference between this estimator's expected value and the true value of the parameter being estimated. An estimator or decision rule with zero bias is called ''unbiased''. In statistics, "bias" is an property of an estimator. Bias is a distinct concept from consistency: consistent estimators converge in probability to the true value of the parameter, but may be biased or unbiased (see bias versus consistency for more). All else being equal, an unbiased estimator is preferable to a biased estimator, although in practice, biased estimators (with generally small bias) are frequently used. When a biased estimator is used, bounds of the bias are calculated. A biased estimator may be used for various reasons: because an unbiased estimator does not exist without further assumptions about a population; because an estimator is difficult to compute (as in unbiased estimation of standard deviation); because a biased esti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Polynomial Least Squares

In statistics, polynomial regression is a form of regression analysis in which the relationship between the independent variable ''x'' and the dependent variable ''y'' is modeled as a polynomial in ''x''. Polynomial regression fits a nonlinear relationship between the value of ''x'' and the corresponding conditional mean of ''y'', denoted E(''y'' , ''x''). Although polynomial regression fits a nonlinear model to the data, as a statistical estimation problem it is linear, in the sense that the regression function E(''y'' , ''x'') is linear in the unknown parameters that are estimated from the data. Thus, polynomial regression is a special case of linear regression. The explanatory (independent) variables resulting from the polynomial expansion of the "baseline" variables are known as higher-degree terms. Such variables are also used in classification settings. History Polynomial regression models are usually fit using the method of least squares. The leas ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Hypothesis Testing

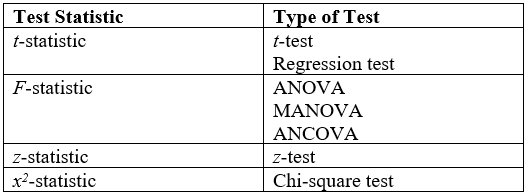

A statistical hypothesis test is a method of statistical inference used to decide whether the data provide sufficient evidence to reject a particular hypothesis. A statistical hypothesis test typically involves a calculation of a test statistic. Then a decision is made, either by comparing the test statistic to a Critical value (statistics), critical value or equivalently by evaluating a p-value, ''p''-value computed from the test statistic. Roughly 100 list of statistical tests, specialized statistical tests are in use and noteworthy. History While hypothesis testing was popularized early in the 20th century, early forms were used in the 1700s. The first use is credited to John Arbuthnot (1710), followed by Pierre-Simon Laplace (1770s), in analyzing the human sex ratio at birth; see . Choice of null hypothesis Paul Meehl has argued that the epistemological importance of the choice of null hypothesis has gone largely unacknowledged. When the null hypothesis is predicted by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Significance

In statistical hypothesis testing, a result has statistical significance when a result at least as "extreme" would be very infrequent if the null hypothesis were true. More precisely, a study's defined significance level, denoted by \alpha, is the probability of the study rejecting the null hypothesis, given that the null hypothesis is true; and the p-value, ''p''-value of a result, ''p'', is the probability of obtaining a result at least as extreme, given that the null hypothesis is true. The result is said to be ''statistically significant'', by the standards of the study, when p \le \alpha. The significance level for a study is chosen before data collection, and is typically set to 5% or much lower—depending on the field of study. In any experiment or Observational study, observation that involves drawing a Sampling (statistics), sample from a Statistical population, population, there is always the possibility that an observed effect would have occurred due to sampling error al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ceteris Paribus

' (also spelled ') (Classical ) is a Latin phrase, meaning "other things equal"; some other English translations of the phrase are "all other things being equal", "other things held constant", "all else unchanged", and "all else being equal". A statement about a causal, empirical, moral, or logical relation between two states of affairs is ''ceteris paribus'' if it is acknowledged that the statement, although usually accurate in expected conditions, can fail because of, or the relation can be abolished by, intervening factors. chapter 2 A ''ceteris paribus'' assumption is often key to scientific inquiry, because scientists seek to eliminate factors that perturb a relation of interest. Thus epidemiologists, for example, may seek to control independent variables as factors that may influence dependent variables—the outcomes of interest. Likewise, in scientific modeling, simplifying assumptions permit illustration of concepts considered relevant to the inquiry. An example ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performance of a country or region. Several national and international economic organizations maintain definitions of GDP, such as the OECD and the International Monetary Fund. GDP is often used as a metric for international comparisons as well as a broad measure of economic progress. It is often considered to be the world's most powerful statistical indicator of national development and progress. The GDP can be divided by the total population to obtain the average GDP per capita. Total GDP can also be broken down into the contribution of each industry or sector of the economy. Nominal GDP is useful when comparing national economies on the international market according to the exchange rate. To compare economies over time inflation can be adjus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Okun's Law

In economics, Okun's law is an Empirical research, empirically observed relationship between unemployment and losses in a country's production. It is named after Arthur Melvin Okun, who first proposed the relationship in 1962. The "gap version" states that for every 1% increase in the unemployment rate, a country's Gross Domestic Product, GDP will be roughly an additional 2% lower than its potential GDP. The "difference version" describes the relationship between quarterly changes in unemployment and quarterly changes in real GDP. The stability and usefulness of the law has been disputed. Imperfect relationship Okun's law is an empirical relationship. In Okun's original statement of his law, a 2% increase in output corresponds to a 1% decline in the rate of cyclical unemployment; a 0.5% increase in labor force participation; a 0.5% increase in hours worked per employee; and a 1% increase in output per hours worked (labor productivity). Okun's law states that a one-point increase ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Forecasting

Economic forecasting is the process of making predictions about the economy. Forecasts can be carried out at a high level of aggregation—for example for GDP, inflation, unemployment or the fiscal deficit—or at a more disaggregated level, for specific sectors of the economy or even specific firms. Economic forecasting is a measure to find out the future prosperity of a pattern of investment and is the key activity in economic analysis. Many institutions engage in economic forecasting: national governments, banks and central banks, consultants and private sector entities such as think-tanks, and companies or international organizations such as the International Monetary Fund, World Bank and the OECD. A broad range of forecasts are collected and compiled b"Consensus Economics" Some forecasts are produced annually, but many are updated more frequently. The economist typically considers risks (i.e., events or conditions that can cause the result to vary from their initial estimat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic History

Economic history is the study of history using methodological tools from economics or with a special attention to economic phenomena. Research is conducted using a combination of historical methods, statistical methods and the Applied economics, application of economic theory to historical situations and institutions. The field can encompass a wide variety of topics, including equality, finance, technology, labour, and business. It emphasizes historicizing the economy itself, analyzing it as a dynamic entity and attempting to provide insights into the way it is structured and conceived. Using both quantitative data and Qualitative data, qualitative sources, economic historians emphasize understanding the historical context in which major economic events take place. They often focus on the institutional dynamics of systems of Production (economics), production, Wage labour, labor, and Capital (economics), capital, as well as the economy's impact on society, culture, and language. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometric Model

Econometric models are statistical models used in econometrics. An econometric model specifies the statistics, statistical relationship that is believed to hold between the various economic quantities pertaining to a particular economic phenomenon. An econometric model can be derived from a Deterministic system (philosophy), deterministic economic model by allowing for uncertainty, or from an economic model which itself is stochastic. However, it is also possible to use econometric models that are not tied to any specific economic theory. A simple example of an econometric model is one that assumes that monthly Consumption (economics), spending by consumers is linearly Dependent and independent variables, dependent on consumers' income in the previous month. Then the model will consist of the equation :C_t = a + bY_ + e_t, where ''C''''t'' is consumer spending in month ''t'', ''Y''''t''-1 is income during the previous month, and ''et'' is an Errors and residuals in statistics, err ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |