|

Bankers' Clearing House

Cheque clearing (or check clearing in American English) or bank clearance is the process of moving cash (or its equivalent) from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds. History England Cheques came into use in England in the 1600s. The person to whom the cheque was drawn (the "payee") could go to the drawer's bank ("the issuing bank") and present the cheque and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American And British English Spelling Differences

Despite the various English dialects spoken from country to country and within different regions of the same country, there are only slight regional variations in English orthography, the two most notable variations being British and American spelling. Many of the differences between American and British English date back to a time before spelling standards were developed. For instance, some spellings seen as "American" today were once commonly used in Britain, and some spellings seen as "British" were once commonly used in the United States. A "British standard" began to emerge following the 1755 publication of Samuel Johnson's '' A Dictionary of the English Language'', and an "American standard" started following the work of Noah Webster and, in particular, his ''An American Dictionary of the English Language'', first published in 1828. Webster's efforts at spelling reform were somewhat effective in his native country, resulting in certain well-known patterns of spelling ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

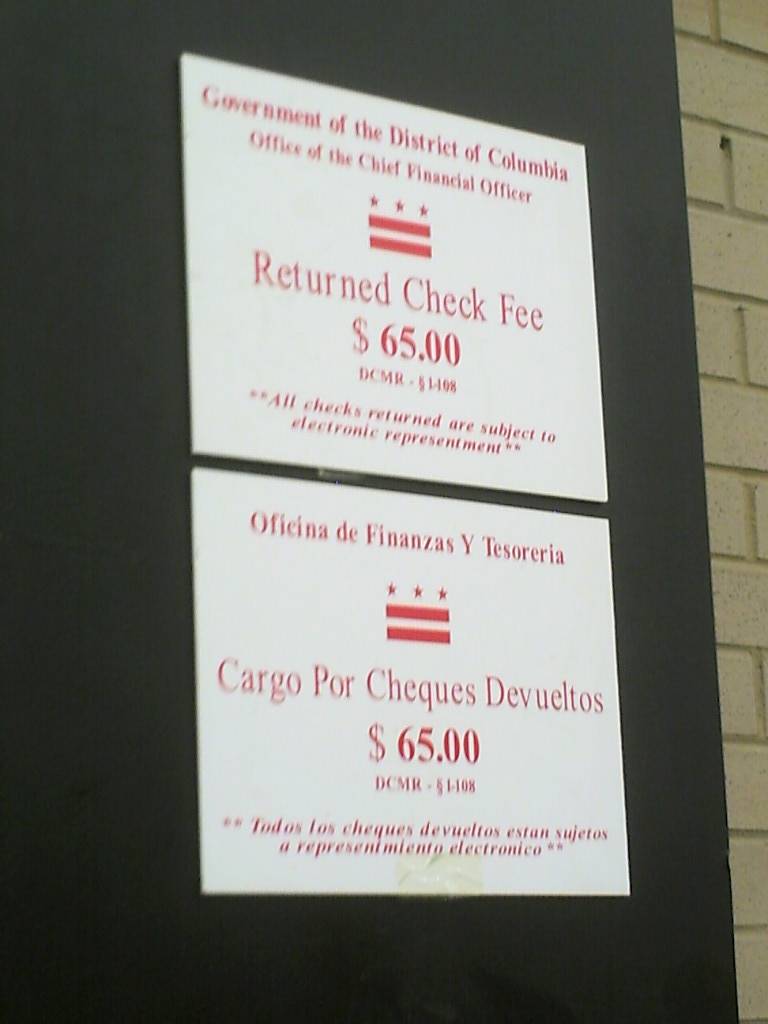

Dishonoured Cheque

Dishonoured cheques (also spelled check) are cheques that a bank on which is drawn declines to pay (“honour”). There are a number of reasons why a bank would refuse to honour a cheque, with non-sufficient funds (NSF) being the most common one, indicating that there are insufficient cleared funds in the account on which the cheque was drawn. An NSF check may be referred to as a bad check, dishonored check, bounced check, cold check, rubber check, returned item, or hot check. In England and Wales and Australia, such cheques are typically returned endorsed "Refer to drawer", an instruction to contact the person issuing the cheque for an explanation as to why it was not paid. If there are funds in an account, but insufficient cleared funds, the cheque is normally endorsed “Present again”, by which time the funds should have cleared. When more than one cheque is presented for payment on the same day, and the payment of both would result in the account becoming overdrawn (or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CHAPS

Chaps ( or ) are sturdy coverings for the legs consisting of leggings and a belt. They are buckled on over trousers with the chaps' integrated belt, but unlike trousers, they have no seat (the term "assless chaps" is a tautology) and are not joined at the crotch. They are designed to provide protection for the legs and are usually made of leather or a leather-like material. Their name is a shortened version of the Spanish word ''chaparajos''. ''Chaparajos'' were named after the chaparral (thick, thorny, low brush) from which they were designed to protect the legs while riding on horseback. Like much of western American horse culture, the origin of ''chaparajos'' was in the south of Spain, from which it then passed on to the part of New Spain that later became Mexico, and has been assimilated into cowboy culture of the American west. They are a protective garment to be used when riding a horse through brushy terrain. In the modern world, they are worn for both practical work pur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Clearing House

An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits. The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low value payments. History The first automated clearing house was BACS in the United Kingdom, which started processing payments in April 1968. In the U.S. in the late 1960s, a group of banks in California sought a replacement for check payments. This led to the first automated clearing house in the US in 1972, operated by the Federal Reserve Bank of San Francisco. BACS operated from the beginning on a net settlement basis. Netting ACH transactions reduces the amount of deposits a bank must hold. Operation ACHs process large volumes of credit and debit transactions in batches. ACH cred ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real-time Gross Settlement

Real-time gross settlement (RTGS) systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a "real-time" and on a " gross" basis. Settlement in "real time" means a payment transaction is not subjected to any waiting period, with transactions being settled as soon as they are processed. "Gross settlement" means the transaction is settled on a one-to-one basis, without bundling or netting with any other transaction. "Settlement" means that once processed, payments are final and irrevocable. History As of 1985, three central banks implemented RTGS systems, while by the end of 2005, RTGS systems had been implemented by 90 central banks. The first system that had the attributes of an RTGS system was the US Fedwire system which was launched in 1970. This was based on a previous method of transferring funds electronically between US federal reserve banks via telegraph. The United Kingdom and France both in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clearing House Interbank Payments System

The Clearing House Interbank Payments System (CHIPS) is a United States private clearing house for large-value transactions. By 2015, it was settling well over US$1.5 trillion a day in around 250,000 interbank payments in cross border and domestic transactions. Together with the Fedwire Funds Service (which is operated by the Federal Reserve Banks), CHIPS forms the primary U.S. network for large-value domestic and international USD payments where it has a market share of around 96%. CHIPS transfers are governed by Article 4A of Uniform Commercial Code. Unlike the Fedwire system which is part of a regulatory body, CHIPS is owned by the financial institutions that use it. For payments that are less time-sensitive in nature, banks typically prefer to use CHIPS instead of Fedwire, as CHIPS is less expensive (both by charges and by funds required). One of the reasons is that Fedwire is a real-time gross settlement system, while CHIPS allows payments to be netted. Differences from Fe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Clearing House

An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits. The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low value payments. History The first automated clearing house was BACS in the United Kingdom, which started processing payments in April 1968. In the U.S. in the late 1960s, a group of banks in California sought a replacement for check payments. This led to the first automated clearing house in the US in 1972, operated by the Federal Reserve Bank of San Francisco. BACS operated from the beginning on a net settlement basis. Netting ACH transactions reduces the amount of deposits a bank must hold. Operation ACHs process large volumes of credit and debit transactions in batches. ACH cred ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electronic Payment

An e-commerce payment system (or an electronic payment system) facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking. Credit cards remain the most common forms of payment for e-commerce transactions. As of 2008, in North America, almost 90% of online retail transactions were made with this payment type.Turban, E. King, D. McKay, J. Marshall, P. Lee, J & Vielhand, D. (2008). Electronic Commerce 2008: A Managerial Perspective. London: Pearson Education Ltd. p.550 It is difficult for an online retailer to operate without supporting credit and debit cards due to their widespread use. Online merchants must comply with stringent rules stipulated by the credit and debit card issuers (e.g. Visa and Mastercard) in accordance with a bank and financial regulation in the countrie ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smartphone

A smartphone is a portable computer device that combines mobile telephone and computing functions into one unit. They are distinguished from feature phones by their stronger hardware capabilities and extensive mobile operating systems, which facilitate wider software, internet (including web browsing over mobile broadband), and multimedia functionality (including music, video, cameras, and gaming), alongside core phone functions such as voice calls and text messaging. Smartphones typically contain a number of metal–oxide–semiconductor (MOS) integrated circuit (IC) chips, include various sensors that can be leveraged by pre-included and third-party software (such as a magnetometer, proximity sensors, barometer, gyroscope, accelerometer and more), and support wireless communications protocols (such as Bluetooth, Wi-Fi, or satellite navigation). Early smartphones were marketed primarily towards the enterprise market, attempting to bridge the functionality ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Remote Deposit

Remote deposit or mobile deposit is the ability of a bank customer to deposit a cheque into a bank account from a remote location, without having to physically deliver the cheque to the bank. This was originally accomplished by scanning a digital image of a cheque into a computer then transmitting that image to the bank, but is now accomplished with a smartphone. The practice became legal in the United States in 2004 when the '' Check Clearing for the 21st Century Act'' (Check 21 Act) took effect, though banks are not required to implement the system. This service was originally used primarily by businesses with dedicated check scanners, but with the spread of smartphones and mobile banking it is now common in consumer banks. History Remote deposits became legal in the United States in 2004 when the ''Check Clearing for the 21st Century Act'' (or Check 21 Act) went into effect. The Act is intended in part to keep the country's financial services operational in the event of a cata ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque Truncation

Cheque truncation (check truncation in American English) is a cheque clearance system that involves the digitization of a physical paper cheque into a substitute electronic form for transmission to the paying bank. The process of cheque clearance, involving data matching and verification, is done using digital images instead of paper copies. Cheque truncation reduces or eliminates the physical movement of paper cheques and reduces the time and cost of cheque clearance. Cheque truncation also offers the potential reduction in settlement periods with the electronic processing of the cheque payment system. History For cheque clearance, a cheque has to be presented to the drawee bank for payment. Originally this was done by taking the cheque to the drawee bank, but as cheque usage increased this became cumbersome and banks arranged to meet each day at a central location to exchange cheques and receive payment in money. This became known as central clearing. Bank customers who rec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |