|

Bond Market

The bond market (also debt market or credit market) is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market (total debt outstanding) is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to Securities Industry and Financial Markets Association (SIFMA). Bonds and bank loans form what is known as the ''credit market''. The global credit market in aggregate is about three times the size of the global equity market. Bank loans are not securities under the Securities and Exchange Act, but bonds typically are and are therefore more highly regulated. Bonds are typically not secured by col ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield Curve

In finance, the yield curve is a graph which depicts how the yields on debt instruments - such as bonds - vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity. Those who issue and trade in forms of debt, such as loans and bonds, use yield curves to determine their value. Shifts in the shape and slope of the yield curve are thought to be related to investor expectations for the economy and interest rates. Ronald Melicher and Merle Welshans have identified several characteristics of a properly constructed yield curve. It should be based on a set of securities which have differing lengths of time to maturity, and all yields should be calculated as of the same point in time. All securities measured in the yield curve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

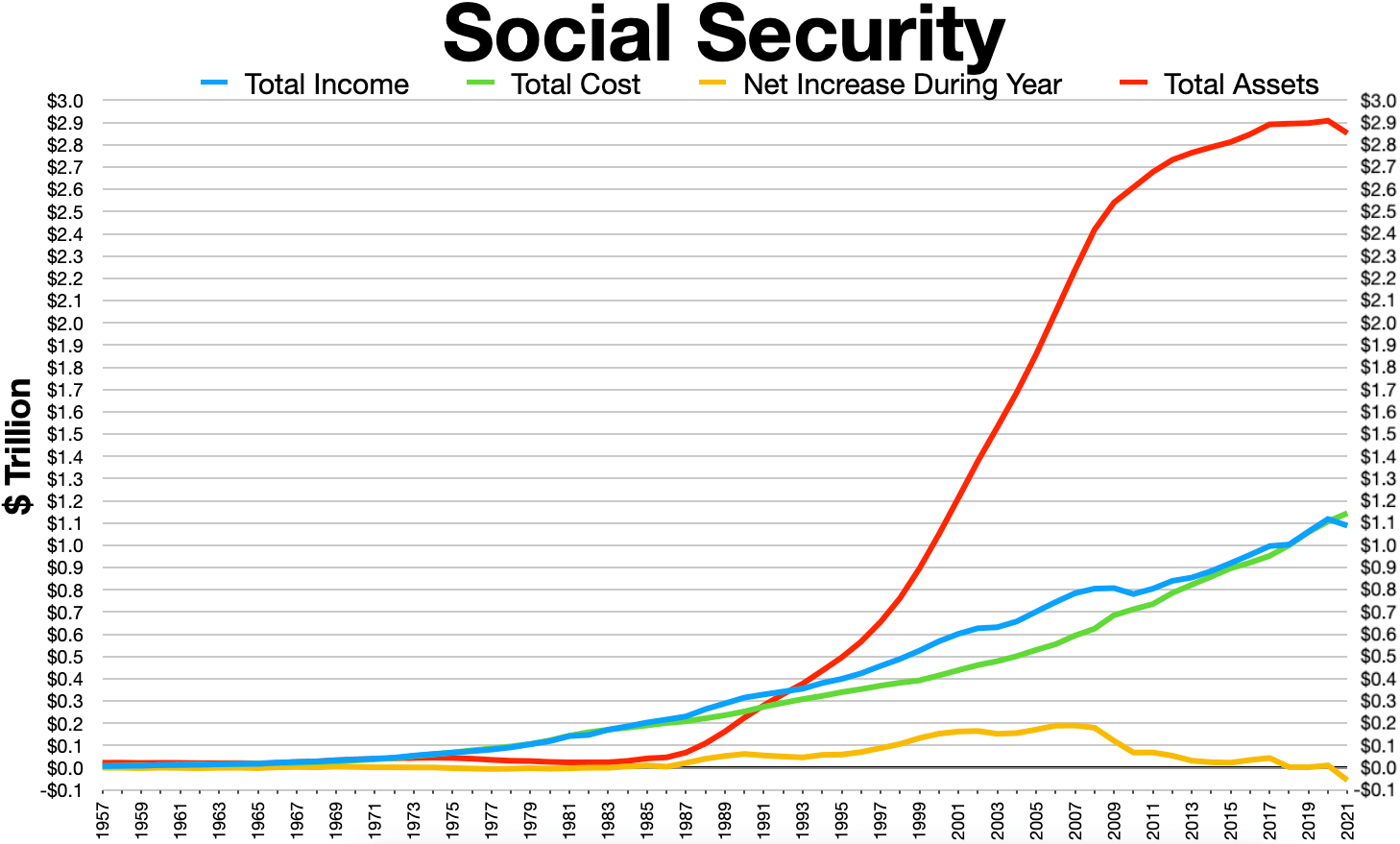

Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and Disability Insurance; OASDI) benefits administered by the United States Social Security Administration. The Social Security Administration collects payroll taxes and uses the money collected to pay Old-Age, Survivors, and Disability Insurance benefits by way of trust funds. When the program runs a surplus, the excess funds increase the value of the Trust Fund. As of 2021, the Trust Fund contained (or alternatively, was owed) $2.908 trillion The Trust Fund is required by law to be invested in non-marketable securities issued and guaranteed by the "full faith and credit" of the federal government. These securities earn a market rate of interest. Excess funds are used by the government for non-Social Security purposes, creating the obligatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and regulating banks, maintaining the stabil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north toward the East China Sea, Philippine Sea, and Taiwan in the south. Japan is a part of the Ring of Fire, and spans Japanese archipelago, an archipelago of List of islands of Japan, 6852 islands covering ; the five main islands are Hokkaido, Honshu (the "mainland"), Shikoku, Kyushu, and Okinawa Island, Okinawa. Tokyo is the Capital of Japan, nation's capital and largest city, followed by Yokohama, Osaka, Nagoya, Sapporo, Fukuoka, Kobe, and Kyoto. Japan is the List of countries and dependencies by population, eleventh most populous country in the world, as well as one of the List of countries and dependencies by population density, most densely populated and Urbanization by country, urbanized. About three-fourths of Geography of Japan, the c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Funds

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital') and open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond or fixed income funds, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. Primary structures of mutual funds are open-end funds, closed-end funds, unit investment trusts. Open-end funds are purchased from or sold to the issuer at the net asset value of each share as of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Funds

A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income. Pension funds typically have large amounts of money to invest and are the major investors in listed and private companies. They are especially important to the stock market where large institutional investors dominate. The largest 300 pension funds collectively hold about USD$6 trillion in assets. In 2012, PricewaterhouseCoopers estimated that pension funds worldwide hold over $33.9 trillion in assets (and were expected to grow to more than $56 trillion by 2020), the largest for any category of institutional investor ahead of mutual funds, insurance companies, currency reserves, sovereign wealth funds, hedge funds, or private equity. The Federal Old-age and Survivors Insurance Trust Fund, which oversees $2.66 trillion in assets, is the world's largest public pension fund. Classifications Open vs. closed pension fund Open pension funds sup ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trader (finance)

A trader is a person, firm, or entity in finance who buys and sells financial instruments, such as forex, cryptocurrencies, stocks, bonds, commodities, derivatives, and mutual funds in the capacity of agent, hedger, arbitrageur, or speculator. Duties and types Traders buy and sell financial instruments traded in the stock markets, derivatives markets and commodity markets, comprising the stock exchanges, derivatives exchanges, and the commodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, including: *Bond trader *Floor trader *Hedge fund trader * High-frequency trader *Market maker * Pattern day trader * Principal trader * Proprietary trader *Rogue trader *Scalper * Stock trader Income According to the Wall Street Journal in 2004, a managing director convertible bond trader was earning between $700,000 and $900,000 on average. See also *Commodities exchange *Commodity market *Derivatives market * List of commodity tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investor

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment managem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateralized Debt Obligation

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing mortgage-backed securities (MBS).Lepke, Lins and Pi card, ''Mortgage-Backed Securities'', §5:15 (Thomson West, 2014). Like other private label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the CDO collects from the pool of bonds or other assets it owns. Distinctively, CDO credit risk is typically assessed based on a probability of default (PD) derived from ratings on those bonds or assets. The CDO is "sliced" into sections known as "tranches", which "catch" the cash flow of interest and principal payments in sequence based on seniority. If some loans default and the cash collected by the CDO is insufficient to pay all of its investors, those in the lowest, most "junior" tranches suffer l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |