|

Contestable Market

In economics, the theory of contestable markets, associated primarily with its 1982 proponent William J. Baumol, held that there are markets served by a small number of firms that are nevertheless characterized by competitive equilibrium, and therefore desirable welfare outcomes, because of the existence of potential short-term entrants.Brock, 1983. p.1055. Theory A perfectly contestable market has three main features: # No entry or exit barriers # No sunk costs # The same level of technology is available to incumbent businesses and new entrants. A perfectly contestable market is not possible in real life. Instead, the degree of contestability can be observed within markets. The more contestable a market is, the closer it will be to a perfectly contestable market. Some economists argue that determining price and output is actually dependent not on the type of market structure (whether it is a monopoly or perfectly competitive market) but on the threat of competition.Critic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is a behavioral science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyses what is viewed as basic elements within economy, economies, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyses economies as systems where production, distribution, consumption, savings, and Expenditure, investment expenditure interact; and the factors of production affecting them, such as: Labour (human activity), labour, Capital (economics), capital, Land (economics), land, and Entrepreneurship, enterprise, inflation, economic growth, and public policies that impact gloss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition Law

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law (or just antitrust), anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies (known as trusts) is commonly known as trust busting. The history of competition law reaches back to the Roman Empire. The business practices of market traders, guilds and governments have always been subject to scrutiny, and sometimes severe sanctions. Since the 20th century, competition law has become global. The two largest and most influential systems of competition regulation are United States antitrust law and European Union competition law. National and regional competition authorities across the world have formed international support and enforcement networks. Modern competition law ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Stigler

George Joseph Stigler (; January 17, 1911 – December 1, 1991) was an American economist. He was the 1982 laureate in Nobel Memorial Prize in Economic Sciences and is considered a key leader of the Chicago school of economics. Early life and education Stigler was born in Seattle, Washington, the son of Hungarian Elsie Elizabeth (Erzsébet Hungler, born in Bakonypéterd, Veszprém county, Kingdom of Hungary) and Bavarian Joseph Stigler. He was of German and Hungarian descent and spoke German in his childhood. He graduated from the University of Washington in 1931 with a B.A. and then spent a year at Northwestern University, from which he obtained his MBA in 1932. It was during his studies at Northwestern that Stigler developed an interest in economics and decided on an academic career. After he received a tuition scholarship from the University of Chicago, Stigler enrolled there in 1933 to study economics and went on to earn his PhD in economics in 1938. Career Stigler t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

A Dictionary Of Economics

A, or a, is the first letter and the first vowel letter of the Latin alphabet, used in the modern English alphabet, and others worldwide. Its name in English is '' a'' (pronounced ), plural ''aes''. It is similar in shape to the Ancient Greek letter alpha, from which it derives. The uppercase version consists of the two slanting sides of a triangle, crossed in the middle by a horizontal bar. The lowercase version is often written in one of two forms: the double-storey and single-storey . The latter is commonly used in handwriting and fonts based on it, especially fonts intended to be read by children, and is also found in italic type. In English, '' a'' is the indefinite article, with the alternative form ''an''. Name In English, the name of the letter is the ''long A'' sound, pronounced . Its name in most other languages matches the letter's pronunciation in open syllables. History The earliest known ancestor of A is ''aleph''—the first letter of the Phoenician ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

William Baumol

William Jack Baumol (February 26, 1922 – May 4, 2017) was an American economist. He was a professor of economics at New York University, Academic Director of the Berkley Center for Entrepreneurship and Innovation, and professor emeritus at Princeton University. He was a prolific author of more than eighty books and several hundred journal articles. He is the namesake of the Baumol effect. Baumol wrote extensively about labor market and other economic factors that affect the economy. He also made significant contributions to the theory of entrepreneurship and the history of economic thought. He is among the most influential economists in the world according to IDEAS/RePEc. He was elected a Fellow of the American Academy of Arts and Sciences in 1971, the American Philosophical Society in 1977, and the United States National Academy of Sciences in 1987. Baumol was considered a candidate for the Nobel Prize in Economics for 2003, and Thomson Reuters cited him as a potential reci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

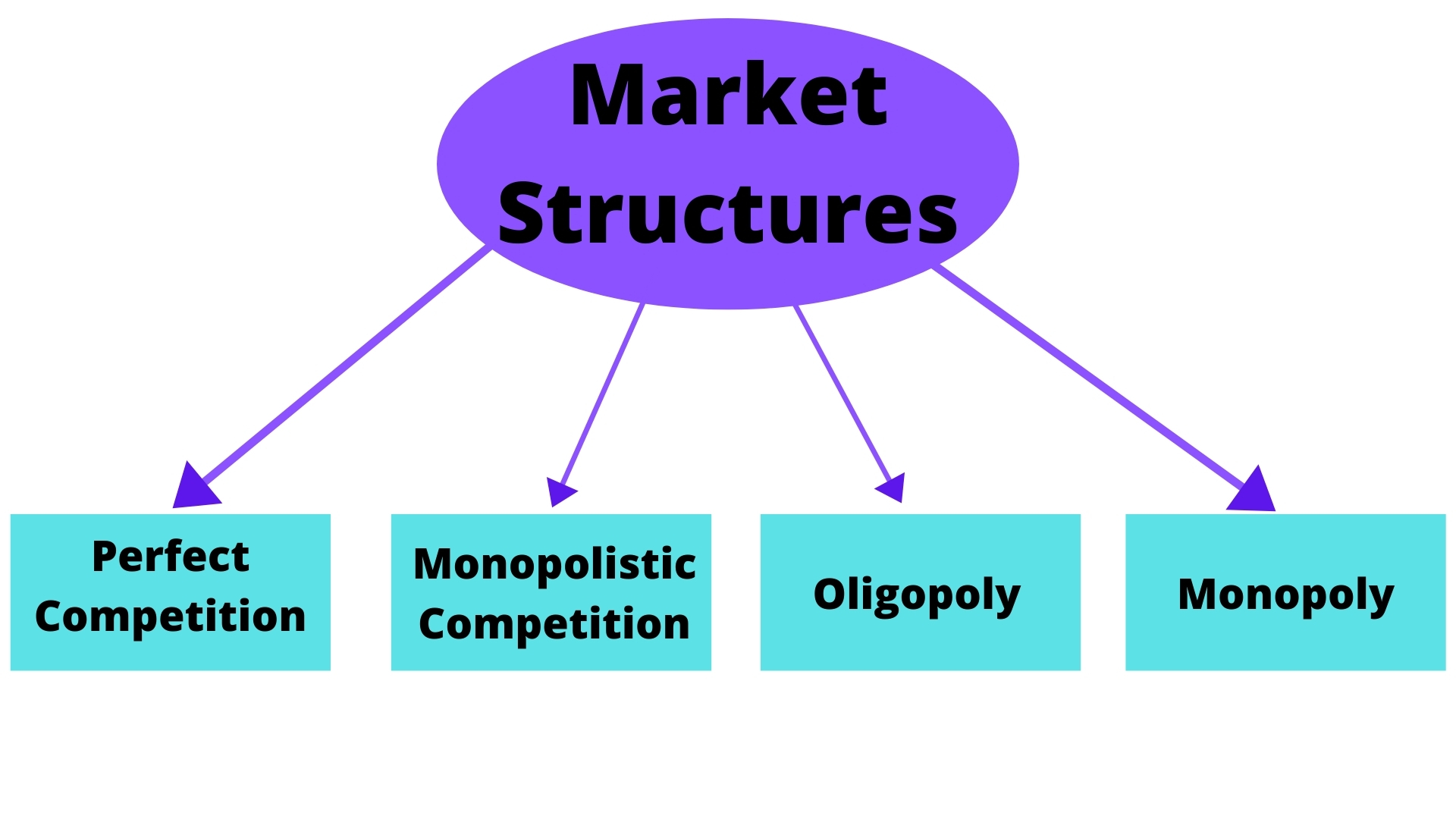

Perfect Competition

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In Economic model, theoretical models where conditions of perfect competition hold, it has been demonstrated that a Market (economics), market will reach an Economic equilibrium, equilibrium in which the quantity supplied for every Goods and services, product or service, including Workforce, labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum. Perfect competition provides both allocative efficiency and productive efficiency: * Such markets are ''allocatively efficient'', as output will always occur where marginal cost is equal to average revenue i.e. price (MC = AR). In perfect competition, any Profit maximization, profit-maximizing producer faces a market price equal to its marginal cost (P = MC). This implies that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monopolistic Competition

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other but selling products that are differentiated from one another (e.g., branding, quality) and hence not perfect substitutes. For monopolistic competition, a company takes the prices charged by its rivals as given and ignores the effect of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition make evolve into government-granted monopoly. Unlike perfect competition, the company may maintain spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The earliest developer of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Coercive Monopoly

In economics and business ethics, a coercive monopoly is a firm that is able to raise prices and make production decisions without the risk that competition will arise to draw away their customers. Greenspan, Alan"Antitrust", in ''Capitalism:The Unknown Ideal'' by Ayn Rand. Als by Nathaniel Branden defines and discusses coercive monopoly. A coercive monopoly is not merely a sole supplier of a particular kind of good or service (a monopoly), but it is a monopoly where there is no opportunity to compete with it through means such as price competition, technological or product innovation, or marketing; entry into the field is closed. As a coercive monopoly is securely shielded from the possibility of competition, it is able to make pricing and production decisions with the assurance that no competition will arise. It is a case of a non-contestable market. A coercive monopoly has very few incentives to keep prices low and may deliberately price gouge consumers by curtailing production ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bertrand–Edgeworth Model

In microeconomics, the Bertrand–Edgeworth model of price-setting oligopoly explores what happens when firms compete to sell a homogeneous product (a good for which consumers buy only from the cheapest available seller) but face limits on how much they can supply. Unlike in the standard Bertrand competition model, where firms are assumed to meet all demand at their chosen price, the Bertrand–Edgeworth model assumes each firm has a capacity constraint: a fixed maximum output it can sell, regardless of price. This constraint may be physical (as in Edgeworth’s formulation) or may depend on price or other conditions. A key result of the model is that pure-strategy price equilibria may fail to exist, even with just two firms, because firms have an incentive to undercut competitors' prices until they hit their capacity constraints. As a result, the model can lead to price cycles or the emergence of mixed-strategy equilibria, where firms randomize over prices. History Joseph Lo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Oligopoly

An oligopoly () is a market in which pricing control lies in the hands of a few sellers. As a result of their significant market power, firms in oligopolistic markets can influence prices through manipulating the supply function. Firms in an oligopoly are mutually interdependent, as any action by one firm is expected to affect other firms in the market and evoke a reaction or consequential action. As a result, firms in oligopolistic markets often resort to collusion as means of maximising profits. Nonetheless, in the presence of fierce competition among market participants, oligopolies may develop without collusion. This is a situation similar to perfect competition, where oligopolists have their own market structure. In this situation, each company in the oligopoly has a large share in the industry and plays a pivotal, unique role. Many jurisdictions deem collusion to be illegal as it violates competition laws and is regarded as anti-competition behaviour. The EU com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Power

In economics, market power refers to the ability of a theory of the firm, firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market power occurs if a firm does not face a perfectly elastic demand curve and can set its price (P) above marginal cost (MC) without losing revenue. This indicates that the magnitude of market power is associated with the gap between P and MC at a firm's profit maximising level of output. The size of the gap, which encapsulates the firm's level of market dominance, is determined by the residual demand curve's form. A steeper reverse demand indicates higher earnings and more dominance in the market. Such propensities contradict Perfect competition, perfectly competitive markets, where market participants have no market power, P = MC and firms earn zero economic profit. Market participants in perfectly competitive markets are cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excess Profit

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both explicit and implicit costs. It is different from accounting profit, which only relates to the explicit costs that appear on a firm's financial statements. An accountant measures the firm's accounting profit as the firm's total revenue minus only the firm's explicit costs. An economist includes all costs, both explicit and implicit costs, when analyzing a firm. Therefore, economic profit is smaller than accounting profit. ''Normal profit'' is often viewed in conjunction with economic profit. Normal profits in business refer to a situation where a company generates revenue that is equal to the total costs incurred in its operation, thus allowing it to remain operational in a competitive industry. It is the minimum profit level that a company can ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |