|

Counterparty

A counterparty (sometimes contraparty) is a Juristic person, legal entity, unincorporated entity, or collection of entities to which an exposure of financial risk may exist. The word became widely used in the 1980s, particularly at the time of the Basel I deliberations in 1988. Well-drafted contracts usually attempt to spell out in explicit detail what each counterparty's rights and obligations are in every conceivable circumstance, though there are limits. There are general provisions for how counterparties are treated under the law, and (at least in common law legal systems) there are many legal precedents that shape the common law. Financial services sector Within the financial services sector, the term market counterparty is used to refer to governments, public banks, national monetary authorities and international monetary organisations such as the World Bank Group that act as the ultimate guarantor for loans and indemnities. The term may also be applied, in a more general se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Counterparty Risk

Credit risk is the chance that a borrower does not repay a loan or fulfill a loan obligation. For lenders the risk includes late or lost interest and principal payment, leading to disrupted cash flows and increased collection costs. The loss may be complete or partial. In an efficient market, higher levels of credit risk will be associated with higher borrowing costs. Because of this, measures of borrowing costs such as yield spreads can be used to infer credit risk levels based on assessments by market participants. Losses can arise in a number of circumstances, for example: * A consumer may fail to make a payment due on a mortgage loan, credit card, line of credit, or other loan. * A company is unable to repay asset-secured fixed or floating charge debt. * A business or consumer does not pay a trade invoice when due. * A business does not pay an employee's earned wages when due. * A business or government bond issuer does not make a payment on a coupon or principal p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swaps (finance)

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.Financial Industry Business Ontology Version 2 , Annex D: Derivatives, EDM Council, Inc., Object Management Group, Inc., 2019 The general swap can also be seen as a series of forward contracts through which two parties exchange financial instruments, resulting in a common series of exchange dates and two streams of instruments, the ''legs'' of the swap. The legs can be almost anything but usually one leg involves cash flows based on a |

Over-the-counter (finance)

Over-the-counter (OTC) or off-exchange trading or pink sheet trading is done directly between two parties, without the supervision of an exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, providing transparency, and maintaining the current market price. In an OTC trade, the price is not necessarily publicly disclosed. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivatives of such products. Products traded on traditional stock exchanges, and other regulated bourse platforms, must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in stock exchange-based equities trading. The OTC market does not have this limitation. Parties may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel I

Basel I is the first Basel Accord. It arose from deliberations by central bankers from major countries during the late 1970s and 1980s. In 1988, the Basel Committee on Banking Supervision (BCBS) in Basel, Switzerland, published a set of minimum capital requirements for banks. It is also known as the 1988 Basel Accord, and was enforced by law in the Group of Ten (G-10) countries in 1992. Background The Committee was formed in response to the messy liquidation of Cologne-based Herstatt Bank in 1974. On 26 June 1974 a number of banks had released Deutschmarks (the German currency) to the Herstatt Bank in exchange for dollar payments deliverable in New York City. Due to differences in the time zones, there was a lag in the dollar payment to the counterparty banks; during this lag period, before the dollar payments could be effected in New York, the Herstatt Bank was liquidated by German regulators. This incident prompted the G-10 nations to form the Basel Committee on Ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Bank

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also include currency gains ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract Law

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more Party (law), parties. A contract typically involves consent to transfer of goods, Service (economics), services, money, or promise to transfer any of those at a future date. The activities and intentions of the parties entering into a contract may be referred to as contracting. In the event of a breach of contract, the injured party may seek legal remedy, judicial remedies such as damages or equitable remedies such as specific performance or Rescission (contract law), rescission. A binding agreement between actors in international law is known as a treaty. Contract law, the field of the law of obligations concerned with contracts, is based on the principle that pacta sunt servanda, agreements must be honoured. Like other areas of private law, contract law varies between jurisdictions. In general, contract law is exercised and governed either under common law jur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is referred to as the "ceding company" or "cedent". The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain Solvency, solvent after major claims events, such as major disasters like hurricanes or wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies that accept reinsur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge University Press

Cambridge University Press was the university press of the University of Cambridge. Granted a letters patent by King Henry VIII in 1534, it was the oldest university press in the world. Cambridge University Press merged with Cambridge Assessment to form Cambridge University Press and Assessment under Queen Elizabeth II's approval in August 2021. With a global sales presence, publishing hubs, and offices in more than 40 countries, it published over 50,000 titles by authors from over 100 countries. Its publications include more than 420 academic journals, monographs, reference works, school and university textbooks, and English language teaching and learning publications. It also published Bibles, runs a bookshop in Cambridge, sells through Amazon, and has a conference venues business in Cambridge at the Pitt Building and the Sir Geoffrey Cass Sports and Social Centre. It also served as the King's Printer. Cambridge University Press, as part of the University of Cambridge, was a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cambridge

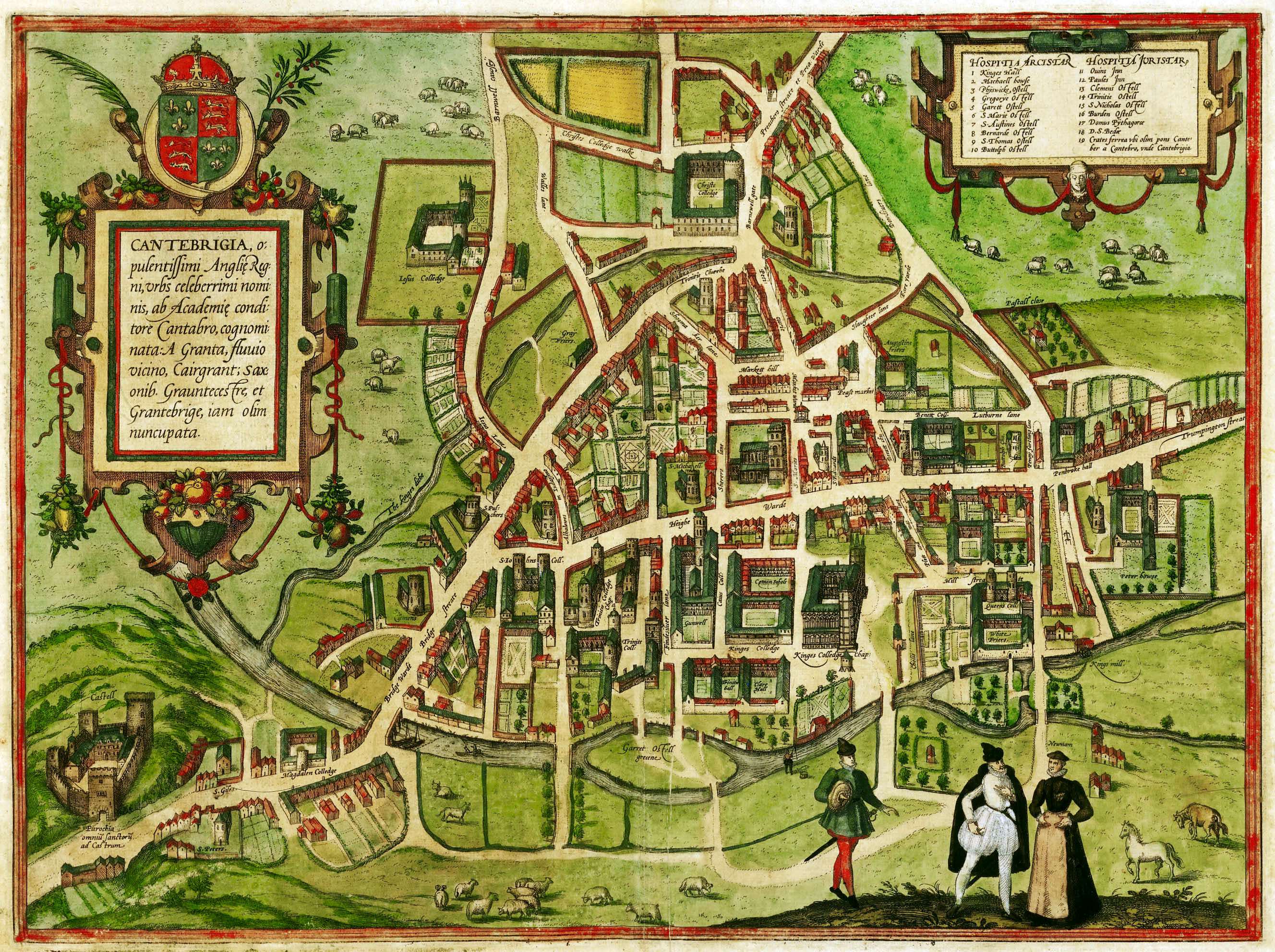

Cambridge ( ) is a List of cities in the United Kingdom, city and non-metropolitan district in the county of Cambridgeshire, England. It is the county town of Cambridgeshire and is located on the River Cam, north of London. As of the 2021 United Kingdom census, the population of the City of Cambridge was 145,700; the population of the wider built-up area (which extends outside the city council area) was 181,137. (2021 census) There is archaeological evidence of settlement in the area as early as the Bronze Age, and Cambridge became an important trading centre during the Roman Britain, Roman and Viking eras. The first Town charter#Municipal charters, town charters were granted in the 12th century, although modern city status was not officially conferred until 1951. The city is well known as the home of the University of Cambridge, which was founded in 1209 and consistently ranks among the best universities in the world. The buildings of the university include King's College Chap ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Juristic Person

A juridical person is a legal person that is not a natural person but an organization recognized by law as a fictitious person such as a corporation, government agency, non-governmental organisation, or international organization (such as the European Union). Other terms include artificial person, corporate person, judicial person, juridical entity, juridic person, or juristic person. A juridical person maintains certain duties and rights as enumerated under relevant laws. The rights and responsibilities of a juridical person are distinct from those of the natural persons constituting it. Since the beginning of writing at the start of recorded history, associations have been known as the original form of the juridical person. This is documented for the 1st century A.D. for Jewish trading companies. In Roman law, entities gained significance through institutions such as the state, communities, corporations (''universitates'') and their associations of persons and assets, as well ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |