|

Asymmetric Cointegration

In statistics and econometrics, asymmetric cointegration describes a long-term relationship between variables where positive and negative shocks to the equilibrium have different impacts. This builds upon the concept of cointegration, which refers to a long-term, stable relationship between two or more variables, even if those variables individually fluctuate over time. For example, consider the price of a commodity and the price of a related derivative In mathematics, the derivative is a fundamental tool that quantifies the sensitivity to change of a function's output with respect to its input. The derivative of a function of a single variable at a chosen input value, when it exists, is t .... While both prices might fluctuate daily, they are expected to maintain a long-term equilibrium relationship. However, a sudden increase in the commodity price might lead to a faster adjustment in the derivative price than a sudden decrease. This difference in adjustment speeds would ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistics

Statistics (from German language, German: ', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a scientific, industrial, or social problem, it is conventional to begin with a statistical population or a statistical model to be studied. Populations can be diverse groups of people or objects such as "all people living in a country" or "every atom composing a crystal". Statistics deals with every aspect of data, including the planning of data collection in terms of the design of statistical survey, surveys and experimental design, experiments. When census data (comprising every member of the target population) cannot be collected, statisticians collect data by developing specific experiment designs and survey sample (statistics), samples. Representative sampling assures that inferences and conclusions can reasonably extend from the sample ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econometrics

Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. M. Hashem Pesaran (1987). "Econometrics", '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8–22 Reprinted in J. Eatwell ''et al.'', eds. (1990). ''Econometrics: The New Palgrave''p. 1 p. 1–34Abstract ( 2008 revision by J. Geweke, J. Horowitz, and H. P. Pesaran). More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today. A basic tool for econometrics is the multiple linear regression model. ''Econome ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Random Variable

A random variable (also called random quantity, aleatory variable, or stochastic variable) is a Mathematics, mathematical formalization of a quantity or object which depends on randomness, random events. The term 'random variable' in its mathematical definition refers to neither randomness nor variability but instead is a mathematical function (mathematics), function in which * the Domain of a function, domain is the set of possible Outcome (probability), outcomes in a sample space (e.g. the set \ which are the possible upper sides of a flipped coin heads H or tails T as the result from tossing a coin); and * the Range of a function, range is a measurable space (e.g. corresponding to the domain above, the range might be the set \ if say heads H mapped to -1 and T mapped to 1). Typically, the range of a random variable is a subset of the Real number, real numbers. Informally, randomness typically represents some fundamental element of chance, such as in the roll of a dice, d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cointegration

In econometrics, cointegration is a statistical property describing a long-term, stable relationship between two or more time series variables, even if those variables themselves are individually non-stationary (i.e., they have trends). This means that despite their individual fluctuations, the variables move together in the long run, anchored by an underlying equilibrium relationship. More formally, if several time series are individually integrated of order ''d'' (meaning they require ''d'' differences to become stationary) but a linear combination of them is integrated of a lower order, then those time series are said to be cointegrated. That is, if (''X'',''Y'',''Z'') are each integrated of order ''d'', and there exist coefficients ''a'',''b'',''c'' such that is integrated of order less than d, then ''X'', ''Y'', and ''Z'' are cointegrated. Cointegration is a crucial concept in time series analysis, particularly when dealing with variables that exhibit trends, such as ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity

In economics, a commodity is an economic goods, good, usually a resource, that specifically has full or substantial fungibility: that is, the Market (economics), market treats instances of the good as equivalent or nearly so with no regard to who Production (economics), produced them. The price of a commodity good is typically determined as a function of its market as a whole: well-established physical commodities have actively traded spot market, spot and derivative (finance), derivative markets. The wide availability of commodities typically leads to smaller profit margins and diminishes the importance of factors (such as brand, brand name) other than price. Most commodities are raw materials, basic resources, agriculture, agricultural, or mining products, such as iron ore, sugar, or grains like rice and wheat. Commodities can also be mass-produced unspecialized products such as chemical substance, chemicals and computer memory. Popular commodities include Petroleum, crude ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract between a buyer and a seller. The derivative can take various forms, depending on the transaction, but every derivative has the following four elements: # an item (the "underlier") that can or must be bought or sold, # a future act which must occur (such as a sale or purchase of the underlier), # a price at which the future transaction must take place, and # a future date by which the act (such as a purchase or sale) must take place. A derivative's value depends on the performance of the underlier, which can be a commodity (for example, corn or oil), a financial instrument (e.g. a stock or a bond), price index, a price index, a currency, or an interest rate. Derivatives can be used to insure against price movements (Hedge (finance)#Etymology, hedging), increase exposure to price movements for speculation, or get access to otherwise hard-to-trade assets or markets. Most derivatives are price guarantees. But some are based on an event or p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Hypothesis Testing

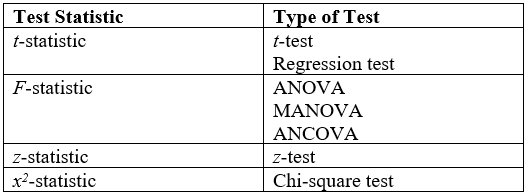

A statistical hypothesis test is a method of statistical inference used to decide whether the data provide sufficient evidence to reject a particular hypothesis. A statistical hypothesis test typically involves a calculation of a test statistic. Then a decision is made, either by comparing the test statistic to a Critical value (statistics), critical value or equivalently by evaluating a p-value, ''p''-value computed from the test statistic. Roughly 100 list of statistical tests, specialized statistical tests are in use and noteworthy. History While hypothesis testing was popularized early in the 20th century, early forms were used in the 1700s. The first use is credited to John Arbuthnot (1710), followed by Pierre-Simon Laplace (1770s), in analyzing the human sex ratio at birth; see . Choice of null hypothesis Paul Meehl has argued that the epistemological importance of the choice of null hypothesis has gone largely unacknowledged. When the null hypothesis is predicted by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time Series

In mathematics, a time series is a series of data points indexed (or listed or graphed) in time order. Most commonly, a time series is a sequence taken at successive equally spaced points in time. Thus it is a sequence of discrete-time data. Examples of time series are heights of ocean tides, counts of sunspots, and the daily closing value of the Dow Jones Industrial Average. A time series is very frequently plotted via a run chart (which is a temporal line chart). Time series are used in statistics, signal processing, pattern recognition, econometrics, mathematical finance, weather forecasting, earthquake prediction, electroencephalography, control engineering, astronomy, communications engineering, and largely in any domain of applied science and engineering which involves temporal measurements. Time series ''analysis'' comprises methods for analyzing time series data in order to extract meaningful statistics and other characteristics of the data. Time series ''f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |